Form 8880 Credit for Qualified Retirement Savings Contributions 2024-2026

What is the Form 8880 Credit For Qualified Retirement Savings Contributions

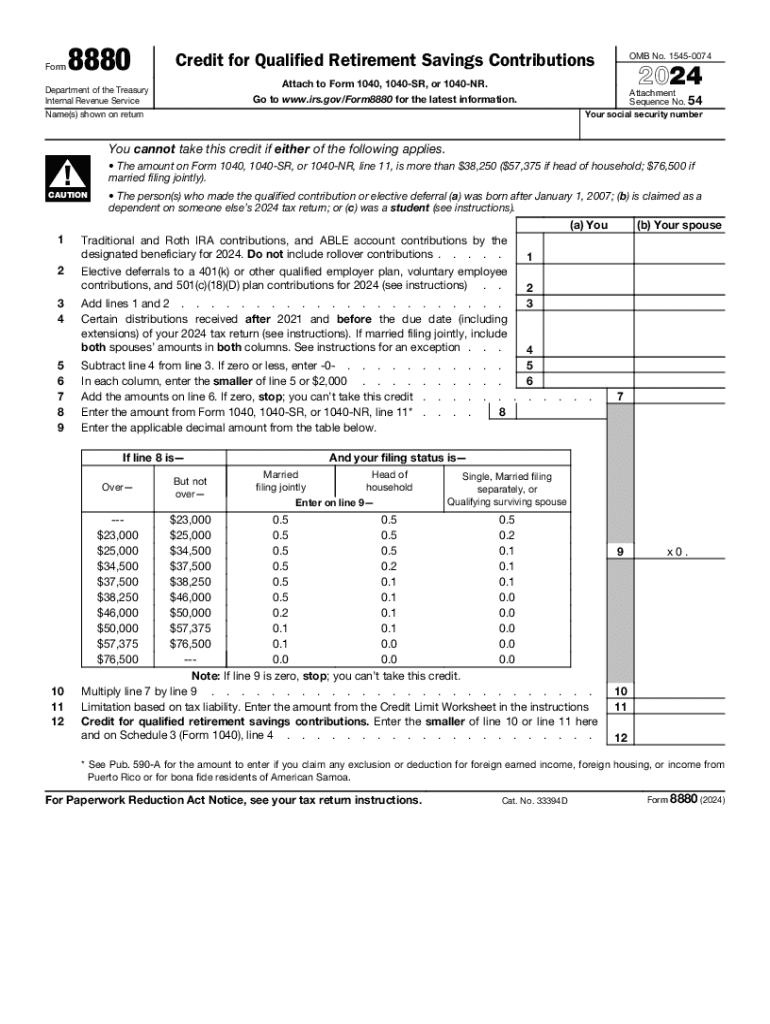

The Form 8880, also known as the Credit for Qualified Retirement Savings Contributions, allows eligible taxpayers to claim a tax credit for contributions made to retirement savings accounts. This credit is designed to encourage individuals to save for retirement by providing a financial incentive. The amount of the credit can vary based on the taxpayer's filing status and income level, making it a valuable resource for those who qualify. Understanding the specifics of this form is essential for maximizing retirement savings and minimizing tax liabilities.

Eligibility Criteria

To qualify for the Form 8880 credit, taxpayers must meet specific eligibility requirements. Primarily, individuals must be at least eighteen years old and not a full-time student or claimed as a dependent on someone else's tax return. Additionally, the taxpayer's adjusted gross income (AGI) must fall below certain thresholds, which can change annually. For the 2024 tax year, these limits will be outlined in IRS guidelines, and it is crucial to verify your income level against these benchmarks to determine eligibility.

Steps to complete the Form 8880 Credit For Qualified Retirement Savings Contributions

Completing the Form 8880 involves several straightforward steps. First, gather documentation of your retirement contributions, which may include statements from your retirement accounts. Next, fill out the form by providing personal information, including your filing status and AGI. Calculate the credit amount based on the contributions made and your income level, referring to the IRS tables for accurate calculations. Finally, attach the completed form to your tax return when filing, ensuring that all information is accurate to avoid delays or issues with your claim.

How to obtain the Form 8880 Credit For Qualified Retirement Savings Contributions

The Form 8880 can be easily obtained through the IRS website, where it is available for download in PDF format. Taxpayers can also access fillable versions of the form, allowing for easier completion. Additionally, tax preparation software often includes this form as part of their package, simplifying the filing process for users. It is important to ensure that you are using the most current version of the form to comply with IRS requirements.

IRS Guidelines

The IRS provides comprehensive guidelines regarding the use of Form 8880, including eligibility criteria, filing procedures, and the calculation of the credit. Taxpayers are encouraged to review these guidelines carefully to ensure compliance and maximize their potential credit. The IRS website features detailed instructions and examples, which can help clarify any uncertainties regarding the form and its requirements. Staying informed about updates to IRS guidelines is essential for effective tax planning and retirement savings strategies.

Required Documents

When completing Form 8880, certain documents are necessary to substantiate your claim. These typically include proof of retirement contributions, such as account statements or contribution receipts. Additionally, taxpayers should have their previous year's tax return on hand, as it may assist in determining AGI and filing status. Collecting these documents beforehand can streamline the process and help ensure that all information submitted is accurate and complete.

Quick guide on how to complete form 8880 credit for qualified retirement savings contributions 765770210

Effortlessly Prepare Form 8880 Credit For Qualified Retirement Savings Contributions on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environment-friendly substitute to traditional printed and signed documents, allowing you to access the proper forms and securely save them online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without any holdups. Manage Form 8880 Credit For Qualified Retirement Savings Contributions on any device with the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

How to Modify and eSign Form 8880 Credit For Qualified Retirement Savings Contributions with Ease

- Find Form 8880 Credit For Qualified Retirement Savings Contributions and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools specifically designed by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to finalize your edits.

- Select how you prefer to send your form, whether by email, text message (SMS), invite link, or download to your computer.

Eliminate concerns about lost or misfiled documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Modify and eSign Form 8880 Credit For Qualified Retirement Savings Contributions to ensure outstanding communication throughout every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8880 credit for qualified retirement savings contributions 765770210

Create this form in 5 minutes!

How to create an eSignature for the form 8880 credit for qualified retirement savings contributions 765770210

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How can airSlate SignNow help with retirement savings documentation?

airSlate SignNow streamlines the process of managing retirement savings documentation by allowing users to easily send, sign, and store important documents securely. This ensures that all paperwork related to retirement savings is organized and accessible, reducing the risk of errors and delays. With our user-friendly interface, managing retirement savings documents becomes efficient and hassle-free.

-

What features does airSlate SignNow offer for retirement savings management?

airSlate SignNow offers a variety of features tailored for retirement savings management, including customizable templates, automated workflows, and secure eSigning capabilities. These features help users efficiently handle retirement savings documents while ensuring compliance and security. Additionally, our platform allows for easy tracking of document status, making it easier to manage retirement savings paperwork.

-

Is airSlate SignNow cost-effective for managing retirement savings?

Yes, airSlate SignNow is a cost-effective solution for managing retirement savings documentation. Our pricing plans are designed to fit various budgets, ensuring that businesses of all sizes can access essential tools for retirement savings management. By reducing the time and resources spent on paperwork, airSlate SignNow ultimately saves you money in the long run.

-

Can airSlate SignNow integrate with other financial tools for retirement savings?

Absolutely! airSlate SignNow seamlessly integrates with various financial tools and platforms that assist in managing retirement savings. This integration allows for a more cohesive workflow, enabling users to synchronize their retirement savings data with other financial applications. By connecting these tools, you can enhance your overall retirement savings strategy.

-

What are the benefits of using airSlate SignNow for retirement savings?

Using airSlate SignNow for retirement savings offers numerous benefits, including increased efficiency, enhanced security, and improved compliance. Our platform simplifies the document management process, allowing users to focus more on their retirement savings goals rather than paperwork. Additionally, the secure eSigning feature ensures that all documents are legally binding and protected.

-

How does airSlate SignNow ensure the security of retirement savings documents?

airSlate SignNow prioritizes the security of your retirement savings documents by employing advanced encryption and secure storage solutions. We adhere to industry standards to protect sensitive information, ensuring that your retirement savings data remains confidential and secure. With our platform, you can have peace of mind knowing that your documents are safe.

-

Is there a mobile app for managing retirement savings with airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows users to manage their retirement savings documents on the go. The app provides full access to all features, enabling users to send, sign, and track documents from their mobile devices. This flexibility ensures that you can manage your retirement savings anytime, anywhere.

Get more for Form 8880 Credit For Qualified Retirement Savings Contributions

Find out other Form 8880 Credit For Qualified Retirement Savings Contributions

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online