Form M 8453 Individual Income Tax Declaration

What is the Form M-8453 Individual Income Tax Declaration

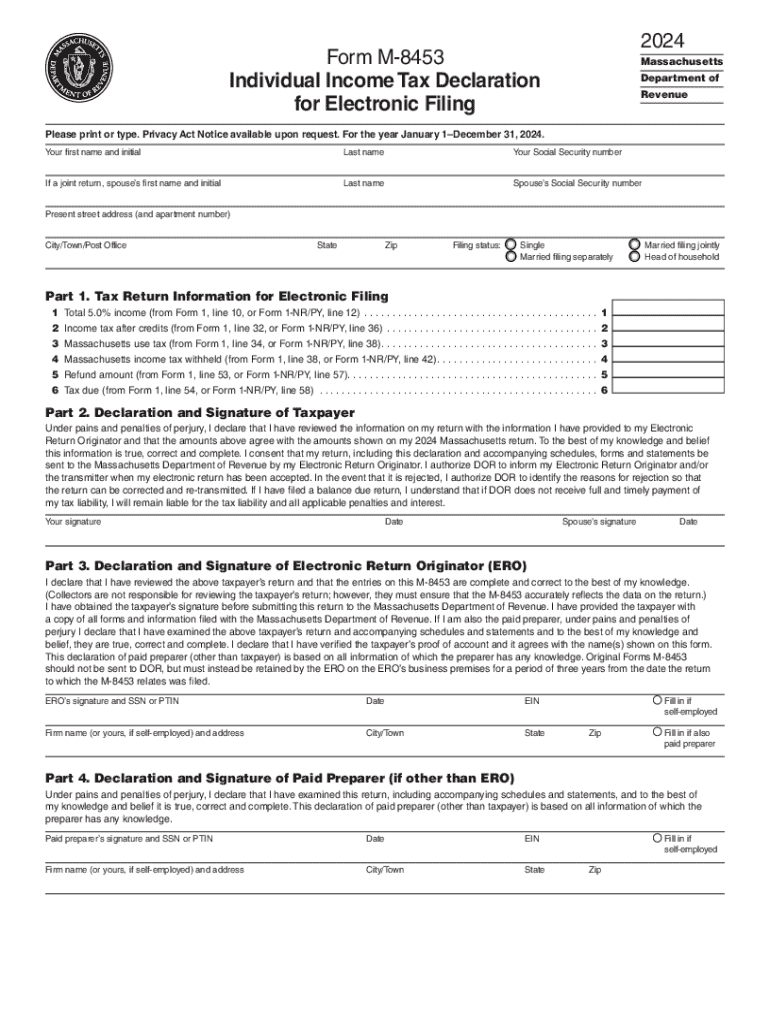

The Form M-8453 is a crucial document used by taxpayers in Massachusetts to declare their individual income tax information. This form serves as a declaration of the taxpayer's intent to file an income tax return electronically. By submitting this form, individuals confirm that they have reviewed their tax return and that it is accurate to the best of their knowledge. The M-8453 is particularly important for those who choose to file their taxes using electronic means, as it provides a necessary verification step in the filing process.

How to use the Form M-8453 Individual Income Tax Declaration

Using the Form M-8453 involves several straightforward steps. First, taxpayers must complete their income tax return, ensuring all information is accurate. After completing the return, the M-8453 form should be filled out with the necessary details, including personal identification information and the signature of the taxpayer. Once the form is completed, it must be submitted alongside the electronic filing of the tax return. This process helps ensure that the tax return is officially recognized by the Massachusetts Department of Revenue.

Steps to complete the Form M-8453 Individual Income Tax Declaration

Completing the Form M-8453 requires careful attention to detail. Here are the key steps:

- Gather all necessary personal information, including your Social Security number and filing status.

- Complete your income tax return accurately, ensuring all income and deductions are reported.

- Fill out the M-8453 form, providing your name, address, and any other required information.

- Sign and date the form to confirm the accuracy of the information provided.

- Submit the M-8453 along with your electronic tax return as instructed by your tax software or e-filing service.

Key elements of the Form M-8453 Individual Income Tax Declaration

The Form M-8453 includes several key elements that are essential for proper filing. These elements typically consist of:

- Taxpayer Information: Personal details such as name, address, and Social Security number.

- Filing Status: Indication of whether the taxpayer is filing as single, married, or head of household.

- Signature: A required signature of the taxpayer, confirming the accuracy of the information.

- Tax Year: The specific tax year for which the return is being filed.

Filing Deadlines / Important Dates

Timely submission of the Form M-8453 is critical to avoid penalties. The filing deadline for individual income tax returns in Massachusetts typically aligns with the federal deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any changes in deadlines due to specific circumstances or legislative updates.

Required Documents

To complete the Form M-8453, taxpayers need to gather several important documents. These typically include:

- W-2 forms from employers, detailing income earned.

- 1099 forms for any additional income sources, such as freelance work or interest income.

- Documentation of deductions or credits, such as receipts for medical expenses or educational costs.

- Any other relevant financial documents that support the information reported on the tax return.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form m 8453 individual income tax declaration

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the m 8453 form and why is it important?

The m 8453 form is a crucial document used for electronic filing of tax returns. It serves as a declaration that the taxpayer has authorized the e-filing of their return. Understanding the m 8453 form is essential for ensuring compliance with IRS regulations.

-

How can airSlate SignNow help with the m 8453 form?

airSlate SignNow simplifies the process of signing and sending the m 8453 form electronically. With our platform, you can easily eSign the document and ensure it is securely transmitted to the IRS. This streamlines your tax filing process and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the m 8453 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solution allows you to manage the m 8453 form and other documents without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the m 8453 form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking for the m 8453 form. These tools enhance your workflow and ensure that your documents are handled efficiently. Our user-friendly interface makes it easy to navigate through the signing process.

-

Can I integrate airSlate SignNow with other software for the m 8453 form?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage the m 8453 form alongside your existing tools. This flexibility allows you to streamline your processes and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for the m 8453 form?

Using airSlate SignNow for the m 8453 form provides numerous benefits, including faster processing times and enhanced security. Our platform ensures that your documents are encrypted and compliant with industry standards. Additionally, you can save time and reduce paperwork by going digital.

-

How secure is airSlate SignNow when handling the m 8453 form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and authentication measures to protect your m 8453 form and other sensitive documents. You can trust that your information is safe while using our platform.

Get more for Form M 8453 Individual Income Tax Declaration

- Create static pdf from dynamic xml form pdf forms

- 2016 form 1040a irsgov

- Fire tower road and portertown road widening project form

- Wine order form template

- Nomination and selection process including the form for the

- John hopkins cognitive test form

- Starfish pre lab questions form

- Flc curling registration form r2 flcseniors

Find out other Form M 8453 Individual Income Tax Declaration

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed