Form CT 1041, CT Income Tax Return for Trusts Ans Estates 2021

What is the Form CT 1041, CT Income Tax Return For Trusts and Estates

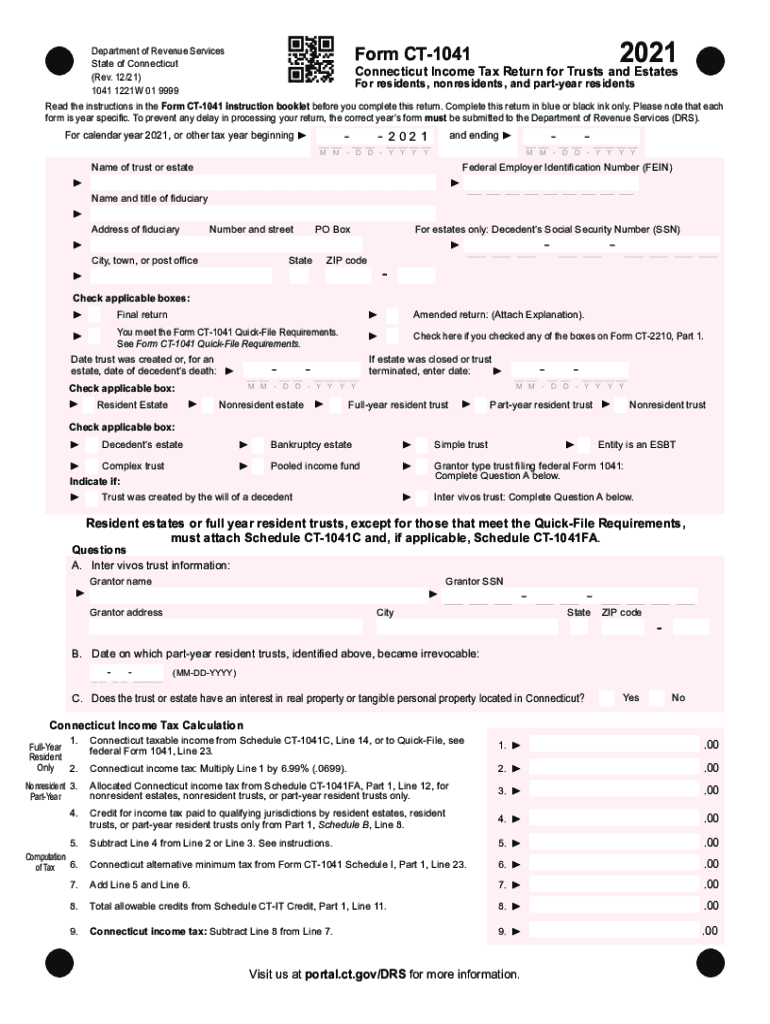

The Form CT 1041 is the Connecticut Income Tax Return specifically designed for trusts and estates. This form is essential for reporting income, deductions, and tax liability for entities that are classified as trusts or estates under Connecticut law. It allows fiduciaries to fulfill their tax obligations while ensuring compliance with state tax regulations. Properly completing this form is crucial for maintaining the legal status of the trust or estate and ensuring that beneficiaries receive accurate tax information.

Steps to Complete the Form CT 1041, CT Income Tax Return For Trusts and Estates

Completing the Form CT 1041 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents related to the trust or estate, including income statements, deductions, and any relevant supporting documentation. Next, carefully fill out each section of the form, ensuring that all income sources are reported and deductions are accurately claimed. Pay close attention to the instructions provided with the form, as they detail specific requirements and calculations. Finally, review the completed form for any errors before submission to avoid potential penalties.

Legal Use of the Form CT 1041, CT Income Tax Return For Trusts and Estates

The legal use of the Form CT 1041 is governed by state tax laws, which mandate that trusts and estates file this return if they have any taxable income. The form serves as an official declaration of the entity's financial activities and tax obligations. Proper filing ensures that the trust or estate remains in good standing with the state of Connecticut. Non-compliance can lead to penalties, including fines and interest on unpaid taxes. Therefore, understanding the legal implications of this form is essential for fiduciaries managing trusts or estates.

Filing Deadlines / Important Dates

Filing deadlines for the Form CT 1041 are critical for ensuring compliance with state tax laws. Typically, the form is due on the fifteenth day of the fourth month following the end of the tax year. For estates and trusts operating on a calendar year, this means the form is generally due by April 15. It is important to stay informed about any changes to deadlines, as extensions may be available under certain circumstances. Marking these dates on a calendar can help fiduciaries avoid late penalties.

Required Documents

To complete the Form CT 1041, several documents are necessary. These typically include:

- Income statements for the trust or estate, such as interest, dividends, and rental income.

- Documentation of deductions, including expenses related to the administration of the trust or estate.

- Previous tax returns, if applicable, to ensure consistency in reporting.

- Any relevant legal documents that define the trust or estate structure.

Having these documents ready will facilitate a smoother filing process and help ensure that all required information is accurately reported.

Form Submission Methods (Online / Mail / In-Person)

The Form CT 1041 can be submitted through various methods to accommodate different preferences. Filers have the option to submit the form online through the Connecticut Department of Revenue Services website, which may offer a more efficient process. Alternatively, the form can be mailed to the appropriate address provided in the form instructions. In-person submissions may also be possible at designated state offices, although it is advisable to check current policies regarding in-person visits due to potential restrictions. Each submission method has its own advantages, so choosing the right one can enhance the filing experience.

Quick guide on how to complete form ct 1041 ct income tax return for trusts ans estates

Complete Form CT 1041, CT Income Tax Return For Trusts Ans Estates effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Form CT 1041, CT Income Tax Return For Trusts Ans Estates on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Form CT 1041, CT Income Tax Return For Trusts Ans Estates with ease

- Locate Form CT 1041, CT Income Tax Return For Trusts Ans Estates and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight essential parts of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form—via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow manages your document needs in just a few clicks from any device you prefer. Edit and eSign Form CT 1041, CT Income Tax Return For Trusts Ans Estates and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 1041 ct income tax return for trusts ans estates

Create this form in 5 minutes!

How to create an eSignature for the form ct 1041 ct income tax return for trusts ans estates

The way to create an e-signature for a PDF document online

The way to create an e-signature for a PDF document in Google Chrome

The best way to generate an e-signature for signing PDFs in Gmail

The best way to make an electronic signature straight from your smart phone

The best way to generate an e-signature for a PDF document on iOS

The best way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is a ct 1041 form?

The ct 1041 form is a crucial document used for Connecticut income tax returns for estates and trusts. Understanding how to complete and file the ct 1041 is essential for ensuring compliance with state tax regulations. airSlate SignNow can help streamline the eSigning process for these forms.

-

How does airSlate SignNow simplify the ct 1041 signing process?

airSlate SignNow offers an intuitive platform that allows users to easily upload, sign, and send the ct 1041 form digitally. With features like templates and automated workflows, you can ensure that all required signatures are collected efficiently, saving time and effort.

-

What pricing plans are available for using airSlate SignNow for ct 1041 eSigning?

airSlate SignNow provides various pricing plans tailored to meet different business needs, including options suitable for personal use or larger organizations. Selecting an appropriate plan for your business will give you the necessary tools and support to manage ct 1041 forms effectively.

-

Are there any integrations available for airSlate SignNow that can assist with the ct 1041 form?

Yes, airSlate SignNow integrates seamlessly with various applications, such as popular cloud storage services and CRM systems. These integrations can help streamline your workflow when handling the ct 1041, allowing for easy access to documents and data essential for tax filing.

-

What features does airSlate SignNow offer to enhance the ct 1041 eSigning process?

Key features of airSlate SignNow include customizable templates, in-person signing options, and advanced security measures. These features ensure that your ct 1041 form is not only easy to manage but also securely handled throughout the signing and submission process.

-

Can I track the status of my ct 1041 documents using airSlate SignNow?

Absolutely! airSlate SignNow offers real-time tracking for all documents, including your ct 1041 forms. You can monitor who has signed and who still needs to sign, giving you peace of mind and control over your document flow.

-

What benefits can I expect from using airSlate SignNow for my ct 1041 forms?

Using airSlate SignNow for your ct 1041 forms streamlines the entire eSigning process, allowing for faster and more organized document handling. Additionally, the platform enhances collaboration and improves compliance with tax requirements, which can lead to signNow time and cost savings.

Get more for Form CT 1041, CT Income Tax Return For Trusts Ans Estates

- Louisiana marriage 497309078 form

- Louisiana domestic form

- Concerning community form

- Contributions to education or training packet louisiana form

- La marriage form

- Louisiana emancipation form

- Natural tutor louisiana form

- Packet concerning the appointment of representation for absent defendant louisiana form

Find out other Form CT 1041, CT Income Tax Return For Trusts Ans Estates

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT