State Form 50 132 Application

What is the 132 property form?

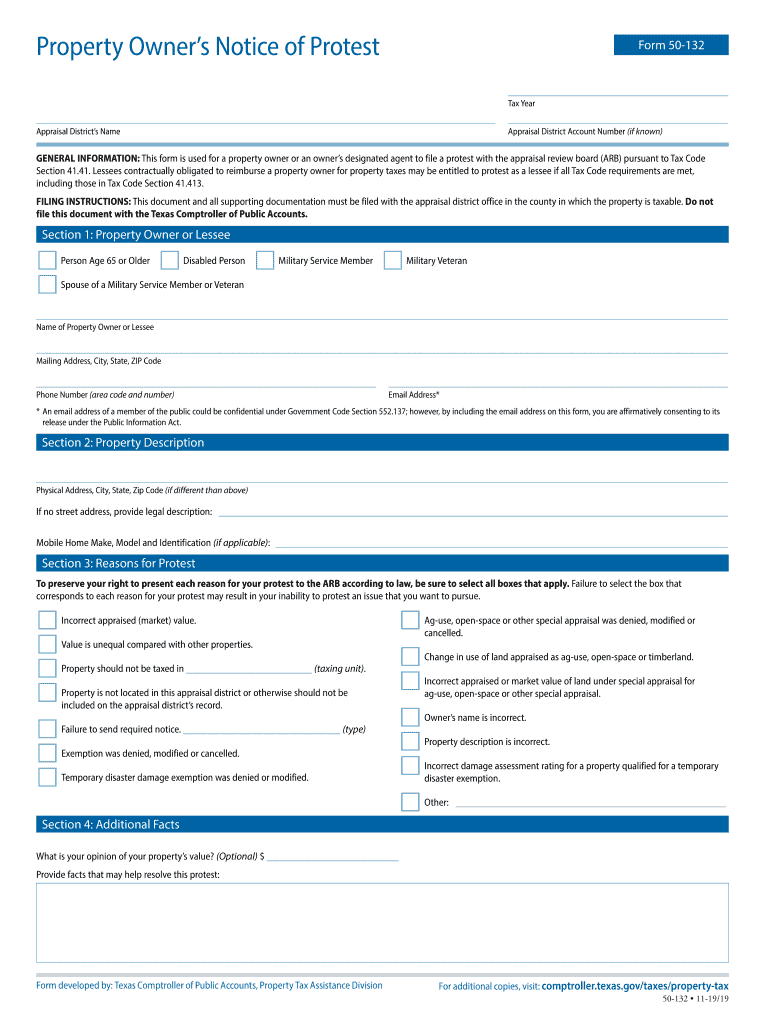

The 132 property form, often referred to as the 50-132 comptroller, is a document used in Texas for property tax purposes. It is primarily utilized by property owners to protest the appraised value of their properties as determined by local appraisal districts. This form allows taxpayers to formally challenge their property assessments, which can significantly impact their tax liabilities. Understanding the purpose and implications of the 132 property form is essential for homeowners and business owners alike, as it provides a structured way to address concerns regarding property valuations.

Steps to complete the 132 property form

Completing the 132 property form requires careful attention to detail. Follow these steps to ensure your application is accurate and complete:

- Gather necessary documentation, including your property tax statement and any evidence supporting your claim, such as recent sales data or property appraisals.

- Fill out the 132 property form with your personal information, property details, and the specific reasons for your protest.

- Attach all supporting documents that substantiate your case, ensuring they are clearly labeled and organized.

- Review the completed form for accuracy, checking for any missing information or errors.

- Submit the form by the designated deadline, either online, by mail, or in person, depending on your local appraisal district's requirements.

Legal use of the 132 property form

The 132 property form is legally recognized as a valid means for property owners to contest their property appraisals. To ensure its legal standing, it must be completed accurately and submitted within the specified time frame set by the Texas Comptroller's office. Compliance with local regulations and guidelines is crucial, as failure to adhere to these can result in the rejection of your protest. The form must also be signed and dated to confirm its authenticity, establishing a formal record of your dispute.

Eligibility criteria for the 132 property form

To be eligible to file the 132 property form, you must meet specific criteria established by Texas law. Generally, you must be the owner of the property in question or an authorized representative acting on behalf of the owner. Additionally, the property must be subject to local property taxes, and you must file your protest within the designated timeline, typically within 30 days of receiving your property tax appraisal notice. Understanding these eligibility requirements is essential to ensure your protest is valid.

Required documents for the 132 property form

When submitting the 132 property form, certain documents are necessary to support your protest effectively. These may include:

- A copy of your most recent property tax statement.

- Evidence of comparable property sales that demonstrate a lower market value.

- Any recent appraisals or assessments that contradict the appraisal district's valuation.

- Photographs of the property, if applicable, to illustrate any discrepancies or issues that may affect its value.

Providing comprehensive documentation will strengthen your case and increase the likelihood of a favorable outcome.

Form submission methods for the 132 property form

The 132 property form can be submitted through various methods, depending on your local appraisal district's guidelines. Common submission methods include:

- Online submission via the appraisal district's website, which may offer a streamlined process for electronic filing.

- Mailing the completed form and supporting documents to the appropriate appraisal district office.

- In-person submission at the local appraisal district office, allowing for direct communication with staff who can assist with any questions.

Choosing the right submission method can facilitate a smoother process and ensure your protest is received on time.

Quick guide on how to complete 96 1425 property tax basics bexar appraisal district

Complete State Form 50 132 Application effortlessly on any device

Online document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage State Form 50 132 Application on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The easiest way to edit and eSign State Form 50 132 Application seamlessly

- Obtain State Form 50 132 Application and click on Get Form to begin.

- Employ the tools we provide to finalize your form.

- Highlight important sections of your documents or conceal sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Craft your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign State Form 50 132 Application and ensure outstanding communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 96 1425 property tax basics bexar appraisal district

How to generate an eSignature for the 96 1425 Property Tax Basics Bexar Appraisal District online

How to generate an electronic signature for your 96 1425 Property Tax Basics Bexar Appraisal District in Chrome

How to generate an electronic signature for putting it on the 96 1425 Property Tax Basics Bexar Appraisal District in Gmail

How to create an eSignature for the 96 1425 Property Tax Basics Bexar Appraisal District from your mobile device

How to generate an electronic signature for the 96 1425 Property Tax Basics Bexar Appraisal District on iOS devices

How to create an electronic signature for the 96 1425 Property Tax Basics Bexar Appraisal District on Android

People also ask

-

What is 132 property in relation to airSlate SignNow?

The 132 property refers to a specific offering within airSlate SignNow that simplifies the electronic signing process for businesses. With this feature, users can easily manage and send documents for eSignature, ensuring a seamless experience.

-

How does airSlate SignNow ensure security for my 132 property documents?

Security is a top priority when using airSlate SignNow for your 132 property documents. The platform employs advanced encryption and authentication measures to protect all your sensitive information throughout the signing process.

-

What are the pricing options for using airSlate SignNow for 132 property?

airSlate SignNow offers flexible pricing plans for businesses handling 132 property documents. These plans are competitively priced, allowing companies of all sizes to find a solution that fits their budget while maximizing efficiency in document handling.

-

Can I integrate airSlate SignNow with other software for managing 132 property?

Yes, airSlate SignNow provides robust integrations with various software applications that enhance the handling of 132 property. By connecting to tools like CRM systems and workflow applications, users can streamline their document management processes.

-

What features does airSlate SignNow offer for managing the 132 property?

airSlate SignNow offers a range of features tailored for 132 property management, including customizable templates, automatic reminders, and real-time tracking of document status. These features ensure efficient and effective document workflows.

-

How can airSlate SignNow benefit my business with 132 property documents?

By using airSlate SignNow for your 132 property documents, you can improve turnaround times and enhance the client experience. The easy-to-use interface allows for swift all-digital transactions, reducing paperwork and increasing productivity.

-

Is training required to use airSlate SignNow for 132 property management?

No extensive training is required to use airSlate SignNow for managing 132 property documents. The platform is designed to be user-friendly, allowing new users to quickly learn and start sending documents for eSignature.

Get more for State Form 50 132 Application

- Mi form 4884 fill and sign printable template

- 4976 michigan home heating credit claim mi 1040cr 7 supplemental 4976 michigan home heating credit claim mi 1040cr 7 form

- Form oic i 2 individual offer in compromise virginia tax

- Form oic b 2 business offer in compromise virginia tax

- Cattle assessment return instructions general beg form

- Individual income tax filingvirginia tax form

- Draft form 763 virginia nonresident income tax return virginia nonresident income tax return

- Attachment to memorandum no 97 57 form co17xp

Find out other State Form 50 132 Application

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT