1099 Form

What is the 1099?

The 1099 form is a series of IRS tax forms used to report various types of income other than wages, salaries, and tips. It is commonly utilized by independent contractors, freelancers, and other non-employees to report earnings to the Internal Revenue Service (IRS). The most widely recognized version is the 1099-MISC, which is used for reporting miscellaneous income, while the 1099-NEC is specifically for non-employee compensation. Understanding the 1099 form is essential for both the issuer and the recipient to ensure accurate tax reporting and compliance with U.S. tax laws.

How to complete the 1099

Completing the 1099 form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the recipient's name, address, and taxpayer identification number (TIN). Next, accurately report the amount paid to the contractor in the appropriate box, depending on the type of income being reported. Ensure that all information is double-checked for accuracy before submission. It's also important to provide a copy of the completed form to the contractor by January thirty-first of the following tax year, as well as to the IRS by the appropriate deadline.

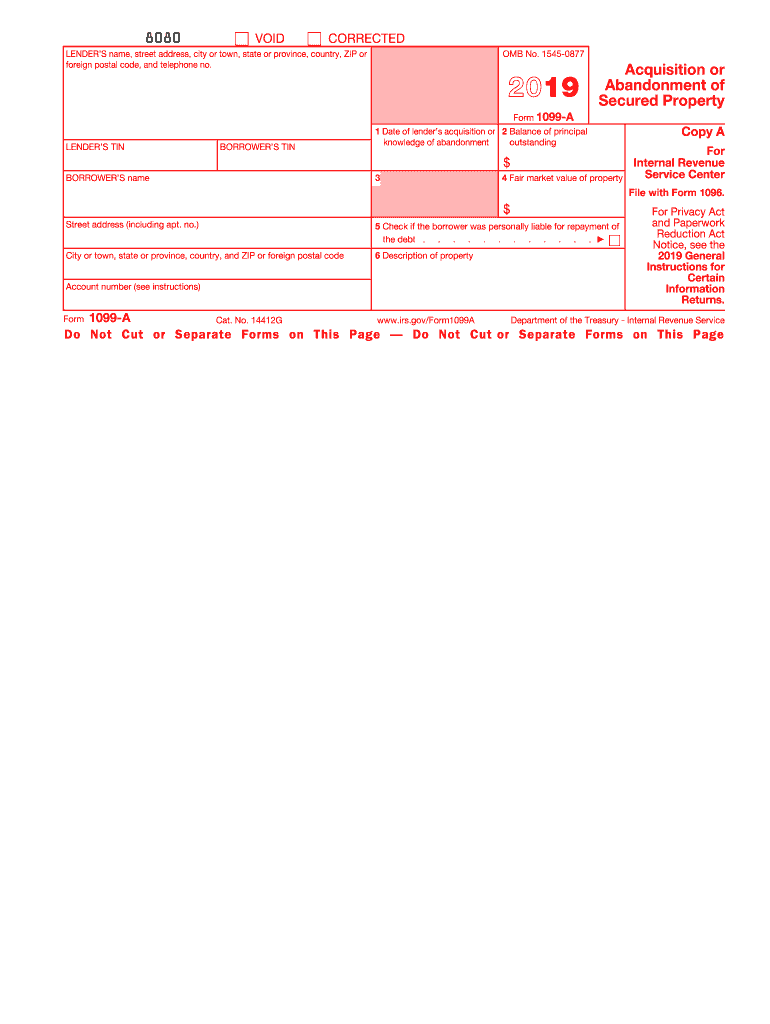

Key elements of the 1099

The 1099 form contains several critical elements that must be accurately filled out. These include:

- Recipient's Information: Name, address, and TIN.

- Payer's Information: Your business name, address, and TIN.

- Payment Amount: Total amount paid to the contractor during the tax year.

- Type of Income: Indicate the nature of the payment (e.g., non-employee compensation, rent).

Each of these elements plays a vital role in ensuring that the form is filled out correctly and that both parties can accurately report their income to the IRS.

IRS Guidelines

The IRS has specific guidelines regarding the use of the 1099 form. It is crucial to familiarize yourself with these guidelines to ensure compliance. For instance, the IRS requires that a 1099 form be issued for any contractor paid $600 or more in a calendar year. Additionally, the form must be submitted to the IRS along with Form 1096, which serves as a summary of all 1099 forms submitted. Failure to comply with these guidelines can result in penalties, so understanding the requirements is essential for both businesses and contractors.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 form are critical to avoid penalties. Generally, the deadline to provide the 1099 form to recipients is January thirty-first of the year following the tax year in which the payments were made. The deadline for filing with the IRS is typically February twenty-eighth for paper submissions and March thirty-first for electronic submissions. It is important to keep these dates in mind to ensure timely and accurate filing.

Who Issues the Form

The 1099 form is issued by businesses or individuals who have paid non-employees for services rendered. This includes freelancers, independent contractors, and other non-employee service providers. It is the responsibility of the payer to ensure that the form is completed accurately and submitted to both the recipient and the IRS. Understanding who issues the form helps clarify the responsibilities of both parties involved in the transaction.

Quick guide on how to complete 2019 form 1099 a acquisition or abandonment of secured property

Complete 1099 effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can effortlessly locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without unnecessary holdups. Manage 1099 on any gadget with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign 1099 with ease

- Find 1099 and then click Get Form to begin.

- Use the tools we provide to fill out your document.

- Mark key sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing additional copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign 1099 and ensure exceptional communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 1099 a acquisition or abandonment of secured property

How to make an electronic signature for your 2019 Form 1099 A Acquisition Or Abandonment Of Secured Property online

How to create an electronic signature for your 2019 Form 1099 A Acquisition Or Abandonment Of Secured Property in Chrome

How to make an electronic signature for putting it on the 2019 Form 1099 A Acquisition Or Abandonment Of Secured Property in Gmail

How to create an eSignature for the 2019 Form 1099 A Acquisition Or Abandonment Of Secured Property from your smart phone

How to make an eSignature for the 2019 Form 1099 A Acquisition Or Abandonment Of Secured Property on iOS

How to make an eSignature for the 2019 Form 1099 A Acquisition Or Abandonment Of Secured Property on Android

People also ask

-

What is the impact of 2019 abandonment on document signing processes?

The concept of 2019 abandonment highlights how businesses struggle with incomplete document workflows. This can lead to unnecessary delays and lost opportunities. By utilizing airSlate SignNow, companies can efficiently manage their signing processes, ensuring that all documents are signed promptly and reducing the risk of abandonment.

-

How does airSlate SignNow help reduce 2019 abandonment rates?

AirSlate SignNow minimizes 2019 abandonment rates by providing a seamless eSigning experience. With user-friendly features, reminders, and real-time tracking, businesses can ensure that documents are completed on time. This proactive approach supports better engagement and completion rates for all documents.

-

What are the pricing options available for airSlate SignNow to prevent 2019 abandonment?

AirSlate SignNow offers flexible pricing plans tailored to different business needs, which can help reduce the chances of 2019 abandonment. Competitive prices allow companies of all sizes to find a suitable plan that ensures efficient document management without breaking their budgets. Investing in the right plan can signNowly enhance your workflow efficiency.

-

Can airSlate SignNow integrate with existing systems to address 2019 abandonment?

Yes, airSlate SignNow can easily integrate with a variety of existing business systems, which directly addresses the issue of 2019 abandonment. By streamlining processes across platforms, businesses can reduce friction in document transactions. This integration facilitates a smoother workflow and enhances overall productivity.

-

What features does airSlate SignNow offer to address the challenges of 2019 abandonment?

AirSlate SignNow provides features such as custom workflows, automatic reminders, and notifications aimed at reducing 2019 abandonment. These tools help keep users engaged and prompt them to complete their signing tasks efficiently. The more features you utilize, the less likely you are to experience abandonment in your document processes.

-

How does eSigning with airSlate SignNow benefit businesses facing 2019 abandonment issues?

ESigning with airSlate SignNow offers several benefits that directly combat 2019 abandonment. By enabling quick and easy signing from any device, it enhances user satisfaction and increases completion rates. This not only saves time but also ensures that critical documents are finalized without unnecessary delays.

-

Is customer support available to help with 2019 abandonment concerns using airSlate SignNow?

Absolutely, airSlate SignNow provides robust customer support to assist businesses with any issues related to 2019 abandonment. Their team is available to guide you through the features and troubleshooting processes. Ensuring that you have all the support you need helps maintain effective document management practices.

Get more for 1099

Find out other 1099

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure