Schedule D 1041 Form

What is the Schedule D 1041 Form

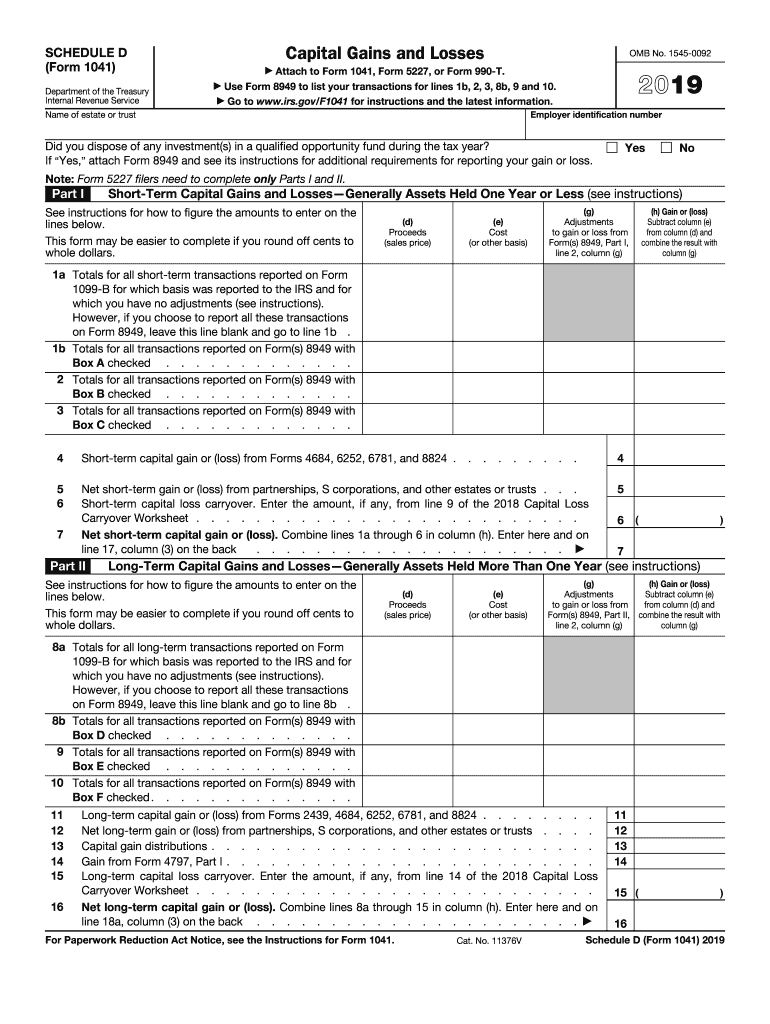

The Schedule D 1041 Form is a tax document used by estates and trusts to report capital gains and losses. It is an essential part of the federal income tax return for estates and trusts, specifically the Form 1041. This form helps in calculating the tax owed on any gains from the sale of assets, such as stocks or real estate, that the estate or trust has disposed of during the tax year. Understanding this form is crucial for accurate tax reporting and compliance with IRS regulations.

How to use the Schedule D 1041 Form

To use the Schedule D 1041 Form, start by gathering all relevant financial information regarding capital gains and losses for the estate or trust. This includes details about the sale of assets, their purchase price, and any associated costs. The form requires you to list each transaction and calculate the total gains or losses. Ensure that you follow the IRS guidelines closely to avoid errors that could lead to penalties or audits.

Steps to complete the Schedule D 1041 Form

Completing the Schedule D 1041 Form involves several key steps:

- Gather all necessary documentation related to capital gains and losses.

- Fill out Part I of the form, which details short-term capital gains and losses.

- Complete Part II for long-term capital gains and losses.

- Calculate the overall capital gain or loss by combining both parts.

- Transfer the total to the appropriate section of Form 1041.

Double-check all entries for accuracy before submitting the form to the IRS.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule D 1041 Form. It is important to refer to the latest IRS publications and instructions to ensure compliance. Key guidelines include understanding which transactions need to be reported, how to calculate gains and losses, and the importance of accurate record-keeping. Adhering to these guidelines will help in avoiding common mistakes that could lead to tax liabilities.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule D 1041 Form align with the due dates for Form 1041. Generally, the form must be filed by the 15th day of the fourth month following the close of the tax year. For estates and trusts operating on a calendar year, this typically means the deadline is April 15. It is advisable to keep track of any changes in deadlines, especially if extensions are filed.

Required Documents

To complete the Schedule D 1041 Form, certain documents are required, including:

- Transaction records for all capital asset sales.

- Purchase documentation showing the original cost of assets.

- Any supporting documentation for expenses related to the sale of assets.

- Prior year tax returns if applicable.

Having these documents organized will facilitate a smoother filing process and help ensure accuracy.

Quick guide on how to complete 2019 schedule d form 1041 capital gains and losses

Prepare Schedule D 1041 Form effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the appropriate template and securely archive it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents quickly without hold-ups. Manage Schedule D 1041 Form across any platform with the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

How to modify and electronically sign Schedule D 1041 Form without hassle

- Locate Schedule D 1041 Form and click on Get Form to begin.

- Make use of the features we offer to complete your document.

- Emphasize important sections of your documents or hide sensitive details using tools that airSlate SignNow provides for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to deliver your form—by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Schedule D 1041 Form and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 schedule d form 1041 capital gains and losses

How to make an eSignature for your 2019 Schedule D Form 1041 Capital Gains And Losses in the online mode

How to create an eSignature for the 2019 Schedule D Form 1041 Capital Gains And Losses in Chrome

How to make an electronic signature for putting it on the 2019 Schedule D Form 1041 Capital Gains And Losses in Gmail

How to make an electronic signature for the 2019 Schedule D Form 1041 Capital Gains And Losses straight from your smartphone

How to generate an electronic signature for the 2019 Schedule D Form 1041 Capital Gains And Losses on iOS

How to generate an eSignature for the 2019 Schedule D Form 1041 Capital Gains And Losses on Android

People also ask

-

What is the 1041 form 2019 schedule d?

The 1041 form 2019 schedule d is used for reporting capital gains and losses as part of the estate or trust income tax return. It helps ensure accurate reporting of transactions for the previous year. This form is crucial for compliance and can affect overall tax liabilities.

-

How can airSlate SignNow assist with the 1041 form 2019 schedule d?

airSlate SignNow streamlines the completion and e-signing of the 1041 form 2019 schedule d. By offering a user-friendly interface, it simplifies the process of gathering signatures and securely sending documents. This can save time and enhance accuracy in your tax filing.

-

Is airSlate SignNow affordable for tax professionals needing the 1041 form 2019 schedule d?

Yes, airSlate SignNow provides a cost-effective solution that caters to the needs of tax professionals. With flexible pricing options, you can choose a plan that fits your budget while gaining access to tools designed for managing documents related to the 1041 form 2019 schedule d efficiently.

-

What features does airSlate SignNow offer for completing the 1041 form 2019 schedule d?

AirSlate SignNow includes features such as customizable templates, electronic signatures, and secure cloud storage, all of which enhance the handling of the 1041 form 2019 schedule d. These tools make it easier to prepare, send, and store your documents in compliance with tax regulations.

-

Can airSlate SignNow integrate with other software for the 1041 form 2019 schedule d?

Absolutely! airSlate SignNow offers integrations with a variety of accounting software and other platforms to streamline the process of handling the 1041 form 2019 schedule d. This ensures that data is easily transferred and managed across systems, improving efficiency.

-

What benefits does using airSlate SignNow provide for the 1041 form 2019 schedule d?

Using airSlate SignNow allows users to complete the 1041 form 2019 schedule d faster and with greater accuracy. The ease of e-signing and document management helps reduce errors and ensures timely submissions to the IRS, ultimately leading to hassle-free tax filing.

-

How secure is the information submitted through the 1041 form 2019 schedule d using airSlate SignNow?

Security is a top priority for airSlate SignNow. All documents, including the 1041 form 2019 schedule d, are encrypted and stored securely in compliance with industry standards. This provides assurance that your sensitive tax information is well protected.

Get more for Schedule D 1041 Form

Find out other Schedule D 1041 Form

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online