Form 8880 Credit for Qualified Retirement Savings Contributions 2020

What is the Form 8880 Credit for Qualified Retirement Savings Contributions

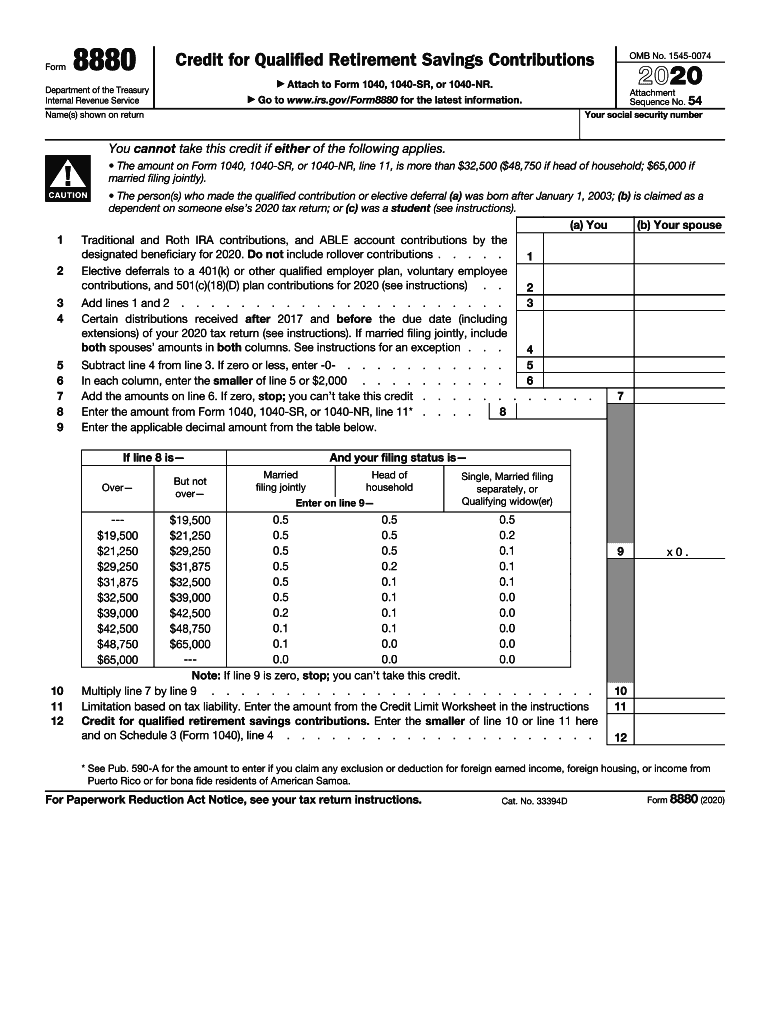

The Form 8880 is designed to help taxpayers claim a tax credit for contributions made to qualified retirement savings accounts. This credit, known as the Credit for Qualified Retirement Savings Contributions, is available to individuals who meet specific income thresholds and contribute to eligible retirement plans, such as 401(k)s or IRAs. The purpose of this credit is to encourage savings for retirement, making it financially beneficial for low- to moderate-income earners to invest in their future.

Eligibility Criteria for the Form 8880 Credit

To qualify for the credit, taxpayers must meet certain criteria. Eligibility is primarily based on income, filing status, and age. Generally, individuals must be at least eighteen years old and not a full-time student or dependent on someone else's tax return. The income limits vary depending on the filing status, so it is essential to check the IRS guidelines for the specific thresholds applicable for the year in question.

Steps to Complete the Form 8880 Credit for Qualified Retirement Savings Contributions

Completing the Form 8880 involves several steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of retirement contributions and income statements. Next, fill out the form by providing personal information, including your filing status and adjusted gross income. Calculate the credit amount based on the contributions made and refer to the IRS tables for the correct percentage. Finally, attach the completed form to your tax return when filing.

IRS Guidelines for the Form 8880

The IRS provides specific guidelines for completing and submitting the Form 8880. It is crucial to follow these instructions to avoid errors that could delay processing or result in penalties. The guidelines detail how to calculate the credit, what documents are needed, and how to report the credit on your tax return. Staying informed about any updates or changes in the tax code regarding retirement savings credits is also essential for compliance.

Form Submission Methods for the Form 8880

Taxpayers can submit the Form 8880 in several ways, depending on their preference and filing method. The form can be filed electronically using tax software, which often includes prompts to ensure accuracy. Alternatively, taxpayers may choose to print the form and submit it by mail along with their tax return. In-person submissions are typically not available for this form, as it is primarily processed through electronic or mail channels.

Key Elements of the Form 8880

The Form 8880 includes several key elements that taxpayers must understand to ensure proper completion. These elements include personal identification information, income details, and contributions made to retirement accounts. Additionally, the form contains calculations for determining the credit amount based on the taxpayer's income level and contribution percentage. Understanding these components is vital for maximizing the potential tax benefits associated with retirement savings contributions.

Quick guide on how to complete 2020 form 8880 credit for qualified retirement savings contributions

Complete Form 8880 Credit For Qualified Retirement Savings Contributions effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to access the proper form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage Form 8880 Credit For Qualified Retirement Savings Contributions on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Form 8880 Credit For Qualified Retirement Savings Contributions with ease

- Find Form 8880 Credit For Qualified Retirement Savings Contributions and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow offers for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device you prefer. Modify and eSign Form 8880 Credit For Qualified Retirement Savings Contributions and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 8880 credit for qualified retirement savings contributions

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 8880 credit for qualified retirement savings contributions

The best way to make an eSignature for your PDF online

The best way to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

The best way to generate an electronic signature for a PDF file on Android

People also ask

-

What is form 8880 for 2017 and who needs it?

Form 8880 for 2017 is used by eligible taxpayers to claim a tax credit for contributions made to qualified retirement plans. This form is particularly beneficial for lower to moderate-income individuals saving for retirement. Understanding form 8880 for 2017 is essential for maximizing tax benefits.

-

How can airSlate SignNow help with signing form 8880 for 2017?

AirSlate SignNow simplifies the process of signing form 8880 for 2017 by allowing users to eSign documents securely and efficiently. You can upload your tax forms, sign them electronically, and send them directly to the appropriate authorities. This streamlines the tax filing process and ensures timely submissions.

-

What features does airSlate SignNow offer for managing form 8880 for 2017?

AirSlate SignNow provides features like document templates, automated workflows, and real-time tracking that can help manage form 8880 for 2017 effectively. These tools facilitate collaboration and ensure that all necessary signatures are collected promptly. Users can also store and retrieve documents easily.

-

Is there a cost associated with using airSlate SignNow for form 8880 for 2017?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, making it a cost-effective solution for managing form 8880 for 2017. Pricing is competitive and varies based on the number of users and features required. You can sign up for a free trial to evaluate the service before committing.

-

Can I access airSlate SignNow on mobile devices when filling out form 8880 for 2017?

Absolutely! AirSlate SignNow is mobile-friendly, allowing you to manage form 8880 for 2017 on the go. You can access, edit, and eSign documents directly from your smartphone or tablet. This flexibility ensures you can work anytime, anywhere.

-

Are there integration options available with airSlate SignNow for form 8880 for 2017?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance your workflow for form 8880 for 2017. You can connect it with accounting software, cloud storage solutions, and CRM systems, making it easier to manage your tax documentation efficiently. These integrations streamline the entire process.

-

What security measures does airSlate SignNow implement for form 8880 for 2017?

AirSlate SignNow employs robust security measures to protect documents, including form 8880 for 2017. Features like end-to-end encryption and compliant data handling ensure that your sensitive information remains secure. You can trust that your documents are protected while using our platform.

Get more for Form 8880 Credit For Qualified Retirement Savings Contributions

Find out other Form 8880 Credit For Qualified Retirement Savings Contributions

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF