Form 8880 20 Attach to Form 1040, Form 1040A, or Form 2021

What is the Form 8880?

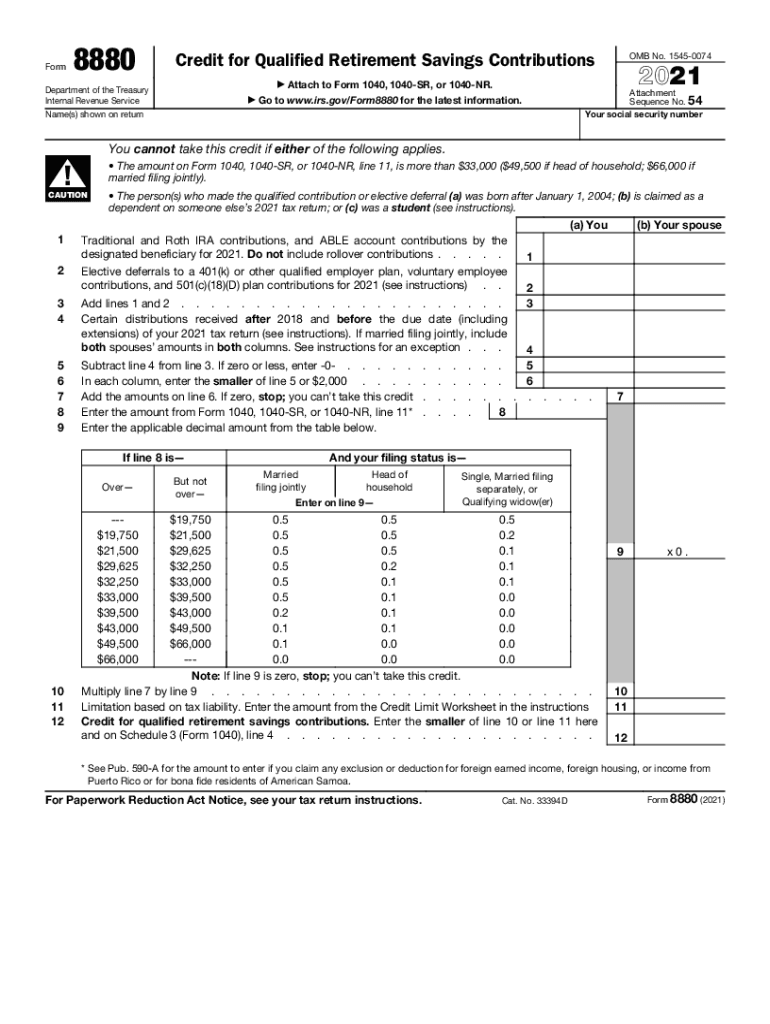

The Form 8880, officially known as the IRS Form 8880, is used to claim the Retirement Savings Contributions Credit, also referred to as the Saver's Credit. This form is designed for eligible taxpayers who contribute to a retirement plan, such as a 401(k) or an IRA. The credit can reduce the amount of tax owed, making it a valuable tool for individuals saving for retirement. To claim this credit, Form 8880 must be attached to your Form 1040, Form 1040A, or Form 1040NR when filing your taxes.

Eligibility Criteria for Form 8880

To qualify for the Saver's Credit and use Form 8880, certain eligibility criteria must be met. Taxpayers must be at least eighteen years old, not a full-time student, and cannot be claimed as a dependent on someone else's tax return. Additionally, the credit is subject to income limits, which vary based on filing status. For example, single filers must have an adjusted gross income below a certain threshold to qualify for the credit. Understanding these criteria is essential to ensure that you can take advantage of the benefits offered by the form.

Steps to Complete the Form 8880

Completing Form 8880 involves several steps to ensure accurate reporting and eligibility for the credit. First, gather information about your retirement contributions for the tax year. Next, complete the form by providing your personal information and calculating your credit based on your contributions and adjusted gross income. It's important to follow the instructions carefully to avoid errors that could delay processing or affect your credit amount. Once completed, attach the form to your main tax return and submit it by the filing deadline.

Required Documents for Form 8880

When preparing to file Form 8880, certain documents are necessary to support your claim. These include records of your retirement contributions, such as W-2 forms showing employer contributions, 1099-R forms for distributions, and any statements from your retirement accounts. Additionally, documentation proving your adjusted gross income may be required. Keeping these documents organized will facilitate a smoother filing process and help ensure that you meet all eligibility requirements for the credit.

Filing Deadlines for Form 8880

The filing deadline for Form 8880 aligns with the general tax return deadlines set by the IRS. Typically, individual tax returns are due on April fifteenth of each year. However, if you need additional time, you may file for an extension, which allows you to submit your return by October fifteenth. It is crucial to file Form 8880 by the appropriate deadline to ensure that you can claim the Saver's Credit for the tax year in question.

IRS Guidelines for Form 8880

The IRS provides specific guidelines regarding the use of Form 8880, including eligibility requirements and instructions for completing the form. Taxpayers should refer to the IRS website or the form's instructions for the most current information on income limits, credit calculations, and any updates to the process. Adhering to these guidelines helps ensure compliance and maximizes the benefits of the Saver's Credit.

Quick guide on how to complete form 8880 20 attach to form 1040 form 1040a or form

Accomplish Form 8880 20 Attach To Form 1040, Form 1040A, Or Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage Form 8880 20 Attach To Form 1040, Form 1040A, Or Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to alter and eSign Form 8880 20 Attach To Form 1040, Form 1040A, Or Form with ease

- Locate Form 8880 20 Attach To Form 1040, Form 1040A, Or Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searching, or mistakes that require new document prints. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 8880 20 Attach To Form 1040, Form 1040A, Or Form and ensure outstanding communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8880 20 attach to form 1040 form 1040a or form

Create this form in 5 minutes!

How to create an eSignature for the form 8880 20 attach to form 1040 form 1040a or form

The best way to create an e-signature for your PDF file in the online mode

The best way to create an e-signature for your PDF file in Chrome

The best way to make an e-signature for putting it on PDFs in Gmail

The way to make an e-signature from your smartphone

The way to generate an electronic signature for a PDF file on iOS devices

The way to make an e-signature for a PDF file on Android

People also ask

-

What is form 8880 and why is it important?

Form 8880, also known as the Credit for Qualified Retirement Savings Contributions, helps eligible taxpayers claim a tax credit for contributions to retirement accounts. Understanding form 8880 is crucial for maximizing your tax savings, especially if you're contributing to a plan like a 401(k) or an IRA.

-

How can airSlate SignNow help with completing form 8880?

airSlate SignNow allows users to easily fill out and electronically sign form 8880. With our user-friendly interface, you can complete the form accurately and efficiently, ensuring that you don't miss any critical information needed for your tax filing.

-

What are the pricing options for using airSlate SignNow to manage form 8880?

airSlate SignNow offers a variety of pricing plans, catering to businesses of all sizes. Whether you need a basic plan or advanced features for form 8880 processing, our competitive pricing ensures that you find a solution that fits your budget.

-

Are there any special features for handling form 8880 in airSlate SignNow?

Yes, airSlate SignNow includes features specifically designed for handling form 8880, such as data validation, templates, and secure signing options. These features streamline the process, ensuring that your form is completed accurately and quickly.

-

What benefits do I gain from using airSlate SignNow for my form 8880 submissions?

Using airSlate SignNow for your form 8880 submissions provides you with convenience, security, and efficiency. Our platform ensures that your documents are securely stored, and you can access them anytime, which simplifies your tax preparation process.

-

Can I integrate airSlate SignNow with my existing tax software for form 8880?

Absolutely! airSlate SignNow offers integration capabilities with various tax software tools, making it seamless to handle form 8880 within your existing setup. This integration enhances your workflow and reduces the chances of errors during the submission process.

-

Is electronic signing of form 8880 legal and secure?

Yes, electronic signing of form 8880 using airSlate SignNow is both legal and secure. Our platform complies with e-signature laws, ensuring that your signed documents are valid and protected against unauthorized access.

Get more for Form 8880 20 Attach To Form 1040, Form 1040A, Or Form

- Site work contract for contractor district of columbia form

- Siding contract for contractor district of columbia form

- Refrigeration contract for contractor district of columbia form

- Drainage contract for contractor district of columbia form

- Foundation contract for contractor district of columbia form

- Plumbing contract for contractor district of columbia form

- Brick mason contract for contractor district of columbia form

- Roofing contract for contractor district of columbia form

Find out other Form 8880 20 Attach To Form 1040, Form 1040A, Or Form

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document