1099 Div Form

What is the 1099 Div

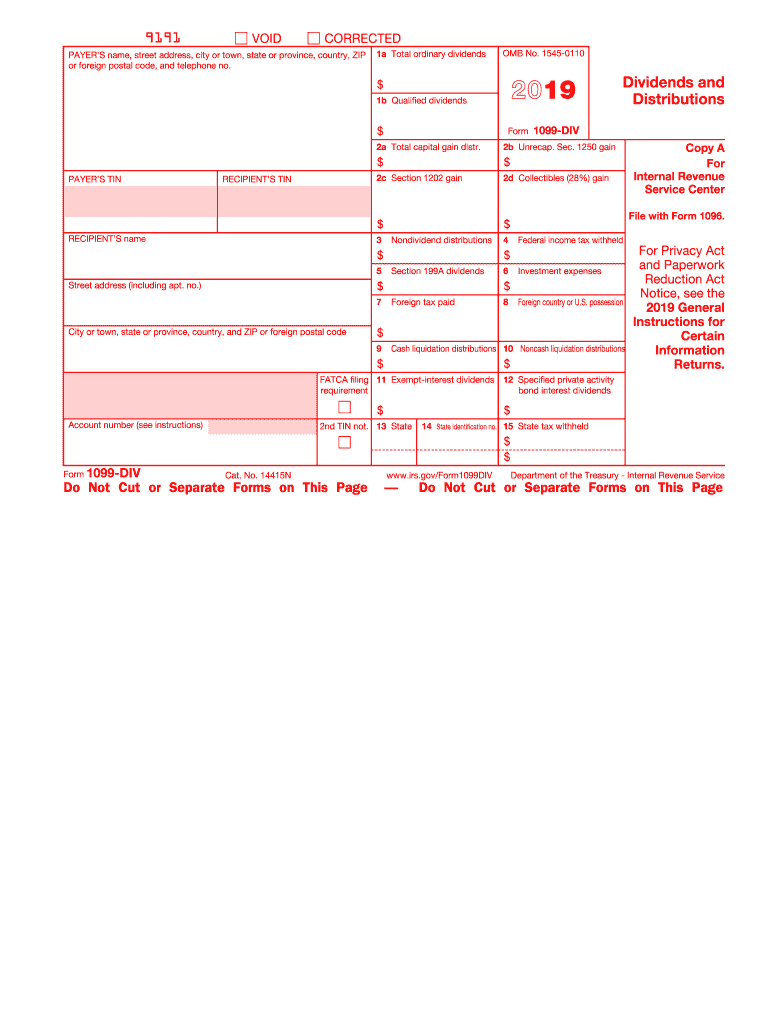

The 1099 Div form is a tax document used to report dividends and distributions received by a taxpayer during the tax year. It is essential for individuals who have earned dividends from investments, such as stocks or mutual funds. This form provides detailed information about the total dividends received, qualified dividends, and any federal income tax withheld. Understanding this form is crucial for accurate tax reporting and compliance with IRS regulations.

How to use the 1099 Div

Using the 1099 Div involves several key steps. First, taxpayers should review the information provided on the form to ensure accuracy. This includes checking the payer's details, the total dividends, and any amounts withheld for taxes. Next, taxpayers must report the dividends on their income tax return, typically on Form 1040. It is important to categorize dividends correctly, distinguishing between ordinary and qualified dividends, as they are taxed at different rates.

Steps to complete the 1099 Div

Completing the 1099 Div requires careful attention to detail. Follow these steps:

- Gather all necessary financial documents related to dividends received.

- Fill in the payer's information, including name, address, and taxpayer identification number.

- Enter the total amount of dividends received in the appropriate box.

- Indicate any qualified dividends, which are eligible for lower tax rates.

- Report any federal income tax withheld, if applicable.

- Review the form for accuracy before submission.

Legal use of the 1099 Div

The legal use of the 1099 Div is governed by IRS regulations. This form must be issued by financial institutions or corporations that have paid dividends to shareholders. It serves as a record for both the taxpayer and the IRS, ensuring that all income is reported accurately. Failure to report dividends can lead to penalties, so it is crucial to use the form correctly and retain copies for personal records.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 Div are critical for compliance. Generally, the form must be sent to recipients by January thirty-first of the year following the tax year. Additionally, the issuer must file the form with the IRS by the end of February if submitting by paper or by the end of March if filing electronically. Keeping track of these dates helps avoid penalties and ensures timely reporting of dividend income.

Who Issues the Form

The 1099 Div form is typically issued by financial institutions, such as banks or brokerage firms, that manage investments. Corporations that distribute dividends to shareholders are also responsible for providing this form. It is important for taxpayers to ensure they receive their 1099 Div from these entities to accurately report their income during tax season.

Quick guide on how to complete dividends and distributions irsgov

Complete 1099 Div effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely save it online. airSlate SignNow provides all the functionalities you need to create, modify, and electronically sign your documents quickly without delays. Manage 1099 Div on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign 1099 Div without effort

- Find 1099 Div and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or hide sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and then click the Done button to save your modifications.

- Select how you would like to submit your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or errors that require reprinting new versions. airSlate SignNow manages all your document handling needs in just a few clicks from your chosen device. Modify and eSign 1099 Div, ensuring excellent communication at any point in your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dividends and distributions irsgov

How to make an electronic signature for your Dividends And Distributions Irsgov in the online mode

How to make an eSignature for the Dividends And Distributions Irsgov in Google Chrome

How to make an electronic signature for signing the Dividends And Distributions Irsgov in Gmail

How to create an electronic signature for the Dividends And Distributions Irsgov right from your smartphone

How to make an eSignature for the Dividends And Distributions Irsgov on iOS

How to generate an electronic signature for the Dividends And Distributions Irsgov on Android

People also ask

-

What is a 1099 Div and why do I need it?

A 1099 Div is a tax form used to report dividends and distributions received from investments. If you are an investor or a business that distributes dividends, you'll need this form for accurate tax filing. Using airSlate SignNow can streamline the process of signing and sending your 1099 Div forms securely and efficiently.

-

How does airSlate SignNow simplify the 1099 Div signing process?

airSlate SignNow offers an intuitive platform that allows you to easily create, send, and eSign your 1099 Div forms. You can upload your documents, add fields for signatures, and send them for signing in just a few clicks, making tax season less stressful.

-

Is there a cost associated with using airSlate SignNow for 1099 Div forms?

Yes, airSlate SignNow offers various pricing plans designed to fit different business needs. You'll find that the cost is competitive, especially considering the time and resources saved in managing your 1099 Div forms digitally. Check our pricing page for detailed information on each plan.

-

Can I integrate airSlate SignNow with my accounting software for 1099 Div management?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software, allowing you to manage your 1099 Div forms alongside your financial data. This integration enhances your workflow by ensuring that all your documents are in one place, making it easier to maintain accurate records.

-

What features does airSlate SignNow offer for managing 1099 Div forms?

airSlate SignNow provides features such as customizable templates, automated workflows, and secure cloud storage specifically designed for managing 1099 Div forms. These functionalities help you streamline the signing process, ensuring that your documents are completed quickly and securely.

-

How secure is the signing process for 1099 Div forms with airSlate SignNow?

The security of your 1099 Div forms is a top priority at airSlate SignNow. We use advanced encryption protocols and security measures to protect your documents during transmission and storage, ensuring that your sensitive information remains confidential.

-

Can I track the status of my 1099 Div forms sent through airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all documents, including your 1099 Div forms. You will receive notifications when a document is viewed, signed, or completed, giving you complete visibility over the signing process.

Get more for 1099 Div

Find out other 1099 Div

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement