Ifta 100 Mn Form

Understanding the IFTA 100 Form

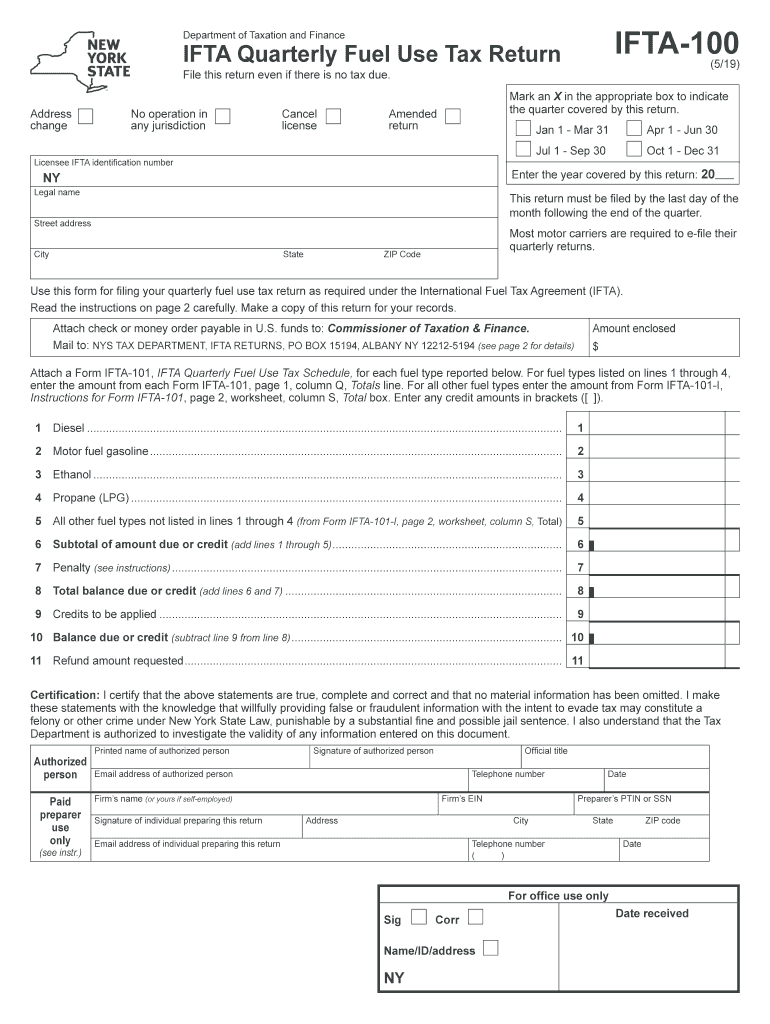

The IFTA 100 form is a crucial document for businesses operating commercial vehicles across state lines in the United States. This form is used to report and pay the International Fuel Tax Agreement (IFTA) quarterly fuel tax. It ensures that fuel taxes are distributed fairly among participating jurisdictions based on the miles driven and fuel purchased in each state. By accurately completing the IFTA 100, businesses can maintain compliance with tax regulations and avoid penalties.

Steps to Complete the IFTA 100 Form

Filling out the IFTA 100 form involves several key steps:

- Gather necessary information, including total miles driven and fuel purchased in each jurisdiction.

- Calculate the total gallons of fuel consumed and the taxable gallons for each state.

- Determine the tax rate for each jurisdiction and calculate the total tax owed.

- Complete the IFTA 100 form by entering all required information accurately.

- Review the form for any errors before submission.

Filing Deadlines for the IFTA 100 Form

It is essential to adhere to the filing deadlines for the IFTA 100 form to avoid penalties. The deadlines typically fall on the last day of the month following the end of each quarter. This means that the due dates are:

- First Quarter: April 30

- Second Quarter: July 31

- Third Quarter: October 31

- Fourth Quarter: January 31

Timely filing ensures compliance and helps maintain good standing with tax authorities.

Form Submission Methods for the IFTA 100

Businesses have several options for submitting the IFTA 100 form:

- Online Submission: Many jurisdictions allow for electronic filing through their websites, providing a quick and efficient way to submit the form.

- Mail Submission: The form can be printed and mailed to the appropriate tax authority, ensuring that it is postmarked by the due date.

- In-Person Submission: Some businesses may prefer to deliver the completed form directly to their local tax office.

Penalties for Non-Compliance with the IFTA 100

Failure to file the IFTA 100 form on time or inaccuracies in reporting can result in significant penalties. These may include:

- Late filing fees, which can accumulate over time.

- Interest on unpaid taxes, increasing the overall amount owed.

- Potential audits by tax authorities, leading to further scrutiny of business practices.

Maintaining accurate records and submitting the form on time is vital to avoid these consequences.

Key Elements of the IFTA 100 Form

Understanding the key elements of the IFTA 100 form is essential for accurate completion. Important sections include:

- Identification Information: Details about the reporting entity, including name, address, and account number.

- Mileage and Fuel Information: Total miles driven and fuel purchased in each jurisdiction during the reporting period.

- Tax Calculation: A breakdown of the total tax owed based on the fuel consumption and applicable rates.

Each section must be filled out carefully to ensure compliance and accuracy.

Quick guide on how to complete mark an x in the appropriate box to indicate

Easily Prepare Ifta 100 Mn on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the required form and store it securely online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Ifta 100 Mn on any platform using airSlate SignNow's Android or iOS applications and simplify your document-based tasks today.

Effortlessly Modify and eSign Ifta 100 Mn

- Obtain Ifta 100 Mn and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information carefully and click on the Done button to save your modifications.

- Select how you want to share your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new document versions. airSlate SignNow satisfies your document management needs in just a few clicks from any device you prefer. Adjust and electronically sign Ifta 100 Mn, ensuring exceptional communication throughout every phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mark an x in the appropriate box to indicate

How to create an electronic signature for your Mark An X In The Appropriate Box To Indicate online

How to make an electronic signature for the Mark An X In The Appropriate Box To Indicate in Google Chrome

How to make an electronic signature for putting it on the Mark An X In The Appropriate Box To Indicate in Gmail

How to make an electronic signature for the Mark An X In The Appropriate Box To Indicate from your smartphone

How to create an electronic signature for the Mark An X In The Appropriate Box To Indicate on iOS devices

How to create an electronic signature for the Mark An X In The Appropriate Box To Indicate on Android devices

People also ask

-

What is IFTA quarterly fuel tax?

The IFTA quarterly fuel tax is a tax imposed on fuel used by commercial vehicles operating in multiple jurisdictions. This tax facilitates the collection of fuel tax revenues for local and state governments. Businesses must file these taxes quarterly, making compliance essential for fleet operations.

-

How can airSlate SignNow help with IFTA quarterly fuel tax reporting?

airSlate SignNow offers a streamlined way to eSign and submit your IFTA quarterly fuel tax documentation efficiently. With our easy-to-use platform, you can quickly gather signatures and ensure that all your tax filings are timely and compliant. This simplifies a complex process, allowing you to focus more on your business.

-

What features does airSlate SignNow provide for managing IFTA quarterly fuel tax documents?

Our platform includes features such as customizable templates, document tracking, and secure cloud storage to manage your IFTA quarterly fuel tax documents. You can easily create, send, and track forms related to your fuel tax filings. Additionally, eSigning ensures that your documents are legally binding and compliant.

-

Is there a specific pricing plan for businesses managing IFTA quarterly fuel tax?

Yes, airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Our solutions are cost-effective and designed to meet the needs of companies managing IFTA quarterly fuel tax. You can choose a plan based on your document volume and feature requirements, ensuring that you only pay for what you need.

-

Can airSlate SignNow integrate with accounting software to manage IFTA quarterly fuel tax?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easy to streamline your IFTA quarterly fuel tax management. This connectivity allows for efficient data transfer between platforms, ensuring that your financial records and tax obligations are aligned.

-

What are the benefits of using airSlate SignNow for IFTA quarterly fuel tax compliance?

Using airSlate SignNow for IFTA quarterly fuel tax compliance simplifies the filing process, reduces the risk of errors, and ensures timely submissions. Our eSigning feature enhances document security and compliance, while our user-friendly interface speeds up workflow. Overall, it saves you time and effort in managing your tax responsibilities.

-

How does airSlate SignNow ensure the security of my IFTA quarterly fuel tax documents?

airSlate SignNow prioritizes the security of your IFTA quarterly fuel tax documents by employing industry-leading encryption and secure cloud storage solutions. Our platform adheres to strict compliance standards, ensuring that your sensitive tax information is protected from unauthorized access. You can confidently manage and store your documents with us.

Get more for Ifta 100 Mn

- Asco educational book manuscript guidelines a form

- University supporter license plate application ok form

- Ldss 3152 nyc rev otda ny form

- Handicap parking placard form hawaii

- Guarantors indemnity to the form

- Standard contract template form

- Standard consult contract template form

- Standard employee contract template form

Find out other Ifta 100 Mn

- eSign Virginia Stock Transfer Form Template Easy

- How To eSign Colorado Payment Agreement Template

- eSign Louisiana Promissory Note Template Mobile

- Can I eSign Michigan Promissory Note Template

- eSign Hawaii Football Registration Form Secure

- eSign Hawaii Football Registration Form Fast

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself