B Relationship between Disqualified Person and 2023

What is the b Relationship Between Disqualified Person And

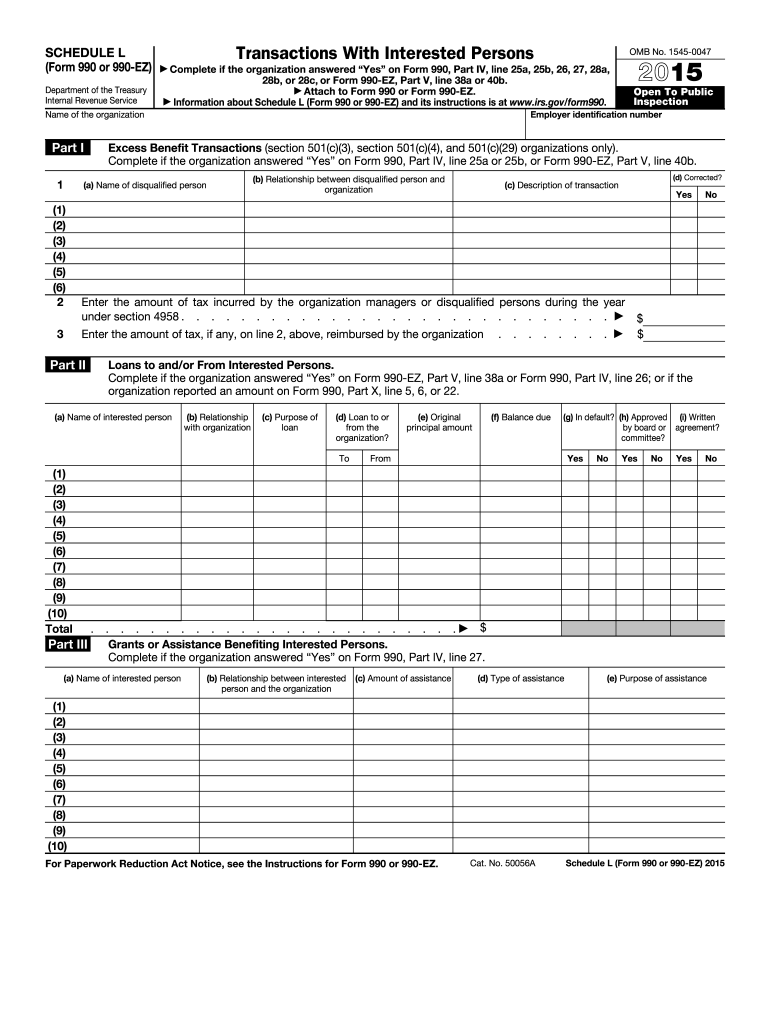

The b Relationship Between Disqualified Person And is a crucial aspect of tax law, particularly in the context of retirement plans and tax-exempt organizations. This form is used to disclose relationships that may affect the eligibility of individuals or entities involved in transactions with disqualified persons. Disqualified persons typically include individuals who have significant control or ownership in an organization, such as executives or major shareholders, and their relationships can impact compliance with IRS regulations.

How to use the b Relationship Between Disqualified Person And

To effectively use the b Relationship Between Disqualified Person And, one must first identify all disqualified persons associated with the organization. This includes understanding the nature of their relationships, such as family ties or business partnerships. Once identified, the relevant information must be accurately documented on the form. This ensures transparency and compliance with IRS requirements, helping to avoid potential penalties.

Steps to complete the b Relationship Between Disqualified Person And

Completing the b Relationship Between Disqualified Person And involves several key steps:

- Gather information about all disqualified persons connected to the organization.

- Document the nature of each relationship, including any financial transactions that may have occurred.

- Fill out the form with accurate and detailed information, ensuring all required fields are completed.

- Review the form for accuracy before submission to prevent any compliance issues.

- Submit the completed form to the appropriate IRS office by the specified deadline.

Legal use of the b Relationship Between Disqualified Person And

The legal use of the b Relationship Between Disqualified Person And is fundamental for maintaining compliance with IRS regulations. Organizations must disclose any transactions with disqualified persons to avoid penalties related to excess benefits or prohibited transactions. This form serves as a protective measure, ensuring that all dealings are transparent and within the legal framework established by tax laws.

Key elements of the b Relationship Between Disqualified Person And

Key elements of the b Relationship Between Disqualified Person And include:

- Identification of disqualified persons and their relationships to the organization.

- Details of any transactions or financial interactions with these individuals.

- Clear documentation to support the disclosures made on the form.

- Compliance with IRS guidelines to ensure that all information is accurate and complete.

Examples of using the b Relationship Between Disqualified Person And

Examples of using the b Relationship Between Disqualified Person And can include scenarios such as:

- A company must disclose that its CEO is also a major shareholder in a vendor company it does business with.

- An organization identifies that a board member is related to an employee receiving significant compensation.

- A nonprofit must report a transaction involving a family member of a key decision-maker to maintain transparency.

Create this form in 5 minutes or less

Find and fill out the correct b relationship between disqualified person and

Create this form in 5 minutes!

How to create an eSignature for the b relationship between disqualified person and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the b Relationship Between Disqualified Person And in the context of airSlate SignNow?

The b Relationship Between Disqualified Person And refers to the legal implications and restrictions that may arise when a disqualified person is involved in a transaction. Understanding this relationship is crucial for businesses to ensure compliance and avoid potential penalties while using airSlate SignNow for document signing.

-

How does airSlate SignNow ensure compliance with the b Relationship Between Disqualified Person And?

airSlate SignNow provides features that help businesses maintain compliance with regulations surrounding the b Relationship Between Disqualified Person And. Our platform includes customizable workflows and audit trails that ensure all parties involved are properly vetted and documented.

-

What pricing options does airSlate SignNow offer for businesses concerned about the b Relationship Between Disqualified Person And?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our pricing options are designed to provide cost-effective solutions while ensuring that users can effectively manage the b Relationship Between Disqualified Person And in their transactions.

-

What features does airSlate SignNow provide to address the b Relationship Between Disqualified Person And?

Our platform includes features such as advanced user permissions, document tracking, and compliance checks that specifically address the b Relationship Between Disqualified Person And. These tools help businesses navigate complex legal landscapes while ensuring secure and efficient document management.

-

Can airSlate SignNow integrate with other tools to manage the b Relationship Between Disqualified Person And?

Yes, airSlate SignNow offers seamless integrations with various third-party applications that can help manage the b Relationship Between Disqualified Person And. This allows businesses to streamline their workflows and enhance their compliance efforts across different platforms.

-

What are the benefits of using airSlate SignNow in relation to the b Relationship Between Disqualified Person And?

Using airSlate SignNow provides businesses with a reliable way to manage the b Relationship Between Disqualified Person And effectively. Our solution enhances document security, ensures compliance, and simplifies the signing process, ultimately saving time and reducing risks.

-

How can airSlate SignNow help in training staff about the b Relationship Between Disqualified Person And?

airSlate SignNow offers resources and training materials that can help staff understand the b Relationship Between Disqualified Person And. By utilizing our platform, businesses can educate their teams on compliance requirements and best practices for managing disqualified persons in transactions.

Get more for b Relationship Between Disqualified Person And

- Requesting deferred disposition houstonrequesting deferred disposition houstonrequesting deferred disposition houstonrequesting form

- Police officer personal history statement mansfield independent mansfieldisd form

- Worthington gardens department of public safety01 form

- Bankruptcy intake form bailey amp galyen

- Division of land recordsgis ada county assessors office form

- State of north carolina trader 614188832 form

- Form 16 fc

- Permit and it may not be easy to remember everything form

Find out other b Relationship Between Disqualified Person And

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online