About Form 8880, Credit for Qualified Retirement SavingsFederal Form 8880 Credit for Qualified Retirement SavingsAbout Form 8880 2022

Understanding Form 8880: Credit for Qualified Retirement Savings

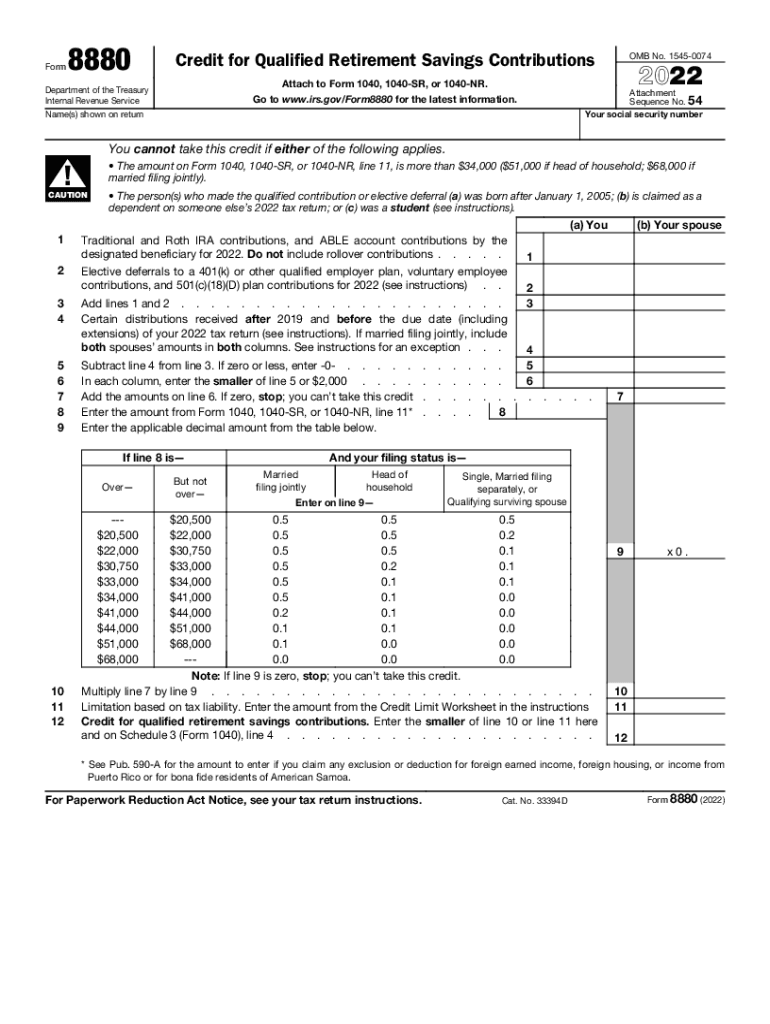

The IRS Form 8880 is designed to help eligible taxpayers claim a credit for contributions made to qualified retirement savings plans. This credit, known as the Retirement Savings Contributions Credit, is aimed at encouraging low- to moderate-income individuals to save for retirement. By completing this form, taxpayers can reduce their tax liability, making retirement savings more accessible.

To qualify for this credit, individuals must meet specific income thresholds and have made contributions to a qualified retirement plan, such as a 401(k) or an IRA. The amount of the credit can vary based on the taxpayer's adjusted gross income and filing status, making it essential to understand the eligibility criteria before applying.

Steps to Complete Form 8880

Completing the Form 8880 involves several key steps to ensure accuracy and compliance with IRS requirements. Start by gathering necessary documents, including your tax return and records of retirement contributions. The form itself consists of various sections where you will report your contributions and calculate the credit amount.

Begin by filling out your personal information, including your filing status and adjusted gross income. Next, report the total contributions made to your retirement accounts. The form will guide you through the calculations needed to determine your credit, which can be a percentage of your contributions, depending on your income level.

Eligibility Criteria for Form 8880

To qualify for the Retirement Savings Contributions Credit through Form 8880, taxpayers must meet specific eligibility criteria. These include being at least eighteen years old, not being a full-time student, and having an adjusted gross income below certain limits set by the IRS.

The income limits vary based on filing status—single, married filing jointly, or head of household. Additionally, the contributions must be made to a qualified retirement plan, and the taxpayer must not have received a distribution from the plan during the tax year. Understanding these criteria is crucial for maximizing potential tax benefits.

Filing Deadlines for Form 8880

Filing deadlines for Form 8880 align with the general tax filing deadlines set by the IRS. Typically, the deadline for submitting your tax return, including Form 8880, is April fifteenth of the following year. However, if you file for an extension, you may have until October fifteenth to submit your return.

It is important to ensure that Form 8880 is filed accurately and on time to avoid penalties and to secure any potential tax credits. Taxpayers should also keep in mind that any changes in income or contributions may affect eligibility for the credit, necessitating careful review before submission.

Legal Use of Form 8880

The legal use of Form 8880 is governed by IRS regulations, which outline the requirements for claiming the Retirement Savings Contributions Credit. This form must be filled out accurately and submitted with your tax return to be considered valid. Failing to comply with IRS guidelines can result in disqualification from receiving the credit.

Moreover, it is essential to maintain proper documentation of all contributions made to retirement accounts, as the IRS may request verification of these contributions. Understanding the legal implications of Form 8880 can help taxpayers navigate the process more effectively and ensure compliance with tax laws.

Quick guide on how to complete about form 8880 credit for qualified retirement savingsfederal form 8880 credit for qualified retirement savingsabout form 8880

Complete About Form 8880, Credit For Qualified Retirement SavingsFederal Form 8880 Credit For Qualified Retirement SavingsAbout Form 8880 seamlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal green alternative to conventional printed and signed papers, as you can obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without unnecessary hold-ups. Manage About Form 8880, Credit For Qualified Retirement SavingsFederal Form 8880 Credit For Qualified Retirement SavingsAbout Form 8880 on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to alter and eSign About Form 8880, Credit For Qualified Retirement SavingsFederal Form 8880 Credit For Qualified Retirement SavingsAbout Form 8880 effortlessly

- Obtain About Form 8880, Credit For Qualified Retirement SavingsFederal Form 8880 Credit For Qualified Retirement SavingsAbout Form 8880 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive content using tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to submit your form, whether by email, SMS, or invitation link, or download it onto your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign About Form 8880, Credit For Qualified Retirement SavingsFederal Form 8880 Credit For Qualified Retirement SavingsAbout Form 8880 while ensuring outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 8880 credit for qualified retirement savingsfederal form 8880 credit for qualified retirement savingsabout form 8880

Create this form in 5 minutes!

People also ask

-

What is form 8880 and who needs it?

Form 8880, also known as the Credit for Qualified Retirement Savings Contributions, is used by individuals to claim a tax credit for making eligible contributions to retirement accounts. It's beneficial for lower to moderate-income earners looking to save for retirement while receiving tax incentives. Understanding the requirements related to form 8880 can help you maximize your savings.

-

How does airSlate SignNow support the completion of form 8880?

With airSlate SignNow, users can easily create, send, and eSign form 8880 directly from the platform. This streamlined process simplifies the fulfillment of the form, making it quick and efficient. Our user-friendly interface ensures that you can complete and file form 8880 with minimal hassle.

-

Is there a cost associated with using airSlate SignNow for form 8880?

airSlate SignNow offers a cost-effective solution for managing documents, including form 8880. Pricing depends on the plan chosen, catering to individuals and businesses alike. With our competitive pricing, you'll find that using airSlate SignNow for form 8880 offers great value for your document management needs.

-

What features does airSlate SignNow offer for managing form 8880?

Our platform includes features such as document templates, cloud storage, and eSigning capabilities that facilitate the management of form 8880. You can also track the status of your documents in real-time, ensuring that your submissions are processed without delay. These features make airSlate SignNow an ideal choice for professionals dealing with tax forms.

-

Are there integrations available for airSlate SignNow when working with form 8880?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance your workflow while managing form 8880. Integrations with tools such as Google Drive, Dropbox, and CRM systems streamline document organization and storage. This ensures that you can efficiently access the information needed for form 8880 at any time.

-

Can airSlate SignNow help with compliance for form 8880?

Absolutely! airSlate SignNow assists users in ensuring compliance with legal and regulatory requirements when submitting form 8880. Our platform provides audit trails and secure storage options to protect your sensitive information. This commitment to compliance helps foster confidence in the integrity of your submitted forms.

-

What are the benefits of using airSlate SignNow to handle form 8880?

Using airSlate SignNow to handle form 8880 provides numerous benefits, including easy access to templates, efficient eSigning, and reliable document storage. This signNowly reduces the time and effort required compared to traditional methods. Additionally, our platform's ease of use makes it suitable for both individuals and organizations dealing with tax documents.

Get more for About Form 8880, Credit For Qualified Retirement SavingsFederal Form 8880 Credit For Qualified Retirement SavingsAbout Form 8880

- General warranty deed from husband and wife to husband and wife ohio form

- Ohio limited warranty form

- Quitclaim deed from husband and wife to an individual ohio form

- General warranty deed from husband and wife to an individual ohio form

- Ohio limited warranty deed form

- Transfer on death designation affidavit tod from individual to individual with contingent beneficiary ohio form

- Notice garnishment form

- Oh grandparents rights form

Find out other About Form 8880, Credit For Qualified Retirement SavingsFederal Form 8880 Credit For Qualified Retirement SavingsAbout Form 8880

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile