Schedule M1mt Form Fill Out and Sign

Understanding the Schedule M1MT Form

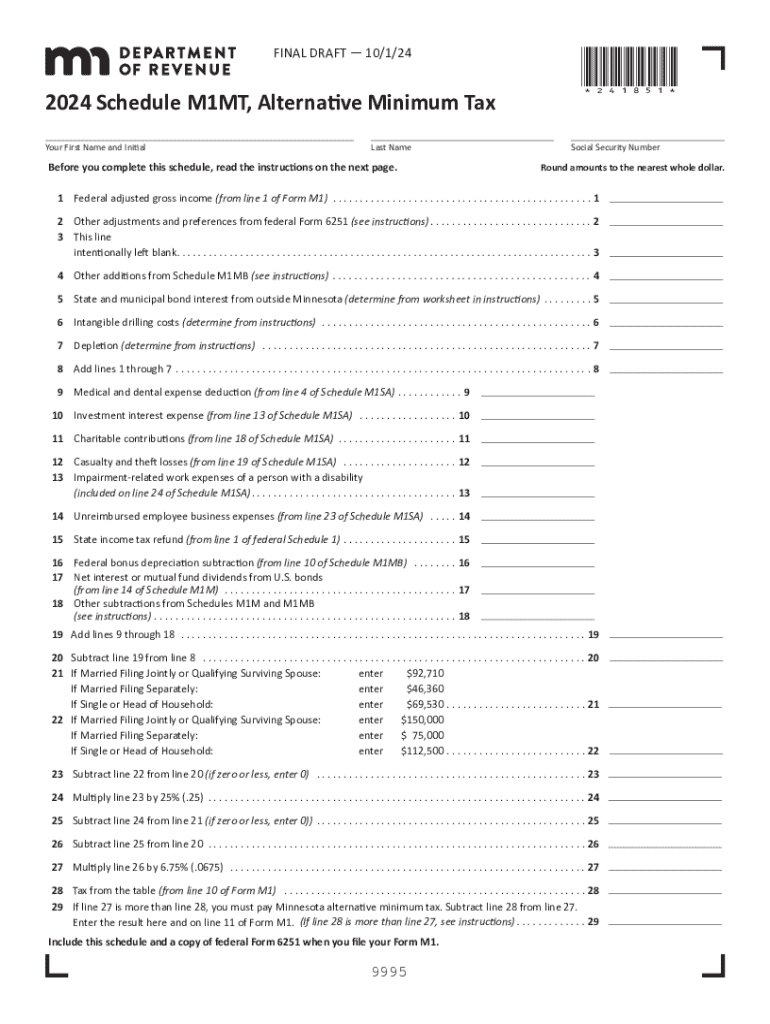

The Schedule M1MT form is a crucial document used by residents of Minnesota to report specific tax adjustments. This form allows taxpayers to calculate their Minnesota minimum tax liability, ensuring compliance with state tax regulations. Understanding its purpose and requirements is essential for accurate tax filing.

Steps to Complete the Schedule M1MT Form

Completing the Schedule M1MT form involves several key steps:

- Gather necessary documentation, including income statements and previous tax returns.

- Fill out personal information, such as your name, address, and Social Security number.

- Calculate your Minnesota minimum tax based on your income and deductions.

- Review the form for accuracy before submission.

Each step is vital for ensuring that your tax return is complete and correct.

Obtaining the Schedule M1MT Form

The Schedule M1MT form can be obtained through the Minnesota Department of Revenue's website or by visiting local tax offices. It is available in both digital and paper formats, making it accessible for all taxpayers. Ensure you have the most current version of the form to avoid any compliance issues.

Key Elements of the Schedule M1MT Form

Several key elements must be included when filling out the Schedule M1MT form:

- Your total income for the year.

- Adjustments for specific deductions and credits.

- Calculation of the minimum tax based on your adjusted income.

Understanding these components helps ensure that you accurately report your tax obligations.

Filing Deadlines and Important Dates

It is important to be aware of the filing deadlines associated with the Schedule M1MT form. Typically, the form must be submitted by April 15 of the following tax year. However, if you are unable to meet this deadline, you may apply for an extension. Always check for any updates or changes to deadlines that may occur annually.

Legal Use of the Schedule M1MT Form

The Schedule M1MT form is legally required for certain taxpayers in Minnesota. Failing to file this form when necessary can result in penalties and interest on unpaid taxes. It is important to understand your obligations under Minnesota tax law to avoid any legal issues.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule m1mt form fill out and sign

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Minnesota minimum for electronic signatures?

The Minnesota minimum for electronic signatures is defined by state law, which recognizes eSignatures as legally binding. This means that businesses in Minnesota can confidently use airSlate SignNow to send and eSign documents, ensuring compliance with local regulations.

-

How does airSlate SignNow help with Minnesota minimum compliance?

airSlate SignNow is designed to meet the Minnesota minimum requirements for electronic signatures. Our platform provides secure and legally compliant eSigning solutions, allowing businesses to streamline their document processes while adhering to state laws.

-

What are the pricing options for airSlate SignNow in Minnesota?

airSlate SignNow offers flexible pricing plans that cater to various business needs in Minnesota. Our cost-effective solutions ensure that you can meet the Minnesota minimum requirements without breaking the bank, making it accessible for businesses of all sizes.

-

What features does airSlate SignNow offer to meet Minnesota minimum standards?

airSlate SignNow includes features such as secure eSigning, document tracking, and customizable templates, all designed to meet Minnesota minimum standards. These tools enhance your document workflow while ensuring compliance with state regulations.

-

Can airSlate SignNow integrate with other software used in Minnesota?

Yes, airSlate SignNow offers seamless integrations with various software applications commonly used in Minnesota. This allows businesses to enhance their workflows while ensuring they meet the Minnesota minimum requirements for electronic documentation.

-

What are the benefits of using airSlate SignNow for Minnesota businesses?

Using airSlate SignNow provides Minnesota businesses with a user-friendly platform that simplifies the eSigning process. By meeting the Minnesota minimum standards, businesses can improve efficiency, reduce turnaround times, and enhance customer satisfaction.

-

Is airSlate SignNow secure for handling sensitive documents in Minnesota?

Absolutely! airSlate SignNow prioritizes security and complies with the Minnesota minimum standards for electronic signatures. Our platform uses advanced encryption and security protocols to protect sensitive documents throughout the signing process.

Get more for Schedule M1mt Form Fill Out And Sign

- Buyers home inspection checklist new mexico form

- Sellers information for appraiser provided to buyer new mexico

- New mexico real estate form

- Subcontractors agreement new mexico form

- Nm notice form

- Option to purchase addendum to residential lease lease or rent to own new mexico form

- New mexico prenuptial premarital agreement uniform premarital agreement act with financial statements new mexico

- New mexico prenuptial form

Find out other Schedule M1mt Form Fill Out And Sign

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT