New Mexico Cit 1 Form

What is the New Mexico Cit 1

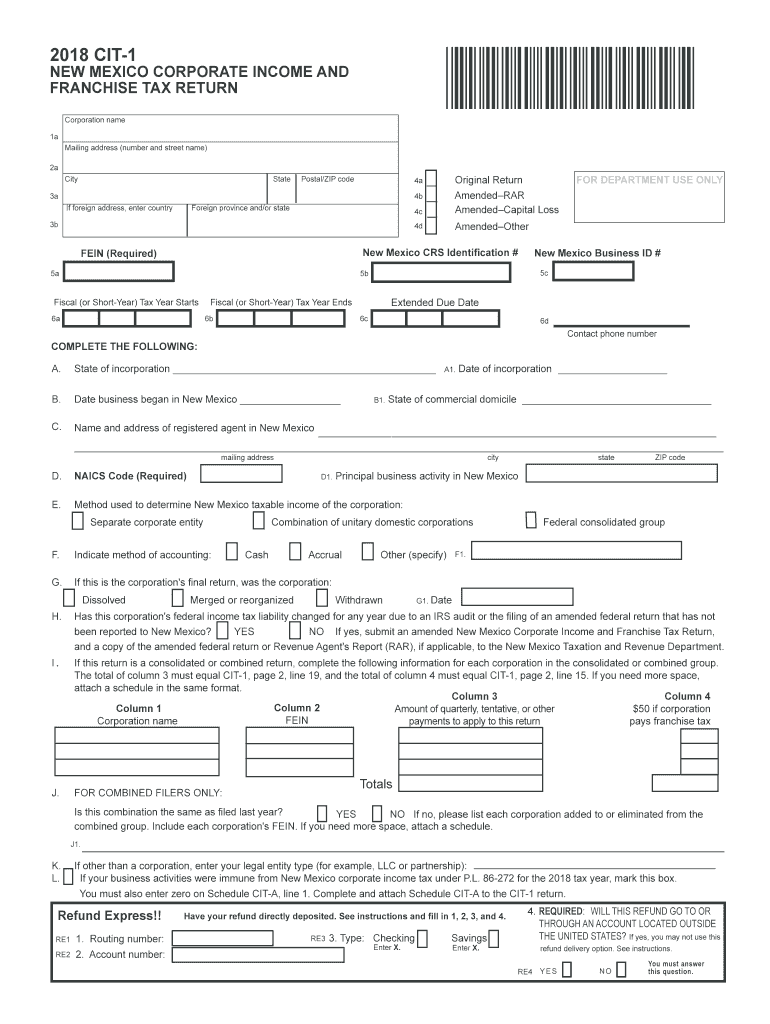

The New Mexico Cit 1 is a tax form used by businesses operating in New Mexico to report their corporate income and franchise taxes. This form is essential for corporations, limited liability companies (LLCs), and partnerships that are subject to state taxation. It provides the New Mexico Taxation and Revenue Department with necessary financial information to assess the tax liability of the business. Understanding the Cit 1 form is crucial for ensuring compliance with state tax regulations and avoiding potential penalties.

How to use the New Mexico Cit 1

Using the New Mexico Cit 1 involves several key steps. First, businesses must gather all relevant financial data, including income, deductions, and credits applicable to their tax situation. Next, the form must be filled out accurately, reflecting the business's financial activities for the reporting period. After completing the form, it can be submitted either electronically or by mail, depending on the preference of the business and the requirements set by the New Mexico Taxation and Revenue Department. It is important to ensure all information is correct to avoid delays in processing or issues with compliance.

Steps to complete the New Mexico Cit 1

Completing the New Mexico Cit 1 involves a series of organized steps:

- Gather financial records, including income statements and expense reports.

- Fill out the form, ensuring all sections are completed accurately, including business name, address, and tax identification number.

- Calculate the total income and allowable deductions to determine taxable income.

- Apply the appropriate tax rate to the taxable income to find the total tax due.

- Review the completed form for accuracy before submission.

- Submit the form electronically through the state’s e-filing system or mail it to the designated address.

Legal use of the New Mexico Cit 1

The legal use of the New Mexico Cit 1 is governed by state tax laws. To be considered valid, the form must be completed in accordance with the guidelines provided by the New Mexico Taxation and Revenue Department. This includes adhering to deadlines for submission and ensuring that all reported information is truthful and accurate. Failure to comply with these regulations can lead to penalties, including fines or additional tax assessments.

Filing Deadlines / Important Dates

Filing deadlines for the New Mexico Cit 1 are critical for compliance. Typically, the form is due on the 15th day of the fourth month following the end of the tax year. For most corporations, this means the deadline is April 15 for calendar year filers. It is essential for businesses to mark these dates on their calendars to avoid late filing penalties. Additionally, any extensions for filing must also be requested in advance to ensure compliance with state regulations.

Form Submission Methods (Online / Mail / In-Person)

The New Mexico Cit 1 can be submitted through various methods, providing flexibility for businesses. The preferred method is electronic filing, which can be done through the New Mexico Taxation and Revenue Department's online portal. This method allows for quicker processing and confirmation of receipt. Alternatively, businesses may choose to mail the completed form to the designated tax office. In-person submission is also an option, although it is less common. Regardless of the method chosen, it is important to retain a copy of the submitted form for record-keeping purposes.

Quick guide on how to complete who must register a business nm taxation and revenue department

Easily set up New Mexico Cit 1 on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary for you to create, modify, and electronically sign your documents swiftly without delays. Handle New Mexico Cit 1 on any platform with the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to modify and electronically sign New Mexico Cit 1 effortlessly

- Obtain New Mexico Cit 1 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements within a few clicks on a device of your choice. Edit and electronically sign New Mexico Cit 1 to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the who must register a business nm taxation and revenue department

How to make an eSignature for the Who Must Register A Business Nm Taxation And Revenue Department online

How to make an electronic signature for your Who Must Register A Business Nm Taxation And Revenue Department in Google Chrome

How to make an electronic signature for signing the Who Must Register A Business Nm Taxation And Revenue Department in Gmail

How to generate an electronic signature for the Who Must Register A Business Nm Taxation And Revenue Department from your smartphone

How to generate an eSignature for the Who Must Register A Business Nm Taxation And Revenue Department on iOS

How to generate an electronic signature for the Who Must Register A Business Nm Taxation And Revenue Department on Android OS

People also ask

-

What is a CIT 1 fillable document?

A CIT 1 fillable document is an electronic form that can be completed digitally, enhancing efficiency in document workflows. With airSlate SignNow, you can easily create and customize CIT 1 fillable forms to meet your specific business needs.

-

How does airSlate SignNow simplify the creation of CIT 1 fillable documents?

airSlate SignNow offers intuitive tools that allow users to effortlessly design CIT 1 fillable documents. You can drag and drop fields, set up workflows, and ensure that your clients can fill out the forms without unnecessary complications.

-

Is there a cost associated with using airSlate SignNow for CIT 1 fillable documents?

Yes, airSlate SignNow offers competitive pricing plans tailored for businesses of all sizes. These plans provide access to features for creating and sending CIT 1 fillable documents without breaking the bank.

-

What are the key benefits of using CIT 1 fillable forms in airSlate SignNow?

Using CIT 1 fillable forms in airSlate SignNow streamlines your document management process, saving time and reducing errors. The ease of signing and filling these forms enhances customer satisfaction and expedites approval processes.

-

Can I integrate CIT 1 fillable documents with other software using airSlate SignNow?

Absolutely! airSlate SignNow supports integrations with various software applications, including CRM systems and cloud storage solutions, making it easy to manage your CIT 1 fillable documents within your existing workflow.

-

How secure are the CIT 1 fillable documents I create with airSlate SignNow?

airSlate SignNow prioritizes security, utilizing advanced encryption and compliance measures to protect your CIT 1 fillable documents. You can trust that confidential information remains safe throughout the signing process.

-

Can I track the status of my CIT 1 fillable documents in airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for your CIT 1 fillable documents. You can easily monitor when a document is viewed, filled out, or signed, keeping you informed throughout the entire process.

Get more for New Mexico Cit 1

- Corporation income tax return form

- Application or revocation of the authorization to file separate form

- Edms cover sheet instructions ohio department of medicaid form

- Road closure notice form townofstratford com

- Fire watch log sheet this fire watch log sheets form

- Louisiana high school powerlifting association scholarship application lhspla form

- Department of education fins referral checklist tangischools form

- Order form 272844815

Find out other New Mexico Cit 1

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word