1096 Form

What is the 1096 Form

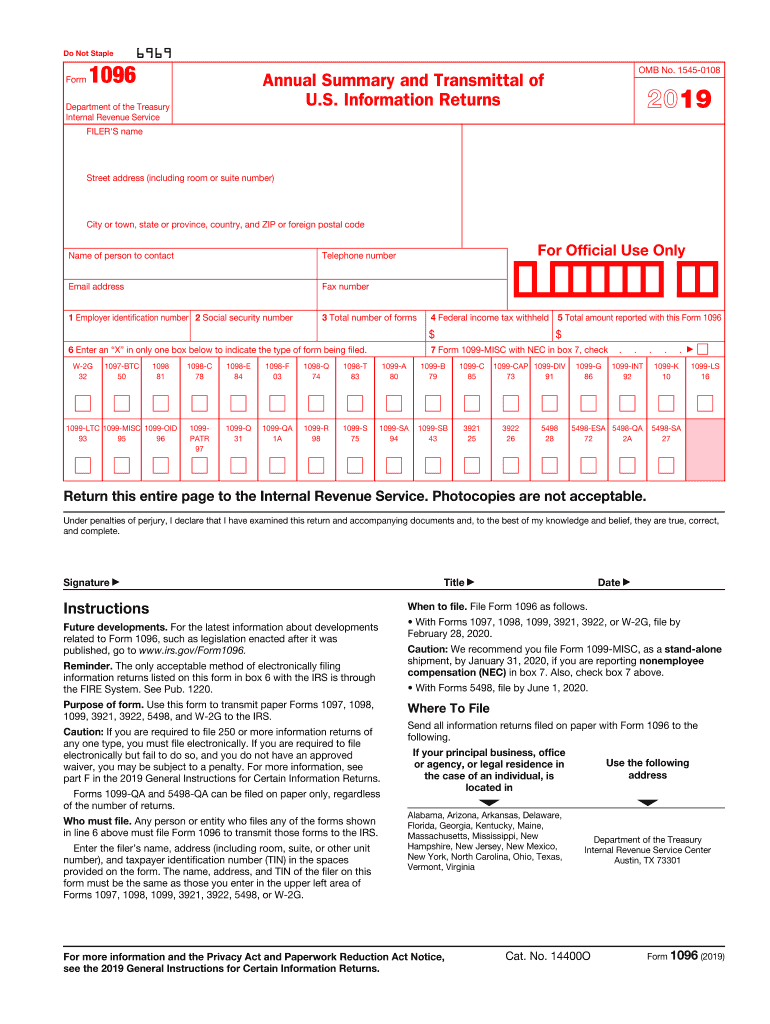

The 1096 transmittal form is a crucial document used in the United States for reporting various types of income and payments made to the Internal Revenue Service (IRS). It serves as a cover sheet for submitting paper forms such as the 1099 series, which includes forms for reporting non-employee compensation, dividends, and interest income. The 1096 form provides the IRS with essential information about the total number of forms being submitted and the types of payments reported.

How to use the 1096 Form

To effectively use the 1096 transmittal form, one must first gather all relevant 1099 forms that need to be submitted. Each type of 1099 form corresponds to a specific category of income, such as freelance earnings or rental income. After completing the necessary 1099 forms, the 1096 form should be filled out with the required information, including the total number of forms submitted and the total amount reported. It is important to ensure that all forms are accurate and complete before submission to avoid penalties.

Steps to complete the 1096 Form

Completing the 1096 transmittal form involves several key steps:

- Gather all applicable 1099 forms that report payments made during the tax year.

- Fill in your name, address, and taxpayer identification number (TIN) in the designated fields.

- Indicate the total number of 1099 forms being submitted.

- Calculate and enter the total amount of payments reported on the 1099 forms.

- Sign and date the form to certify that the information is accurate.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the 1096 transmittal form. It is essential to adhere to these guidelines to ensure compliance and avoid potential penalties. The IRS requires that the 1096 form be submitted alongside the corresponding 1099 forms by the established deadlines. Additionally, the form must be filled out legibly and accurately to facilitate processing by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the 1096 transmittal form are crucial for compliance. Typically, the form must be submitted to the IRS by the end of February if filing by paper or by the end of March if filing electronically. It is important to check the IRS website for any updates or changes to these deadlines, as they can vary from year to year. Late submissions may result in penalties, making timely filing essential.

Form Submission Methods (Online / Mail / In-Person)

The 1096 transmittal form can be submitted through various methods. For those filing electronically, the form can be submitted via IRS-approved e-filing services. Alternatively, if submitting by mail, it is important to send the form to the correct IRS address based on the location of the filer. In-person submission is generally not available for the 1096 form, as it is primarily processed through mail or electronic filing.

Quick guide on how to complete 2019 form 1096 annual summary and transmittal of us information returns

Effortlessly Prepare 1096 Form on Any Device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely keep it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your files promptly without interruptions. Manage 1096 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and eSign 1096 Form with Ease

- Obtain 1096 Form and click on Get Form to begin.

- Use the tools provided to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Alter and eSign 1096 Form and guarantee excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 1096 annual summary and transmittal of us information returns

How to generate an electronic signature for the 2019 Form 1096 Annual Summary And Transmittal Of Us Information Returns online

How to generate an electronic signature for your 2019 Form 1096 Annual Summary And Transmittal Of Us Information Returns in Chrome

How to generate an electronic signature for signing the 2019 Form 1096 Annual Summary And Transmittal Of Us Information Returns in Gmail

How to generate an electronic signature for the 2019 Form 1096 Annual Summary And Transmittal Of Us Information Returns from your smartphone

How to make an eSignature for the 2019 Form 1096 Annual Summary And Transmittal Of Us Information Returns on iOS

How to create an eSignature for the 2019 Form 1096 Annual Summary And Transmittal Of Us Information Returns on Android devices

People also ask

-

What is the 1096 fillable form 2019 and why do I need it?

The 1096 fillable form 2019 is a summary form used to report annual information returns to the IRS. Businesses need this form to summarize information about the 1099 forms they've issued throughout the year. It's important to fill it out accurately to avoid penalties from the IRS.

-

How does airSlate SignNow help with the 1096 fillable form 2019?

airSlate SignNow simplifies the process of completing the 1096 fillable form 2019 by providing an intuitive interface to fill out and eSign documents. Our platform streamlines document management, allowing you to easily compile and submit the necessary forms electronically, ensuring compliance and efficiency.

-

Is there a cost associated with using airSlate SignNow for the 1096 fillable form 2019?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features necessary for managing documents, including the 1096 fillable form 2019. Check our pricing page to find a plan that fits your budget and requirements.

-

Can I eSign the 1096 fillable form 2019 using airSlate SignNow?

Absolutely! With airSlate SignNow, you can eSign the 1096 fillable form 2019 securely and efficiently. Our platform allows for seamless electronic signatures, ensuring your documents are legally binding and reducing the need for physical paperwork.

-

What features does airSlate SignNow provide for filling out the 1096 fillable form 2019?

airSlate SignNow offers a variety of features that enhance the process of filling out the 1096 fillable form 2019. These include customizable templates, real-time collaboration, and automated workflows to streamline the document generation and submission process.

-

How can I integrate airSlate SignNow with my existing software for the 1096 fillable form 2019?

airSlate SignNow easily integrates with various tools and software you may already be using, such as Google Drive, Dropbox, and CRM systems. These integrations enhance the efficiency of managing the 1096 fillable form 2019 and other documents, allowing for a smoother workflow across platforms.

-

What are the benefits of using airSlate SignNow for the 1096 fillable form 2019?

Using airSlate SignNow for the 1096 fillable form 2019 provides numerous benefits, including improved accuracy, reduced processing time, and compliance with IRS requirements. Our platform automates much of the work involved, allowing you to focus on your core business activities.

Get more for 1096 Form

Find out other 1096 Form

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template