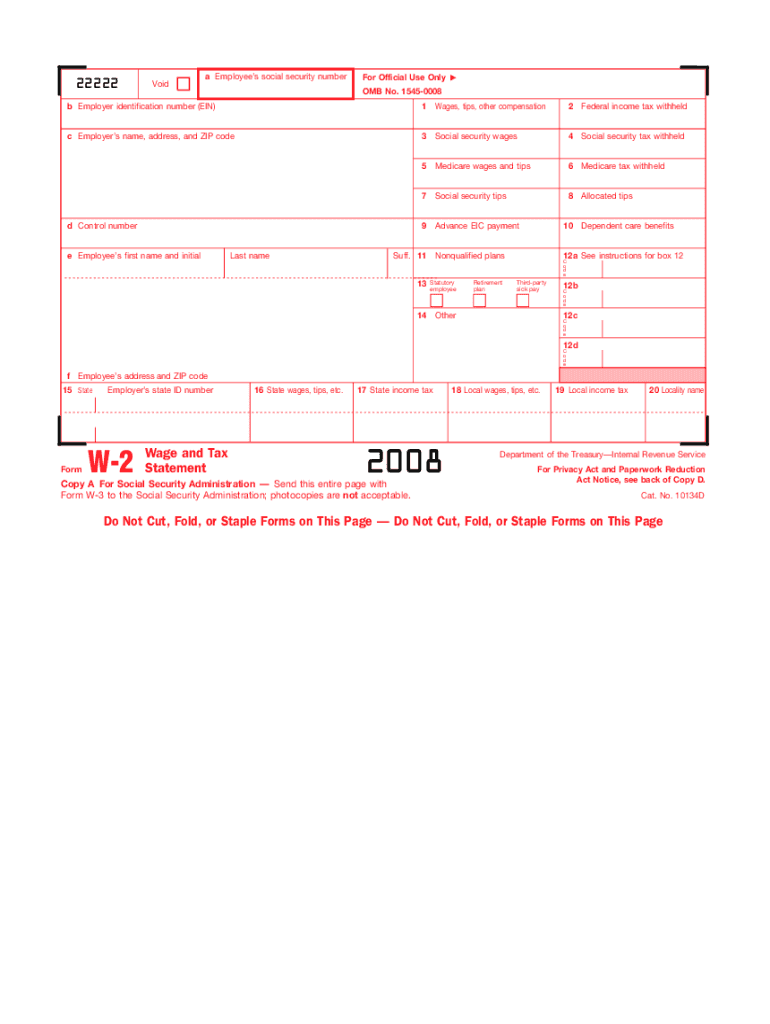

W 2 Form 2008

What makes the 2008 w 2 form legally valid?

Getting documents is not the difficult aspect in terms of web document management; making them legal is.

The first task is to examine the actual relevance of your sample you plan utilizing. Official inctitutions can't accept obsolete forms, so it's important to only use forms that are present and up-to-date.

Secondly, make sure you insert all the necessary information. Review required fields, the list of attachments, and extra samples carefully. File all of the papers in one package in order to avoid misconceptions and increase the speed of the procedure of handling your data.

Additionally, pay attention to the filing methods needed. Find out if you're permitted to file documents via internet, and if you are, think about using specialized services to complete the 2008 w 2 form, electronically sign, and deliver.

The best way to protect your 2008 w 2 form when preparing it online

In case the institution the 2008 w 2 form will be brought to enables you to do it online, implement secure record management by using the recommendations listed below:

- Look for a safe solution. Consider looking at airSlate SignNow. We keep information encrypted on reputable servers.

- Look into the platform's security policies. Read more about a service's acceptance in other countries. As an example, airSlate SignNow eSignatures are accepted in most countries.

- Pay attention to the hardware and software. Encoded connections and secure servers mean nothing in case you have viruses on your computer or make use of public Wi-Fi spots.

- Add more security levels. Switch on two-factor authentications and create locked folders to guard delicate information.

- Count on possible hacking from anyplace. Keep in mind that fraudsters can mask behind your loved ones and co-workers, or companies. Examine documents and hyperlinks you get via electronic mail or in messengers.

Quick guide on how to complete 2008 w 2 form

Uncover the simplest method to complete and sign your W 2 Form

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow offers a superior way to complete and sign your W 2 Form and related forms for public services. Our intelligent electronic signature solution equips you with all you need to manage paperwork swiftly and in compliance with official standards - comprehensive PDF editing, managing, securing, signing, and sharing features all available within an intuitive interface.

Only a few steps are needed to fill out and sign your W 2 Form:

- Upload the fillable template to the editor using the Get Form button.

- Check which information you must provide in your W 2 Form.

- Navigate through the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to populate the blanks with your information.

- Update the content with Text boxes or Images from the top toolbar.

- Emphasize what is signNow or Obscure sections that are no longer relevant.

- Click on Sign to generate a legally binding electronic signature using your preferred method.

- Insert the Date next to your signature and complete your task by pressing the Done button.

Store your completed W 2 Form in the Documents folder within your profile, download it, or export it to your selected cloud storage. Our solution also provides versatile file sharing options. There’s no necessity to print your forms when you need to submit them to the appropriate public office - send them via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out now!

Create this form in 5 minutes or less

Find and fill out the correct 2008 w 2 form

FAQs

-

When do I have to learn how to fill out a W-2 form?

Form W-2 is an obligatory form to be completed by every employer. Form W-2 doesn’t have to be filled out by the employee. It is given to inform the employee about the amount of his annual income and taxes withheld from it.You can find a lot of information here: http://bit.ly/2NjjlJi

-

How do you fill out a W-2 form?

In general, the W-2 form is divided into two parts each with numerous fields to be completed carefully by an employer. The section on the left contains both the employer's and employee`s names and contact information as well social security number and identification number.You can find a lot of information here: http://bit.ly/2NjjlJi

-

How should I fill out my w-2 or w-4 form?

To calculate how much you should withhold you need to calculate two things. Step 1 - Estimate your TaxFirst go to Intuit's TaxCaster (Link -> TurboTax® TaxCaster, Free Tax Calculator, Free Tax Refund Estimator) and put in your family's information and income (estimate what you'll make in 2016 before taxes and put zero for federal and state taxes withheld, don't worry that the TaxCaster is for 2015, you're just trying to get a general number). Once you enter in your correct information it will tell you what you would owe to the federal government.Step 2 - Estimate your Tax Withholding Based on Allowances ClaimedSecond go to Paycheck City (Link -> Salary Paycheck Calculator | Payroll Calculator | Paycheck City) select the correct state, enter in your pay information. Select married filing jointly then try putting in 3 or 4 for withholdings. Once you calculate it will tell you how much taxes are being withheld. Set the pay frequency to annual instead of bi-monthly or bi-weekly since you need a total number for the year. Try changing the Federal withholding allowance until you have enough Federal taxes withheld to cover the amount calculated in the TaxCaster. The Federal withholding allowance number that covers all taxes owed should be the number claimed on your W-4.Don't worry too much about your state. If you claim the same as Federal what will usually happen is you might get a small refund for Federal and owe a small amount for State. I usually end up getting a Federal refund for ~$100 and owing state for just over $100. In the end I net owing state $20-40.Remember, the more details you can put into the TaxCaster and Paycheck City the more accurate your tax estimate will be.

-

How do I fill out an NDA 2 application form?

visit Welcome to UPSC | UPSCclick on apply online option their and select the ndaII option.Its in 2 parts, Fill part 1 and theirafter 2nd as guided on the website their.

-

How do I fill out the IT-2104 form if I live in NJ?

Do you work only in NY? Married? Kids? If your w-2 shows NY state withholding on your taxes, fill out a non-resident NY tax return which is fairly simple. If it doesn't, you don't fill out NY at all. If it shows out NYC withholding you enter that as well on the same forms.Then you would fill out your NJ returns as well with any withholding for NJ. Make sure to put any taxes paid to other states on your reciprocal states (nj paid, on NY return and vice versa)

-

If I have to fill out Form WH-4852, should I also send in my original W-2 and file it?

The purpose of Form 4852 is to substitute for the original W-2 if for some reason you didn't receive one and couldn't get one from an employer. If you have the original W-2, you don't file Form 4852.

-

How do I fill out a W-4 form?

The main thing you need to put on your W-4 besides your name, address and social security number is whether you are married or single and the number of exemptions you wish to take to lower the amount of money with held for taxes from your paycheck. The number of exemptions refers to how many people you support, i. e. children. Say you are single and have 3 children, you can put down 4 exemptions, 1 for your self and 1 for each child. This means you will have more pay to take home because you aren’t having it with held from your paycheck. If you are single and have no children, you can either take 1 or 0 exemptions. If you make decent money, take 0 deductions, if you are barely making it you could probably take 1 exemption. Just realize that if you take exemptions, and not enough money is taken out of your check to pay your taxes, you will be liable for it come April 15th.If you are married and have no children and you make decent money, take 0 deductions. If you have children, only one spouse should take them as exemptions and it should be the one who makes the most money. For example, say your spouse is the major bread winner and you have 2 children, your spouse could take 4 exemptions (one for each member of the family) and then you would take 0 exemptions.Usually, it’s best to err on the side of caution and take the smaller amount of deductions so that you won’t owe a lot of money come tax time. If you’ve had too much with held it will come back to you as a refund.

Create this form in 5 minutes!

How to create an eSignature for the 2008 w 2 form

How to make an eSignature for your 2008 W 2 Form online

How to generate an electronic signature for the 2008 W 2 Form in Chrome

How to generate an electronic signature for putting it on the 2008 W 2 Form in Gmail

How to make an electronic signature for the 2008 W 2 Form straight from your smart phone

How to make an electronic signature for the 2008 W 2 Form on iOS

How to make an electronic signature for the 2008 W 2 Form on Android OS

People also ask

-

What is a W 2 Form and why is it important?

A W 2 Form is a tax document that employers must provide to their employees at the end of each year, detailing their annual wages and the taxes withheld. It is essential for employees to accurately file their income tax returns, ensuring compliance with IRS regulations. Understanding your W 2 Form is crucial for proper tax reporting and to avoid potential penalties.

-

How can airSlate SignNow help with W 2 Form management?

airSlate SignNow offers an intuitive platform for businesses to electronically send and eSign W 2 Forms, streamlining the document management process. With our solution, you can easily prepare, send, and securely store W 2 Forms, saving time and reducing the risk of errors. This efficient workflow helps ensure that your employees receive their tax documents promptly.

-

Is there a cost associated with using airSlate SignNow for W 2 Forms?

Yes, airSlate SignNow provides a variety of pricing plans to suit different business needs, including options for handling W 2 Forms. Our cost-effective solution ensures that you only pay for the features you use, making it a budget-friendly choice for managing essential documents. You can explore our pricing page for detailed information on the plans available.

-

What features does airSlate SignNow offer for W 2 Form signing?

airSlate SignNow includes several features designed specifically for W 2 Form signing, such as customizable templates, secure electronic signatures, and real-time tracking of document status. These features enhance the efficiency of your workflow, allowing you to manage W 2 Forms seamlessly. Additionally, our platform complies with legal standards to ensure the validity of your signed documents.

-

Can I integrate airSlate SignNow with my existing HR software for W 2 Forms?

Absolutely! airSlate SignNow offers integrations with various HR and payroll software, allowing you to sync your employee data and streamline the creation and distribution of W 2 Forms. This integration ensures that your documents are always up to date and minimizes manual data entry, saving you valuable time and reducing errors.

-

How secure is the W 2 Form data in airSlate SignNow?

Security is a top priority at airSlate SignNow. We use advanced encryption and secure servers to protect all W 2 Form data, ensuring that sensitive information remains confidential. Our platform complies with industry standards and regulations, giving you peace of mind when handling important tax documents.

-

Can I track the status of my W 2 Forms with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all documents, including W 2 Forms. You can easily monitor when a form is sent, viewed, and signed, allowing you to stay updated on the progress of your documents. This feature enhances accountability and ensures that you meet deadlines for tax filing.

Get more for W 2 Form

- Bccc maryland residency form baltimore city community college bccc

- Percent yield practice problems form

- Complete these sixteen questions to score your knowledge of present continuous form

- Live scan form a0522

- Qfx club form

- Legal residence 4 special assessment bapplicationb assessorcasc form

- Ny surrogate court forms

- Is it necessary to file new mexico form pte as well as form rpd

Find out other W 2 Form

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History