Irs Form 1310 Printable

What is the IRS Form 1310?

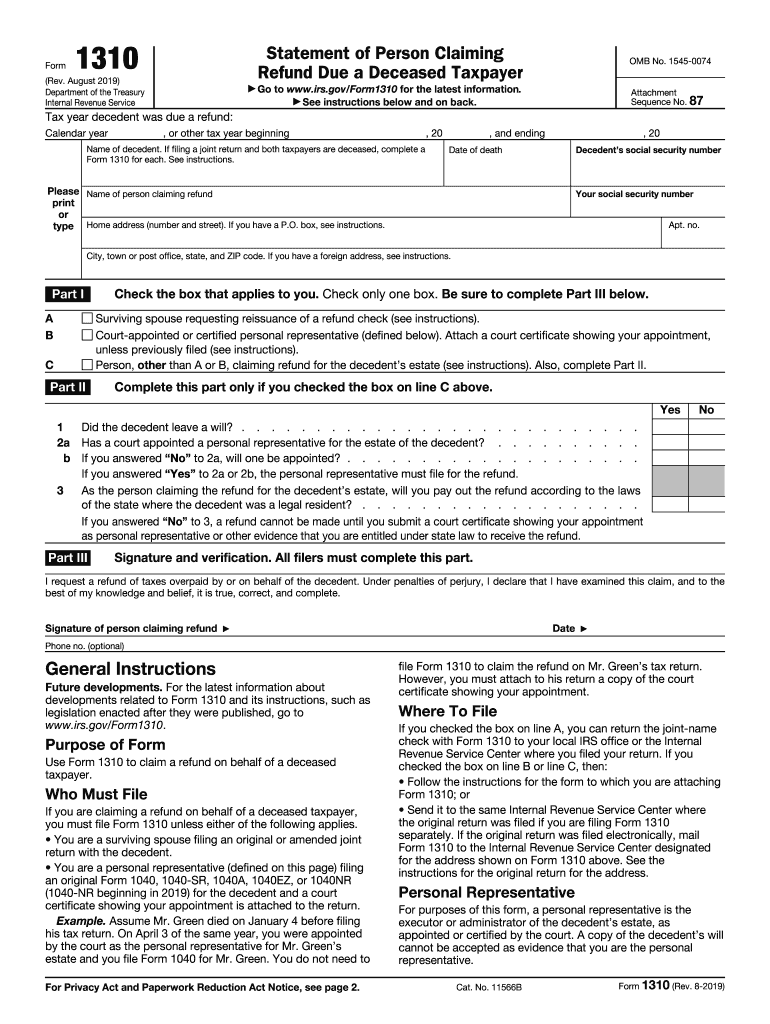

The IRS Form 1310, also known as the 2 form, is a tax document used to claim a refund on behalf of a deceased taxpayer. This form allows the executor or administrator of the deceased's estate to request any tax refund that may be due. It is essential for ensuring that the rightful beneficiaries receive any funds owed to the deceased individual. The form is specifically designed for situations where the taxpayer has passed away, and it provides the necessary information to process the refund correctly.

Steps to Complete the IRS Form 1310

Filling out the IRS Form 1310 involves several key steps to ensure accuracy and compliance. Begin by gathering all relevant information, including the deceased taxpayer's details and the refund amount. Follow these steps:

- Provide the decedent's name, Social Security number, and date of death.

- Indicate your relationship to the deceased and your contact information.

- Complete the refund claim section, specifying the amount to be refunded.

- Sign and date the form, certifying that the information provided is accurate.

It is crucial to double-check all entries for accuracy before submission to avoid delays in processing.

Legal Use of the IRS Form 1310

The IRS Form 1310 is legally binding and must be used in accordance with IRS regulations. It is essential to ensure that the form is completed correctly and submitted with the appropriate tax return. The form serves as a declaration that the executor or administrator has the authority to claim the refund on behalf of the deceased. Failure to comply with the legal requirements may result in delays or denial of the refund claim.

Required Documents for Filing the IRS Form 1310

When submitting the IRS Form 1310, certain documents are typically required to support the claim. These may include:

- A copy of the deceased taxpayer's death certificate.

- A copy of the tax return for the year in which the refund is being claimed.

- Proof of your relationship to the deceased, such as a marriage certificate or will.

Having these documents ready can facilitate a smoother filing process and help expedite the refund claim.

Filing Deadlines for the IRS Form 1310

It is important to be aware of the filing deadlines associated with the IRS Form 1310. Generally, the form should be submitted along with the deceased taxpayer's final tax return. The deadline for filing the final return is typically April fifteenth of the year following the taxpayer's death. However, if the taxpayer was due a refund, the form can be submitted at any time within three years of the original due date of the tax return. Adhering to these deadlines is crucial to ensure that the refund is processed without complications.

Form Submission Methods for the IRS Form 1310

The IRS Form 1310 can be submitted in various ways, depending on the preferences of the executor or administrator. The options include:

- Filing electronically through tax software that supports the form.

- Mailing a paper copy of the form along with the final tax return to the appropriate IRS address.

- In-person submission at designated IRS offices, although this option may vary based on location.

Choosing the right submission method can help ensure timely processing of the refund claim.

Quick guide on how to complete rev 914 form m 1310 statement of claimant to refund due a

Prepare Irs Form 1310 Printable seamlessly on any gadget

Managing documents online has gained traction among enterprises and individuals alike. It serves as an ideal sustainable alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to generate, alter, and eSign your documents quickly without delays. Manage Irs Form 1310 Printable on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to alter and eSign Irs Form 1310 Printable effortlessly

- Find Irs Form 1310 Printable and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all details and click on the Done button to save your modifications.

- Choose how you prefer to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choice. Edit and eSign Irs Form 1310 Printable and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rev 914 form m 1310 statement of claimant to refund due a

How to create an eSignature for the Rev 914 Form M 1310 Statement Of Claimant To Refund Due A in the online mode

How to create an electronic signature for the Rev 914 Form M 1310 Statement Of Claimant To Refund Due A in Chrome

How to create an eSignature for putting it on the Rev 914 Form M 1310 Statement Of Claimant To Refund Due A in Gmail

How to create an eSignature for the Rev 914 Form M 1310 Statement Of Claimant To Refund Due A right from your mobile device

How to make an electronic signature for the Rev 914 Form M 1310 Statement Of Claimant To Refund Due A on iOS devices

How to create an electronic signature for the Rev 914 Form M 1310 Statement Of Claimant To Refund Due A on Android

People also ask

-

What is IRS Form 1310 for 2019?

IRS Form 1310 for 2019 is used by individuals to claim a tax refund on behalf of a deceased person. This form ensures that eligible individuals, such as an executor or administrator of the estate, can receive funds that are owed from the deceased's tax return. It's important to fill out this form accurately to avoid delays in processing.

-

How can airSlate SignNow assist with IRS Form 1310 for 2019?

airSlate SignNow provides a streamlined solution for electronically signing and sending IRS Form 1310 for 2019. Our platform simplifies the process, ensuring secure and efficient document management, which is essential for handling sensitive tax-related documents. This feature helps you complete and submit your forms quickly.

-

Are there any costs associated with filing IRS Form 1310 for 2019 using airSlate SignNow?

Yes, while airSlate SignNow offers competitive pricing plans, there may be costs associated with using our services to file IRS Form 1310 for 2019. We provide various subscription options tailored to different business needs, ensuring that you find a budget-friendly solution to manage your document workflows.

-

What features does airSlate SignNow offer for managing IRS Form 1310 for 2019?

airSlate SignNow offers several features for managing IRS Form 1310 for 2019, including customizable templates, secure electronic signatures, and real-time tracking of document status. These features ensure that you can handle all necessary paperwork efficiently and confidently while staying compliant with IRS regulations.

-

Is airSlate SignNow compliant with IRS regulations for IRS Form 1310 for 2019?

Absolutely! airSlate SignNow is compliant with IRS regulations for documents like IRS Form 1310 for 2019. Our secure platform adheres to industry standards for data protection and electronic document management, ensuring that your submissions are both secure and valid.

-

Can I integrate airSlate SignNow with other applications when filing IRS Form 1310 for 2019?

Yes, airSlate SignNow offers integrations with various applications to enhance your workflow when filing IRS Form 1310 for 2019. This interoperability allows you to connect with popular platforms, streamline processes, and ensure a seamless experience for managing your tax documents.

-

What are the benefits of using airSlate SignNow for IRS Form 1310 for 2019 compared to traditional methods?

Using airSlate SignNow for IRS Form 1310 for 2019 offers numerous benefits over traditional methods, including faster processing times, enhanced security, and greater convenience. By eliminating the need for physical documents, you can save time and reduce the risk of errors, ensuring your tax filings are submitted promptly and accurately.

Get more for Irs Form 1310 Printable

- Hartford ocean cargo application form

- Schwab investment committee form

- Schwab eac form

- Arizona state university employment verification form

- Buyers retail sales tax exemption certificate form 27 0032 794908762

- Form int 2 bank franchise tax return 794877509

- Form 2823 credit institution tax return 794877510

- State of missouri employer039s tax guide form

Find out other Irs Form 1310 Printable

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online