8880 Form 2015

What is the 8880 Form

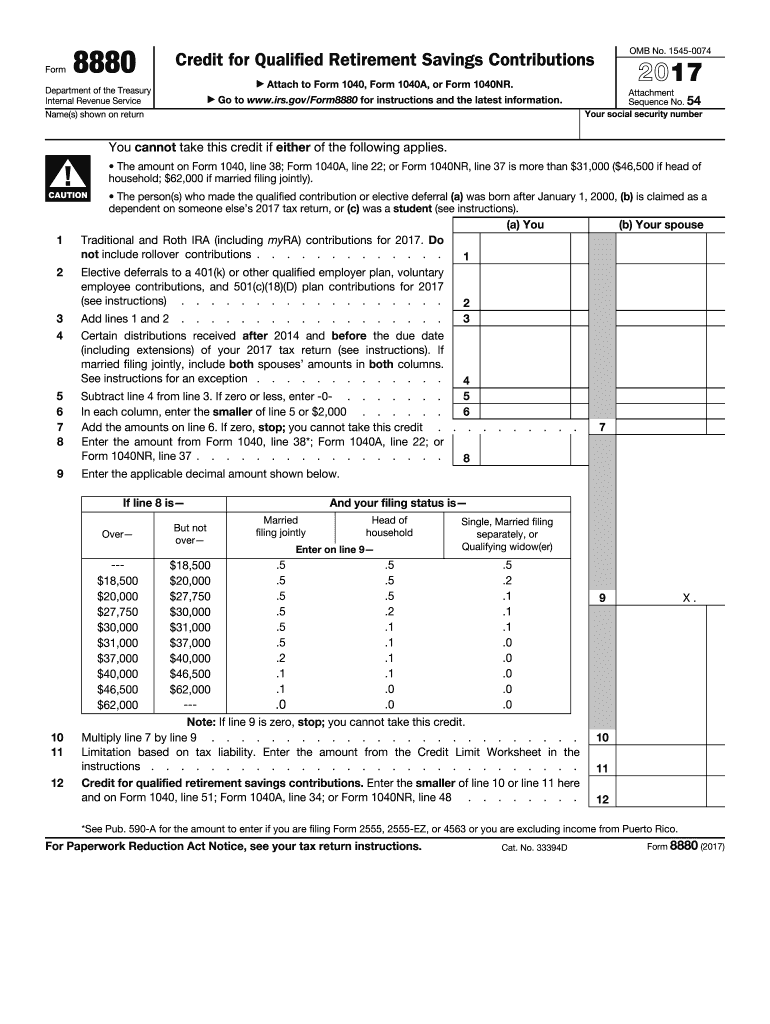

The 8880 Form, officially known as the Credit for Qualified Retirement Savings Contributions, is a tax form used by eligible taxpayers in the United States to claim a credit for contributions made to retirement savings accounts. This form is particularly beneficial for low- to moderate-income individuals who contribute to their retirement plans, such as IRAs or 401(k)s. The credit can help reduce the overall tax liability, making retirement savings more accessible.

How to use the 8880 Form

To use the 8880 Form effectively, taxpayers must first determine their eligibility based on income levels and filing status. Once eligibility is confirmed, individuals can fill out the form by providing necessary information, including the amount contributed to retirement accounts during the tax year. It is essential to follow the instructions carefully to ensure accurate reporting of contributions and to maximize the potential credit.

Steps to complete the 8880 Form

Completing the 8880 Form involves several key steps:

- Gather necessary documents, including proof of contributions to retirement accounts.

- Determine eligibility based on income and filing status as outlined by IRS guidelines.

- Fill out the form by entering personal information, including Social Security number and filing status.

- Report the total contributions made to qualifying retirement accounts.

- Calculate the credit amount based on the instructions provided with the form.

- Review the completed form for accuracy before submission.

Legal use of the 8880 Form

The 8880 Form is legally recognized by the IRS as a valid means for taxpayers to claim a credit for retirement contributions. To ensure its legal use, individuals must meet specific eligibility criteria and adhere to IRS regulations regarding retirement savings. Proper completion and submission of the form can help protect taxpayers from potential audits or penalties related to incorrect claims.

Filing Deadlines / Important Dates

Filing deadlines for the 8880 Form align with the general tax filing deadlines set by the IRS. Typically, taxpayers must submit their tax returns, including the 8880 Form, by April 15 of the following year. However, if an extension is filed, the deadline may be extended to October 15. It is crucial to be aware of these dates to avoid penalties for late filing.

Required Documents

To complete the 8880 Form, taxpayers need to gather several key documents:

- Proof of contributions to retirement accounts, such as bank statements or account statements.

- Income documentation, including W-2 forms or 1099 forms, to verify eligibility.

- Personal identification information, such as Social Security numbers for all individuals listed on the tax return.

Quick guide on how to complete 2015 8880 form

Effortlessly prepare 8880 Form on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any holdups. Handle 8880 Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and electronically sign 8880 Form with ease

- Find 8880 Form and tap on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information using tools specifically designed by airSlate SignNow for this purpose.

- Generate your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method for sharing your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign 8880 Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 8880 form

Create this form in 5 minutes!

How to create an eSignature for the 2015 8880 form

The best way to create an electronic signature for a PDF file in the online mode

The best way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature from your smartphone

The way to create an eSignature for a PDF file on iOS devices

How to generate an eSignature for a PDF file on Android

People also ask

-

What is the 8880 Form used for?

The 8880 Form, also known as the Credit for Qualified Retirement Savings Contributions, is used by taxpayers to claim a tax credit for contributions made to eligible retirement savings plans. By using the 8880 Form, individuals can benefit from tax advantages while saving for their future retirement.

-

How can airSlate SignNow help with the 8880 Form?

airSlate SignNow streamlines the process of preparing and signing the 8880 Form by providing an easy-to-use platform for electronic signatures and document management. With our solution, you can quickly complete the form, ensuring compliance and accuracy while saving valuable time.

-

Is there a cost associated with using airSlate SignNow for the 8880 Form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, allowing you to choose the best option for managing documents like the 8880 Form. Our cost-effective solution ensures that you have access to powerful features without breaking the bank.

-

What features does airSlate SignNow provide for handling the 8880 Form?

airSlate SignNow includes features such as customizable templates, secure electronic signatures, and real-time document tracking, all of which simplify the process of managing the 8880 Form. These features enhance efficiency and help ensure that your documents are processed quickly and securely.

-

Can I integrate airSlate SignNow with other software for the 8880 Form?

Absolutely! airSlate SignNow offers seamless integrations with various business applications, allowing you to connect your workflows for the 8880 Form with tools like CRM systems and cloud storage services. This integration capability enhances productivity and keeps your documents organized.

-

What are the benefits of using airSlate SignNow for the 8880 Form?

Using airSlate SignNow for the 8880 Form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security for sensitive information. Our platform not only simplifies the signing process but also ensures that your documents are legally binding and compliant.

-

How secure is airSlate SignNow when handling the 8880 Form?

Security is a top priority at airSlate SignNow. We employ advanced encryption and authentication protocols to protect your documents, including the 8880 Form, ensuring that your sensitive data remains confidential and secure throughout the signing process.

Get more for 8880 Form

Find out other 8880 Form

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile