Loan Adjustment Form 2018

What is the Loan Adjustment Form

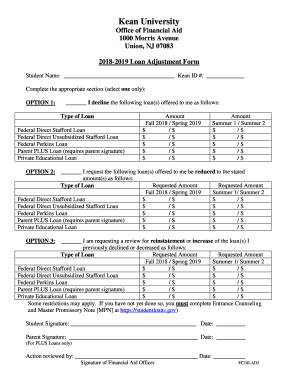

The Loan Adjustment Form is a crucial document used by borrowers to request modifications to the terms of their existing loans. This form typically addresses changes such as interest rates, payment schedules, or loan amounts. It is essential for individuals seeking to manage their loan obligations effectively, especially in situations where financial circumstances have changed. By utilizing this form, borrowers can communicate their needs clearly to lenders, facilitating a smoother negotiation process.

Steps to complete the Loan Adjustment Form

Completing the Loan Adjustment Form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to your loan, including account numbers and current terms. Next, fill out the form with your personal information, including your name, address, and contact details. Clearly state the adjustments you are requesting, providing specific reasons for each change. Review the form for completeness and accuracy before signing and dating it. Finally, submit the form according to your lender's specified method, whether online, by mail, or in person.

How to use the Loan Adjustment Form

Using the Loan Adjustment Form effectively requires understanding its purpose and the context in which it is submitted. Start by identifying the specific changes you wish to request. This could involve reducing monthly payments or extending the loan term. Once you have completed the form, ensure that you provide any supporting documentation that may strengthen your request, such as proof of income or evidence of financial hardship. After submission, follow up with your lender to confirm receipt and discuss the next steps in the adjustment process.

Legal use of the Loan Adjustment Form

The Loan Adjustment Form must be used in accordance with applicable laws and regulations. In the United States, lenders are required to adhere to the Truth in Lending Act and other relevant consumer protection laws when processing loan modifications. This ensures that borrowers are treated fairly and that their rights are protected throughout the adjustment process. It is advisable for borrowers to familiarize themselves with these legal requirements to ensure their requests are valid and compliant.

Key elements of the Loan Adjustment Form

Several key elements are essential for the Loan Adjustment Form to be effective. These include the borrower's personal information, loan account details, and a clear description of the requested adjustments. Additionally, the form should include a section for the borrower's signature, confirming their intent to modify the loan terms. Providing a detailed explanation of the reasons for the requested changes can also enhance the likelihood of approval. Ensuring that all required fields are completed accurately is critical for a successful submission.

Required Documents

When submitting the Loan Adjustment Form, borrowers may need to provide several supporting documents. These typically include recent pay stubs, tax returns, or bank statements to demonstrate financial status. If the adjustment request is based on hardship, documentation such as medical bills or unemployment notices may also be required. It is important to check with the lender for a specific list of required documents to avoid delays in processing the request.

Quick guide on how to complete 2018 2019 loan adjustment form

The optimal method to acquire and endorse Loan Adjustment Form

At the level of an entire organization, ineffective workflows surrounding paper approval can consume a signNow amount of working hours. Approving documents such as Loan Adjustment Form is an inherent aspect of operations across any sector, which is why the effectiveness of each contract’s lifecycle has such a profound impact on the company's overall output. With airSlate SignNow, endorsing your Loan Adjustment Form can be as straightforward and quick as possible. This platform provides you with the latest version of virtually any document. Even better, you can sign it instantly without needing to install external software on your computer or printing anything as physical copies.

Steps to acquire and endorse your Loan Adjustment Form

- Explore our library by category or utilize the search bar to locate the document you require.

- View the document preview by clicking on Learn more to ensure it’s the correct one.

- Click Get form to start editing immediately.

- Fill out your document and include any essential information using the toolbar.

- Once completed, click the Sign tool to endorse your Loan Adjustment Form.

- Choose the signature method that suits you best: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to complete editing and proceed to document-sharing options as necessary.

With airSlate SignNow, you possess everything necessary to manage your documentation efficiently. You can find, complete, edit, and even distribute your Loan Adjustment Form in a single tab effortlessly. Enhance your workflows by utilizing a unified, intelligent eSignature solution.

Create this form in 5 minutes or less

Find and fill out the correct 2018 2019 loan adjustment form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

Create this form in 5 minutes!

How to create an eSignature for the 2018 2019 loan adjustment form

How to make an eSignature for the 2018 2019 Loan Adjustment Form online

How to create an eSignature for your 2018 2019 Loan Adjustment Form in Chrome

How to create an eSignature for signing the 2018 2019 Loan Adjustment Form in Gmail

How to create an eSignature for the 2018 2019 Loan Adjustment Form from your mobile device

How to make an eSignature for the 2018 2019 Loan Adjustment Form on iOS devices

How to generate an eSignature for the 2018 2019 Loan Adjustment Form on Android OS

People also ask

-

What is a Loan Adjustment Form and how can it benefit my business?

A Loan Adjustment Form is a document used to modify the terms of an existing loan. By using airSlate SignNow, you can streamline the process of creating and eSigning this form, ensuring that adjustments are processed quickly and efficiently. This helps your business save time and reduce errors in loan management.

-

How much does it cost to use airSlate SignNow for creating a Loan Adjustment Form?

airSlate SignNow offers flexible pricing plans suitable for businesses of all sizes. The cost to use our platform for generating a Loan Adjustment Form is competitive, ensuring you get a cost-effective solution without compromising on features. Explore our subscription tiers to find the plan that best fits your budget.

-

Can I integrate airSlate SignNow with my existing loan management software?

Yes, airSlate SignNow seamlessly integrates with various loan management systems. This means you can easily streamline your processes for generating and sending a Loan Adjustment Form without disrupting your current workflows. Integration enhances efficiency and helps maintain consistency across your business practices.

-

How secure is airSlate SignNow when handling Loan Adjustment Forms?

Security is a top priority at airSlate SignNow. When you use our platform to create and send a Loan Adjustment Form, your documents are protected by advanced encryption and multiple layers of security. This ensures that sensitive loan information remains confidential and secure.

-

Can multiple users collaborate on a Loan Adjustment Form using airSlate SignNow?

Absolutely! airSlate SignNow allows multiple users to collaborate on a Loan Adjustment Form in real-time. This feature facilitates communication and ensures that all parties can contribute to the document, making the adjustment process more transparent and efficient.

-

What types of documents can I create besides Loan Adjustment Forms with airSlate SignNow?

In addition to Loan Adjustment Forms, airSlate SignNow enables you to create a wide variety of documents, including contracts, agreements, and invoices. Our platform provides customizable templates that cater to various business needs, allowing you to manage all your document workflows in one place.

-

How can I track the status of my Loan Adjustment Form once it's sent?

With airSlate SignNow, you can easily track the status of your Loan Adjustment Form after sending it. Our platform provides real-time notifications and updates, allowing you to see when the form has been viewed, signed, and completed, ensuring you stay informed throughout the process.

Get more for Loan Adjustment Form

- Broward county marriage license application form

- John hancock matching gifts program form

- Dlr 430 506 form

- Buettner assessment of needs diagnoses and interests for bb usm maine form

- Nondiscrimination testing file reviews spooner revise bsc i tel form

- Aacredit union form

- Distribution request ira beneficiary claimdisclai form

- Form centerphoto of the year contest

Find out other Loan Adjustment Form

- eSign Iowa Car Dealer Limited Power Of Attorney Free

- eSign Iowa Car Dealer Limited Power Of Attorney Fast

- eSign Iowa Car Dealer Limited Power Of Attorney Safe

- How Can I eSign Iowa Car Dealer Limited Power Of Attorney

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online