Form 8880 2003

What is the Form 8880

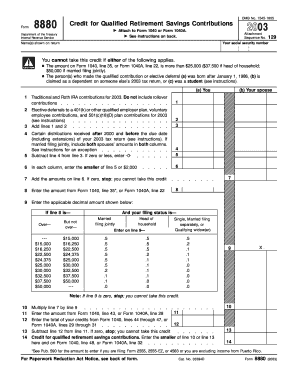

The Form 8880, officially known as the Credit for Qualified Retirement Savings Contributions, is a tax form used by individuals to claim a tax credit for contributions made to eligible retirement accounts. This form is particularly beneficial for low- to moderate-income taxpayers who are saving for retirement. By completing and submitting Form 8880, eligible taxpayers can reduce their tax liability, thereby encouraging retirement savings.

How to use the Form 8880

To effectively use Form 8880, taxpayers must first determine their eligibility based on income and filing status. The form requires information about contributions made to qualified retirement accounts, such as a 401(k) or an IRA. After gathering the necessary details, the taxpayer can fill out the form, calculating the credit amount based on the contributions and applicable percentage rates. Once completed, the form should be submitted along with the annual tax return.

Steps to complete the Form 8880

Completing Form 8880 involves several key steps:

- Gather necessary documentation, including records of retirement contributions.

- Determine eligibility based on adjusted gross income (AGI) and filing status.

- Fill out the form by entering personal information and contribution details.

- Calculate the credit amount using the provided tables based on income levels.

- Attach the completed form to your tax return before submission.

Legal use of the Form 8880

The legal use of Form 8880 is governed by IRS regulations. To ensure compliance, taxpayers must accurately report their income, contributions, and any other pertinent information. It is crucial to retain supporting documentation for contributions made, as the IRS may request this information during audits. Filing the form correctly not only helps in claiming the credit but also avoids potential penalties for misreporting.

Eligibility Criteria

To qualify for the tax credit on Form 8880, taxpayers must meet specific eligibility criteria:

- Must be at least eighteen years old.

- Must not be a full-time student during the tax year.

- Must not be claimed as a dependent on another person's tax return.

- Must have made contributions to a qualified retirement account within the tax year.

- Must meet income limits set by the IRS, which vary based on filing status.

Filing Deadlines / Important Dates

Filing deadlines for Form 8880 align with the general tax return deadlines. Typically, individual tax returns are due on April fifteenth of each year. If taxpayers require additional time, they can file for an extension, which usually allows an additional six months. However, any taxes owed must still be paid by the original due date to avoid penalties and interest.

Quick guide on how to complete form 8880 2003

Prepare Form 8880 effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly and without delays. Manage Form 8880 on any platform using airSlate SignNow's Android or iOS applications and improve any document-related process today.

How to edit and eSign Form 8880 without breaking a sweat

- Locate Form 8880 and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or conceal sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature with the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassles of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Form 8880 and guarantee effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8880 2003

Create this form in 5 minutes!

How to create an eSignature for the form 8880 2003

The best way to create an eSignature for your PDF online

The best way to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The way to make an eSignature right from your smartphone

The way to generate an electronic signature for a PDF on iOS

The way to make an eSignature for a PDF on Android

People also ask

-

What is Form 8880 and how can airSlate SignNow help?

Form 8880 is used to claim the Retirement Savings Contributions Credit. airSlate SignNow simplifies the eSigning process for Form 8880, allowing you to securely send and sign your tax forms electronically, saving time and ensuring accuracy.

-

Are there any fees associated with using airSlate SignNow for Form 8880?

airSlate SignNow offers a range of pricing plans designed to fit different budgets. Whether you need to eSign Form 8880 occasionally or manage high volumes, our pricing is transparent, making it easy to choose the right option for your needs.

-

What features does airSlate SignNow provide for managing Form 8880?

With airSlate SignNow, you can easily upload, send, and track your Form 8880. The platform includes templates, real-time notifications, and the ability to create reusable document templates, streamlining your workflow and ensuring compliance.

-

Can I integrate airSlate SignNow with my existing software for handling Form 8880?

Yes, airSlate SignNow seamlessly integrates with popular applications such as Google Drive, Dropbox, and Salesforce. This ensures that your workflow for managing Form 8880 remains efficient and connected to the tools you already use.

-

What are the benefits of using airSlate SignNow for eSigning Form 8880?

Using airSlate SignNow to eSign Form 8880 provides several benefits, including enhanced security, faster turnaround time, and the ability to access your documents from anywhere. This means you can complete your tax-related tasks efficiently.

-

Is airSlate SignNow compliant with legal regulations for Form 8880?

Absolutely. airSlate SignNow is designed to comply with eSignature laws, such as ESIGN and UETA, ensuring that your eSigned Form 8880 holds the same legal standing as traditional signatures. Your security and compliance are our top priorities.

-

How can I get started with airSlate SignNow for Form 8880?

Getting started with airSlate SignNow is quick and easy. Simply sign up for an account, upload your Form 8880, and follow the intuitive process to eSign your document. You'll be ready to manage your forms in no time!

Get more for Form 8880

Find out other Form 8880

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History