8880 Tax Form 2018

What is the 8880 Tax Form

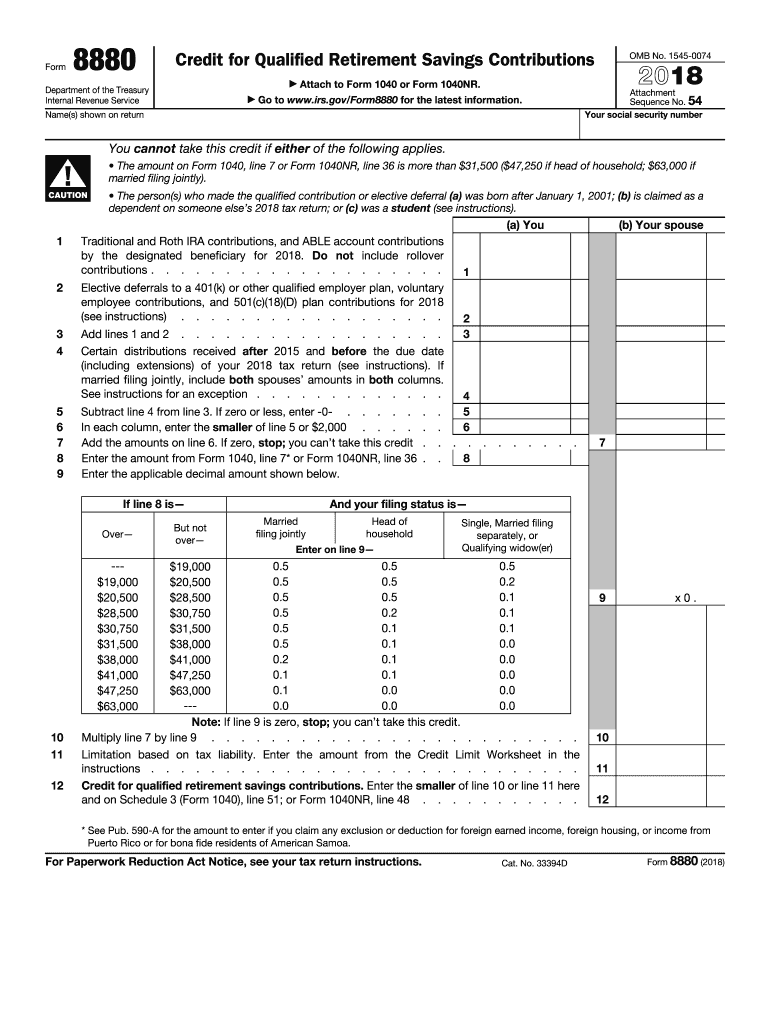

The 2017 tax form 8880 is officially known as the Credit for Qualified Retirement Savings Contributions. This form is used by eligible taxpayers to claim a tax credit for contributions made to qualified retirement plans, such as IRAs and 401(k)s. The credit is designed to encourage individuals to save for retirement by offering a financial incentive based on their contributions and income levels.

How to use the 8880 Tax Form

To effectively use the 2017 tax form 8880, taxpayers must first determine their eligibility based on income and filing status. After confirming eligibility, individuals should complete the form by entering their contributions to retirement accounts and calculating the applicable credit. This form must be submitted along with the federal tax return to claim the credit, reducing the overall tax liability.

Steps to complete the 8880 Tax Form

Completing the 2017 tax form 8880 involves several key steps:

- Gather necessary information, including income details and retirement contributions.

- Determine eligibility by reviewing IRS guidelines on income limits and filing statuses.

- Fill out the form, ensuring all required fields are completed accurately.

- Calculate the credit based on the contributions and applicable percentage.

- Attach the completed form to your federal tax return before submission.

Legal use of the 8880 Tax Form

The 2017 tax form 8880 must be used in accordance with IRS regulations. It is essential to ensure that the form is current and that all information provided is accurate and truthful. Misuse of the form, such as claiming credits for contributions not made, can lead to penalties and legal repercussions. Therefore, it is crucial to maintain compliance with all IRS guidelines when using this form.

Eligibility Criteria

To qualify for the credit on the 2017 tax form 8880, taxpayers must meet specific eligibility criteria, including:

- Being at least eighteen years old by the end of the tax year.

- Not being a full-time student during the tax year.

- Not being claimed as a dependent on another person's tax return.

- Meeting the income limits set by the IRS for the tax year.

Form Submission Methods (Online / Mail / In-Person)

The 2017 tax form 8880 can be submitted through various methods, depending on the taxpayer's preference and situation:

- Online: Taxpayers can file electronically using tax preparation software that supports the form.

- Mail: The form can be printed and mailed to the appropriate IRS address, as specified in the instructions.

- In-Person: Taxpayers may also opt to deliver their forms directly to local IRS offices, although this is less common.

Quick guide on how to complete 8880 form 2018 2019

Discover the simplest method to complete and endorse your 8880 Tax Form

Are you still squandering time preparing your official documents on paper instead of doing it digitally? airSlate SignNow presents a superior approach to finalize and endorse your 8880 Tax Form and related forms for public services. Our intelligent electronic signature tool equips you with everything necessary to manage paperwork swiftly and in compliance with official standards - robust PDF editing, organizing, safeguarding, endorsing, and sharing functionalities all available within a user-friendly interface.

Only a few steps are needed to complete to fill out and endorse your 8880 Tax Form:

- Upload the editable template to the editor using the Get Form button.

- Review what details you need to include in your 8880 Tax Form.

- Move through the fields utilizing the Next option to ensure nothing is overlooked.

- Employ Text, Check, and Cross tools to fill in the blanks with your details.

- Update the content with Text boxes or Images from the top toolbar.

- Emphasize what is essential or Blackout sections that are no longer relevant.

- Press Sign to create a legally binding electronic signature through your preferred method.

- Add the Date next to your signature and conclude your work with the Done button.

Store your completed 8880 Tax Form in the Documents folder of your profile, download it, or export it to your chosen cloud storage. Our solution also offers adaptable form sharing. There’s no need to print your templates when you need to submit them at the relevant public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try now!

Create this form in 5 minutes or less

Find and fill out the correct 8880 form 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

Create this form in 5 minutes!

How to create an eSignature for the 8880 form 2018 2019

How to make an eSignature for the 8880 Form 2018 2019 online

How to generate an eSignature for the 8880 Form 2018 2019 in Google Chrome

How to make an eSignature for signing the 8880 Form 2018 2019 in Gmail

How to generate an eSignature for the 8880 Form 2018 2019 right from your smartphone

How to create an electronic signature for the 8880 Form 2018 2019 on iOS

How to make an electronic signature for the 8880 Form 2018 2019 on Android

People also ask

-

What is the 8880 Tax Form and how can airSlate SignNow help?

The 8880 Tax Form is used to claim the Retirement Savings Contributions Credit. With airSlate SignNow, you can easily eSign and send your completed 8880 Tax Form securely, ensuring that your important documents are handled efficiently.

-

Is airSlate SignNow suitable for submitting the 8880 Tax Form electronically?

Yes, airSlate SignNow provides a user-friendly platform that allows you to electronically sign and submit your 8880 Tax Form quickly. Our secure eSignature solution ensures that your submissions are both valid and compliant with IRS requirements.

-

What are the pricing options for using airSlate SignNow to manage the 8880 Tax Form?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, making it affordable to manage documents like the 8880 Tax Form. You can choose from monthly or annual subscriptions, providing you with the best value for your eSignature needs.

-

How does airSlate SignNow ensure the security of my 8880 Tax Form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols, secure servers, and multi-factor authentication to protect your 8880 Tax Form and other sensitive documents, ensuring that only authorized users can access them.

-

Can I integrate airSlate SignNow with other software to manage my 8880 Tax Form?

Absolutely! airSlate SignNow seamlessly integrates with various applications, including CRM and accounting software, allowing you to streamline the process of handling your 8880 Tax Form. This integration helps maintain accuracy and efficiency in your document management.

-

What features does airSlate SignNow offer for completing the 8880 Tax Form?

airSlate SignNow provides features like customizable templates, bulk sending, and automated reminders to help you manage your 8880 Tax Form effectively. These tools simplify the signing process and ensure that you never miss a deadline.

-

Is it easy to track the status of my 8880 Tax Form with airSlate SignNow?

Yes, airSlate SignNow offers real-time tracking for your documents, including the 8880 Tax Form. You can easily see who has signed, who still needs to sign, and receive notifications when the document is completed.

Get more for 8880 Tax Form

- Haccp manual fwcs nutrition services form

- 5 day eviction notice illinois form

- Outpatient physicians treatment claim form allstate benefits

- Provider fax cover sheet mytricarecom form

- Standard lease addendum form

- Nevada unconditional waiver and release upon progress zlien form

- Official ncaa scorebook form

- Basketball excel scoresheet aps sport form

Find out other 8880 Tax Form

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe