Tax Status Declaration Form Entity Guidance Notes RBS 2016

What is the Tax Status Declaration Form Entity Guidance Notes RBS

The Tax Status Declaration Form Entity Guidance Notes RBS serves as an essential document for entities to declare their tax status accurately. This form is designed to assist businesses in complying with tax regulations and ensuring proper classification for tax purposes. By providing detailed information about the entity's structure and tax obligations, the form helps streamline the tax reporting process and mitigates the risk of errors that could lead to penalties.

How to Use the Tax Status Declaration Form Entity Guidance Notes RBS

Using the Tax Status Declaration Form Entity Guidance Notes RBS involves several straightforward steps. First, gather all necessary information about your business entity, including its legal structure, ownership details, and any relevant tax identification numbers. Next, carefully fill out the form, ensuring that all sections are completed accurately. Once the form is filled, review it for any errors or omissions before submission. This process helps ensure compliance with tax regulations and facilitates a smoother filing experience.

Steps to Complete the Tax Status Declaration Form Entity Guidance Notes RBS

Completing the Tax Status Declaration Form Entity Guidance Notes RBS can be broken down into specific steps:

- Collect essential information about your entity, including its name, address, and tax identification number.

- Determine the appropriate tax classification for your business, such as corporation, partnership, or sole proprietorship.

- Fill out the form, paying close attention to each section to ensure accuracy.

- Review the completed form for any mistakes or missing information.

- Submit the form through the designated method, whether online, by mail, or in person.

Key Elements of the Tax Status Declaration Form Entity Guidance Notes RBS

Several key elements are crucial when filling out the Tax Status Declaration Form Entity Guidance Notes RBS. These include:

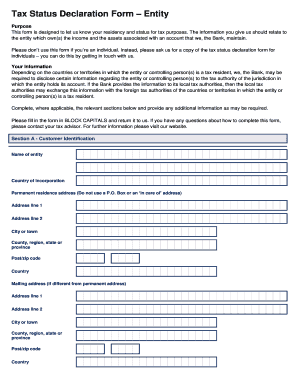

- Entity Information: This section requires the legal name, address, and type of entity.

- Tax Classification: Clearly state the entity's tax classification to ensure proper tax treatment.

- Signature: An authorized representative must sign the form to validate the information provided.

- Date: Include the date of submission to establish a timeline for compliance.

Legal Use of the Tax Status Declaration Form Entity Guidance Notes RBS

The Tax Status Declaration Form Entity Guidance Notes RBS is legally binding and must be completed accurately to avoid penalties. It is used by the Internal Revenue Service (IRS) to determine the tax obligations of the entity submitting it. Misrepresentation or failure to submit the form can lead to significant legal consequences, including fines and increased scrutiny from tax authorities.

Filing Deadlines / Important Dates

Timely submission of the Tax Status Declaration Form Entity Guidance Notes RBS is critical. Entities must be aware of specific filing deadlines to avoid penalties. Generally, the form should be submitted at the beginning of the tax year or whenever there is a change in the entity's tax status. Keeping track of these deadlines ensures compliance and helps maintain good standing with tax authorities.

Quick guide on how to complete tax status declaration form entity guidance notes rbs

Complete Tax Status Declaration Form Entity Guidance Notes RBS effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the correct version and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle Tax Status Declaration Form Entity Guidance Notes RBS on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and eSign Tax Status Declaration Form Entity Guidance Notes RBS effortlessly

- Obtain Tax Status Declaration Form Entity Guidance Notes RBS and click on Get Form to begin.

- Employ the tools we provide to complete your document.

- Select important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere moments and carries the same legal validity as a traditional wet signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Tax Status Declaration Form Entity Guidance Notes RBS and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax status declaration form entity guidance notes rbs

Create this form in 5 minutes!

How to create an eSignature for the tax status declaration form entity guidance notes rbs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Tax Status Declaration Form Entity Guidance Notes RBS?

The Tax Status Declaration Form Entity Guidance Notes RBS provides essential instructions for entities to accurately complete their tax status declaration. This form is crucial for ensuring compliance with tax regulations and helps businesses avoid potential penalties. Understanding this form can streamline your tax processes and enhance your financial reporting.

-

How can airSlate SignNow assist with the Tax Status Declaration Form Entity Guidance Notes RBS?

airSlate SignNow simplifies the process of completing and submitting the Tax Status Declaration Form Entity Guidance Notes RBS by providing an intuitive eSigning platform. Users can easily fill out the form, add necessary signatures, and send it securely. This not only saves time but also ensures that your documents are legally binding and compliant.

-

What are the pricing options for using airSlate SignNow for the Tax Status Declaration Form Entity Guidance Notes RBS?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of different businesses. Whether you are a small business or a large enterprise, you can find a plan that suits your budget while providing access to features necessary for managing the Tax Status Declaration Form Entity Guidance Notes RBS. Check our website for detailed pricing information.

-

What features does airSlate SignNow offer for managing the Tax Status Declaration Form Entity Guidance Notes RBS?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking for the Tax Status Declaration Form Entity Guidance Notes RBS. These features enhance efficiency and ensure that all parties involved can access and manage the document seamlessly. Additionally, the platform supports multiple file formats for added convenience.

-

Are there any integrations available for airSlate SignNow when handling the Tax Status Declaration Form Entity Guidance Notes RBS?

Yes, airSlate SignNow integrates with various applications and platforms, making it easier to manage the Tax Status Declaration Form Entity Guidance Notes RBS alongside your existing tools. This includes integrations with popular CRM systems, cloud storage services, and productivity applications. These integrations help streamline your workflow and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for the Tax Status Declaration Form Entity Guidance Notes RBS?

Using airSlate SignNow for the Tax Status Declaration Form Entity Guidance Notes RBS offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick document turnaround times, which is essential for meeting tax deadlines. Additionally, the electronic signature feature ensures that your documents are legally binding and compliant with regulations.

-

Is airSlate SignNow secure for handling sensitive documents like the Tax Status Declaration Form Entity Guidance Notes RBS?

Absolutely, airSlate SignNow prioritizes security and compliance when handling sensitive documents such as the Tax Status Declaration Form Entity Guidance Notes RBS. The platform employs advanced encryption methods and secure data storage to protect your information. Regular security audits and compliance with industry standards further ensure that your documents remain safe.

Get more for Tax Status Declaration Form Entity Guidance Notes RBS

Find out other Tax Status Declaration Form Entity Guidance Notes RBS

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed