Cbp Form 3347 Instructions

IRS Guidelines for Form 5

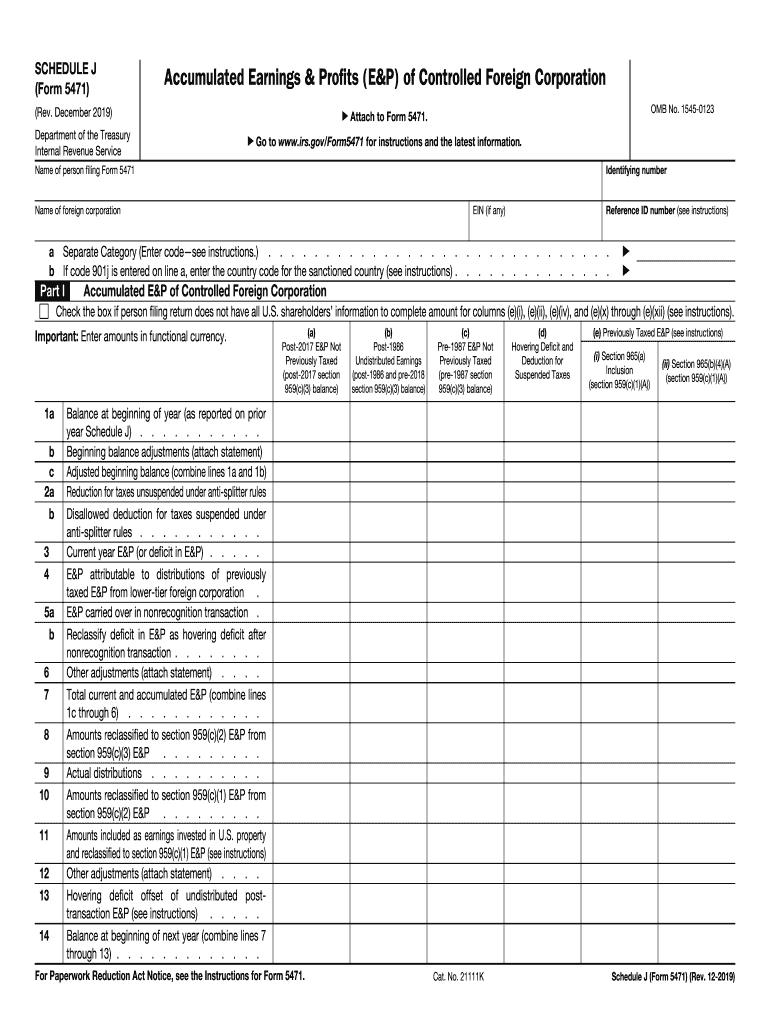

The 2019 IRS Form 5471 is essential for U.S. citizens and residents who are officers, directors, or shareholders in certain foreign corporations. This form is a requirement under the Internal Revenue Code to report information about foreign corporations and their activities. The IRS mandates that this form be filed alongside your income tax return, ensuring compliance with U.S. tax laws. It is crucial to understand the specific IRS guidelines to avoid penalties and ensure accurate reporting.

Filing Deadlines for Form 5

Timely submission of Form 5471 is critical to avoid penalties. Generally, the form must be filed with your annual income tax return, which is typically due on April 15. If you file for an extension, the deadline may be extended to October 15. However, it is important to note that extensions for your tax return do not automatically extend the deadline for Form 5471. Ensure you file the form on time to maintain compliance.

Steps to Complete Form 5

Completing Form 5471 involves several steps to ensure accuracy and compliance. Here is a simplified process:

- Gather necessary information about the foreign corporation, including its name, address, and Employer Identification Number (EIN).

- Identify your relationship with the foreign corporation, including your ownership percentage.

- Complete the relevant sections of the form, which may include financial statements and information about transactions with the foreign corporation.

- Review the form for accuracy and completeness before submission.

Required Documents for Form 5

To accurately complete Form 5471, certain documents are necessary. These may include:

- Financial statements of the foreign corporation, including balance sheets and income statements.

- Documentation of ownership interests and any transactions between you and the foreign corporation.

- Previous year’s Form 5471, if applicable, to ensure consistency and accuracy in reporting.

Penalties for Non-Compliance with Form 5

Failure to file Form 5471 or filing it inaccurately can result in significant penalties. The IRS imposes a penalty of $10,000 for each form that is not filed on time. Additionally, if the IRS deems the failure to file as intentional, further penalties may apply, including potential criminal charges. It is essential to understand the importance of compliance to avoid these severe consequences.

Digital vs. Paper Version of Form 5

Form 5471 can be completed and submitted electronically or in paper format. The digital version offers advantages such as easier data entry, automatic calculations, and immediate submission. However, some individuals may prefer the paper version for its tangible format. Regardless of the method chosen, ensure that all information is accurate and complete to avoid issues with the IRS.

Who Issues Form 5

The Internal Revenue Service (IRS) is the issuing authority for Form 5471. This federal agency is responsible for tax administration and ensuring compliance with U.S. tax laws. Understanding the role of the IRS in the context of Form 5471 helps taxpayers recognize the importance of accurate reporting and adherence to guidelines set forth by the agency.

Quick guide on how to complete form 5471 schedule j accumulated earnings and profits eampampp

Effortlessly Prepare Cbp Form 3347 Instructions on Any Gadget

Digital document management has increasingly gained traction among both businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly and without interruptions. Manage Cbp Form 3347 Instructions on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-centric operations today.

The simplest method to modify and electronically sign Cbp Form 3347 Instructions with ease

- Locate Cbp Form 3347 Instructions and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about losing or misplacing documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Cbp Form 3347 Instructions to ensure seamless communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 5471 schedule j accumulated earnings and profits eampampp

How to generate an electronic signature for your Form 5471 Schedule J Accumulated Earnings And Profits Eampampp online

How to generate an electronic signature for your Form 5471 Schedule J Accumulated Earnings And Profits Eampampp in Google Chrome

How to make an electronic signature for putting it on the Form 5471 Schedule J Accumulated Earnings And Profits Eampampp in Gmail

How to generate an electronic signature for the Form 5471 Schedule J Accumulated Earnings And Profits Eampampp right from your mobile device

How to generate an eSignature for the Form 5471 Schedule J Accumulated Earnings And Profits Eampampp on iOS

How to make an eSignature for the Form 5471 Schedule J Accumulated Earnings And Profits Eampampp on Android devices

People also ask

-

What is the significance of the 5471 2019 form in airSlate SignNow?

The 5471 2019 form is crucial for businesses that need to report ownership in foreign corporations. With airSlate SignNow, you can easily prepare, sign, and send this form, ensuring compliance with IRS regulations. Our platform streamlines the filing process, making it easier for you to manage your international business obligations.

-

How can airSlate SignNow assist with the completion of the 5471 2019 form?

airSlate SignNow provides templates and workflows specifically designed for the 5471 2019 form, allowing for efficient data entry and document management. The intuitive interface ensures you have all the necessary fields covered, minimizing errors and saving valuable time. You can easily share the form with your team for collaboration before eSigning.

-

What are the pricing options for using airSlate SignNow to manage the 5471 2019?

airSlate SignNow offers competitive pricing plans tailored for businesses of all sizes. Our subscription includes access to all features needed to manage forms like the 5471 2019, so you can optimize your documentation processes while staying within budget. Visit our pricing page for detailed plans and promotions.

-

Are there any integrations available for the 5471 2019 with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications like Google Drive, Dropbox, and CRM systems. This integration capability allows businesses to import data needed for the 5471 2019 form directly from their existing software, streamlining the completion process. You can automate workflows to save time and reduce manual entries.

-

What security features does airSlate SignNow provide for documents like the 5471 2019?

Security is a top priority at airSlate SignNow. We employ advanced encryption protocols and multi-factor authentication to protect sensitive documents like the 5471 2019 from unauthorized access. Additionally, our platform offers audit trails that log every action for enhanced accountability.

-

Can airSlate SignNow help with international transactions related to the 5471 2019?

Absolutely! airSlate SignNow simplifies the process of handling international transactions by allowing users to prepare, sign, and send necessary documentation like the 5471 2019. We cater to global businesses, providing tools that ensure accuracy and compliance with international regulations.

-

What are the benefits of using airSlate SignNow for the 5471 2019 form?

Using airSlate SignNow for the 5471 2019 form offers numerous benefits, including improved efficiency and reduced turnaround times. Our platform is user-friendly, enabling quick and easy document preparation and eSigning. Plus, our seamless automation reduces the risk of errors, ensuring smoother operations for your business.

Get more for Cbp Form 3347 Instructions

Find out other Cbp Form 3347 Instructions

- Electronic signature Utah Storage Rental Agreement Easy

- Electronic signature Washington Home office rental agreement Simple

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe