Form 540 2024-2026

What is the Form 540

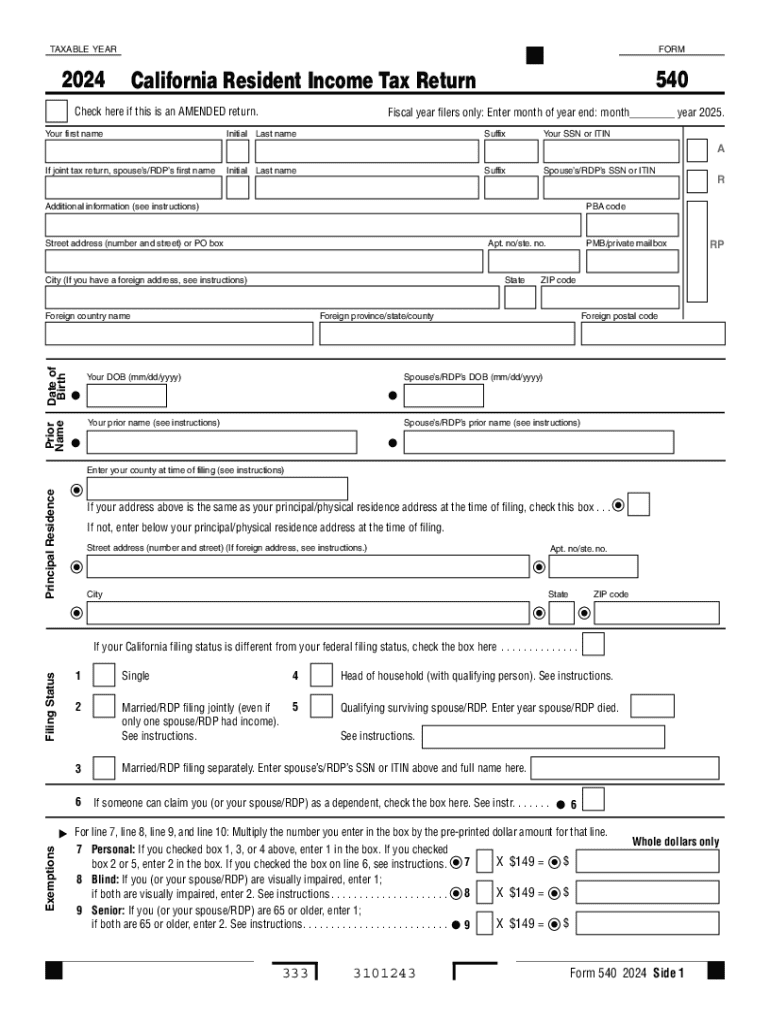

The Form 540 is a state income tax return used by California residents to report their income and calculate their tax liability. It is specifically designed for individuals who are not considered non-residents or part-year residents. The form is essential for filing state taxes and is governed by the California Franchise Tax Board (FTB). The Form 540 allows taxpayers to claim various deductions and credits applicable to their situation, ensuring compliance with California tax laws.

How to obtain the Form 540

To obtain the Form 540, individuals can visit the California Franchise Tax Board's official website, where the form is available for download in both PDF and fillable formats. Additionally, taxpayers can request a physical copy by contacting the FTB directly. Many local libraries and post offices also provide printed versions of the form. It is important to ensure that you are using the correct version for the tax year you are filing.

Steps to complete the Form 540

Completing the Form 540 involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out your personal information, including your name, address, and Social Security number.

- Report your total income, including wages, interest, and dividends.

- Claim any deductions and credits you are eligible for, such as the standard deduction or other specific credits.

- Calculate your total tax liability and any payments made throughout the year.

- Sign and date the form before submission.

Key elements of the Form 540

The Form 540 includes several key elements that are crucial for accurate filing:

- Personal Information: This section requires your name, address, and Social Security number.

- Income Section: Here, you report all sources of income, including wages, self-employment income, and investment earnings.

- Deductions and Credits: Taxpayers can claim various deductions, such as the standard deduction, and credits that reduce the overall tax liability.

- Tax Calculation: This section helps determine the total tax owed based on reported income and applicable deductions.

- Signature: A signed declaration certifies that the information provided is accurate and complete.

Filing Deadlines / Important Dates

The deadline for filing the Form 540 typically aligns with the federal tax filing deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to check for any updates from the California Franchise Tax Board regarding specific deadlines for the current tax year, as extensions may also apply under certain circumstances.

Form Submission Methods

Taxpayers have several options for submitting the Form 540:

- Online Submission: The form can be filed electronically through the California Franchise Tax Board's website, which offers a secure and efficient way to submit.

- Mail: Individuals can print the completed form and send it via postal mail to the designated address provided by the FTB.

- In-Person: Some taxpayers may choose to file in person at local FTB offices, where assistance may also be available.

Handy tips for filling out Form 540 online

Quick steps to complete and e-sign Form 540 online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Obtain access to a GDPR and HIPAA compliant solution for maximum simplicity. Use signNow to e-sign and share Form 540 for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct form 540 771608640

Create this form in 5 minutes!

How to create an eSignature for the form 540 771608640

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 540 and how can airSlate SignNow help with it?

Form 540 is a California income tax return form for residents. airSlate SignNow simplifies the process of completing and submitting Form 540 by allowing users to eSign and send documents securely, ensuring compliance and efficiency.

-

Is there a cost associated with using airSlate SignNow for Form 540?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that streamline the completion and eSigning of Form 540, making it a cost-effective solution for managing your tax documents.

-

What features does airSlate SignNow offer for managing Form 540?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically designed for Form 540. These tools enhance the user experience, making it easier to manage tax documents efficiently.

-

Can I integrate airSlate SignNow with other applications for Form 540?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including cloud storage and accounting software, to facilitate the management of Form 540. This integration helps streamline workflows and enhances productivity.

-

How does airSlate SignNow ensure the security of my Form 540 documents?

airSlate SignNow prioritizes security by employing advanced encryption and compliance measures to protect your Form 540 documents. This ensures that your sensitive information remains confidential and secure throughout the signing process.

-

What are the benefits of using airSlate SignNow for Form 540?

Using airSlate SignNow for Form 540 offers numerous benefits, including faster processing times, reduced paperwork, and improved accuracy. The platform's user-friendly interface makes it easy for anyone to complete and eSign their tax documents.

-

Is airSlate SignNow suitable for both individuals and businesses handling Form 540?

Yes, airSlate SignNow is designed to cater to both individuals and businesses managing Form 540. Whether you're filing as an individual or on behalf of a company, the platform provides the necessary tools to streamline the eSigning process.

Get more for Form 540

- Alabama education association et al v bentley et al no 5 form

- 20 was unjustified and i am reserving all my legal rights and remedies form

- 101 complaint letters that get results pdf document form

- Form 1b summonscasetext

- Rob roy volume 2 by sir walter scott project gutenberg form

- Dr 89 form

- Phone nunber form

- Local rules southern district of alabama united states form

Find out other Form 540

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple