Form Credit 2016

What is the Form Credit

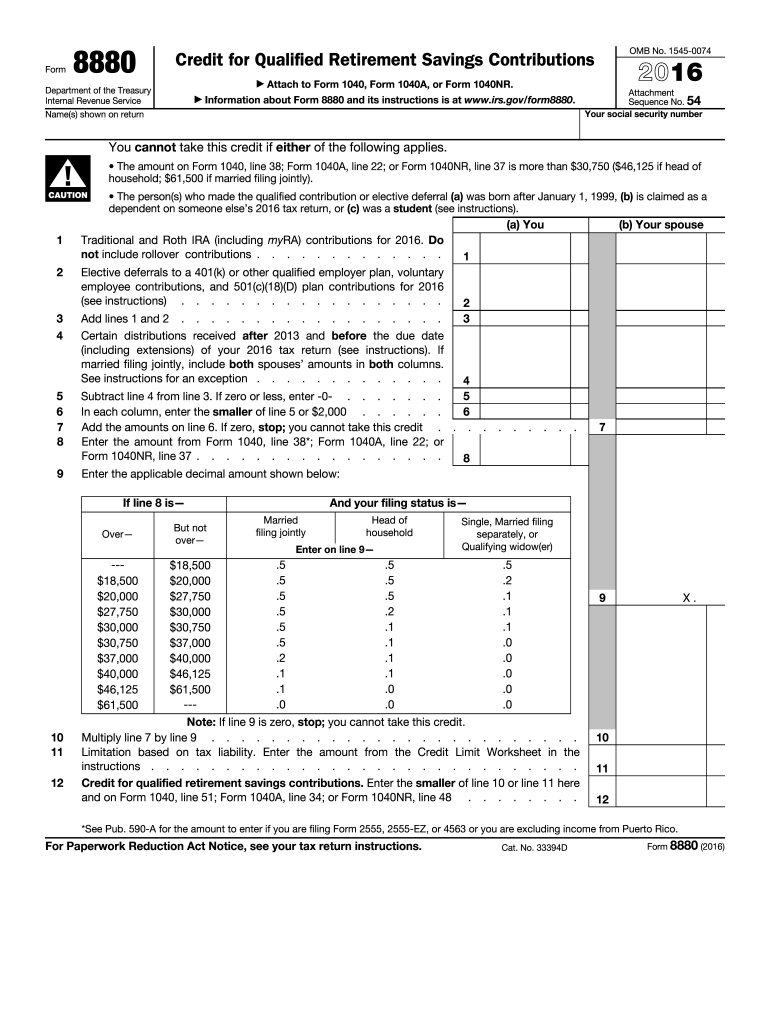

The Form Credit is a document used primarily for tax purposes, allowing individuals and businesses to claim certain credits or deductions on their tax returns. This form is essential for ensuring that taxpayers receive the benefits they are entitled to, which can significantly reduce their tax liability. Understanding the purpose and requirements of the Form Credit is crucial for accurate tax filing and compliance with IRS regulations.

How to use the Form Credit

Using the Form Credit involves several steps to ensure proper completion and submission. First, gather all necessary documentation that supports the claims being made on the form, such as income statements and receipts. Next, accurately fill out the form, ensuring that all information is correct and complete. After completing the form, review it for any errors before submission. Finally, submit the Form Credit according to the specified method, whether online, by mail, or in person, to ensure timely processing.

Steps to complete the Form Credit

Completing the Form Credit requires careful attention to detail. Follow these steps for successful completion:

- Gather all relevant financial documents, including income statements and prior tax returns.

- Fill out the form with accurate personal and financial information.

- Double-check all entries to avoid mistakes that could delay processing.

- Sign and date the form as required.

- Submit the form through the appropriate channels, ensuring it is sent before the deadline.

Legal use of the Form Credit

The legal use of the Form Credit is governed by IRS regulations, which outline the requirements for claiming credits. To be legally binding, the information provided must be truthful and supported by adequate documentation. Misrepresentation or fraudulent claims can lead to penalties, including fines and legal action. It is essential to understand the legal implications of using the Form Credit to ensure compliance and avoid potential issues with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form Credit are critical to ensure that taxpayers do not miss out on potential benefits. Generally, the deadline for submitting tax forms, including the Form Credit, is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any specific deadlines related to the credits they are claiming, as these can vary based on the type of credit and individual circumstances.

Required Documents

When completing the Form Credit, certain documents are required to substantiate the claims made. These may include:

- W-2 forms or 1099 forms to report income.

- Receipts for deductible expenses.

- Previous tax returns for reference.

- Any additional documentation specific to the credits being claimed.

Having these documents ready will facilitate a smoother filing process and help ensure compliance with IRS requirements.

Quick guide on how to complete 2016 form credit

Effortlessly Prepare Form Credit on Any Device

Managing documents online has become increasingly favored by both businesses and individuals. It offers a superb environmentally friendly substitute for conventional printed and signed papers, as you can access the accurate format and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Form Credit on any device using airSlate SignNow apps for Android or iOS and enhance any document-related task today.

The Easiest Way to Edit and Electronically Sign Form Credit

- Obtain Form Credit and click Get Form to begin.

- Make use of our provided tools to fill out your document.

- Emphasize important sections of your documents or obscure confidential information with specialized tools that airSlate SignNow offers for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form hunts, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Edit and electronically sign Form Credit to ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form credit

Create this form in 5 minutes!

How to create an eSignature for the 2016 form credit

How to generate an electronic signature for the 2016 Form Credit in the online mode

How to create an electronic signature for your 2016 Form Credit in Chrome

How to create an eSignature for putting it on the 2016 Form Credit in Gmail

How to make an eSignature for the 2016 Form Credit from your mobile device

How to generate an electronic signature for the 2016 Form Credit on iOS devices

How to make an electronic signature for the 2016 Form Credit on Android devices

People also ask

-

What is Form Credit in airSlate SignNow?

Form Credit is a payment system within airSlate SignNow that allows users to easily pay for their eSignature services. By purchasing Form Credit, businesses can ensure they have the necessary funds to send and sign documents efficiently. This flexible payment option simplifies the process of managing your eSignature needs.

-

How do I purchase Form Credit for airSlate SignNow?

Purchasing Form Credit is simple and can be done directly through the airSlate SignNow dashboard. Users can choose the amount of Form Credit they wish to buy, making it easy to scale as their business grows. This user-friendly approach helps streamline document management and eSigning.

-

What are the benefits of using Form Credit with airSlate SignNow?

Using Form Credit provides multiple benefits, including cost-effectiveness and flexibility in managing your eSignature needs. It allows businesses to pay only for the services they use, optimizing their budget. Additionally, Form Credit ensures a seamless experience when sending and signing documents.

-

How does Form Credit affect the pricing of airSlate SignNow?

Form Credit impacts the pricing model of airSlate SignNow by allowing users to purchase credits instead of committing to a subscription. This pay-as-you-go model ensures that businesses can manage their eSignature costs more efficiently while only paying for the credits they utilize.

-

Can I use Form Credit for multiple users within my organization?

Yes, Form Credit can be shared among multiple users within your organization using airSlate SignNow. This feature enables teams to collaborate efficiently while managing eSignature tasks. Each user can access the credits as needed, streamlining the document signing process.

-

What happens if I run out of Form Credit?

If you run out of Form Credit, you will need to purchase additional credits to continue using airSlate SignNow’s eSignature services. The system will notify you before your credits are depleted, allowing you to replenish them without interruption. This ensures that your document management remains smooth and efficient.

-

Are there any integrations available for Form Credit in airSlate SignNow?

Yes, Form Credit can be integrated with various applications and services within the airSlate SignNow ecosystem. This integration enhances the functionality of your eSignature processes, making it easier to manage documents across different platforms. Users can seamlessly connect their favorite tools to maximize efficiency.

Get more for Form Credit

Find out other Form Credit

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter