Form 540 California Resident Income Tax Return Form 540 California Resident Income Tax Return 2022

What is the Form 540 California Resident Income Tax Return

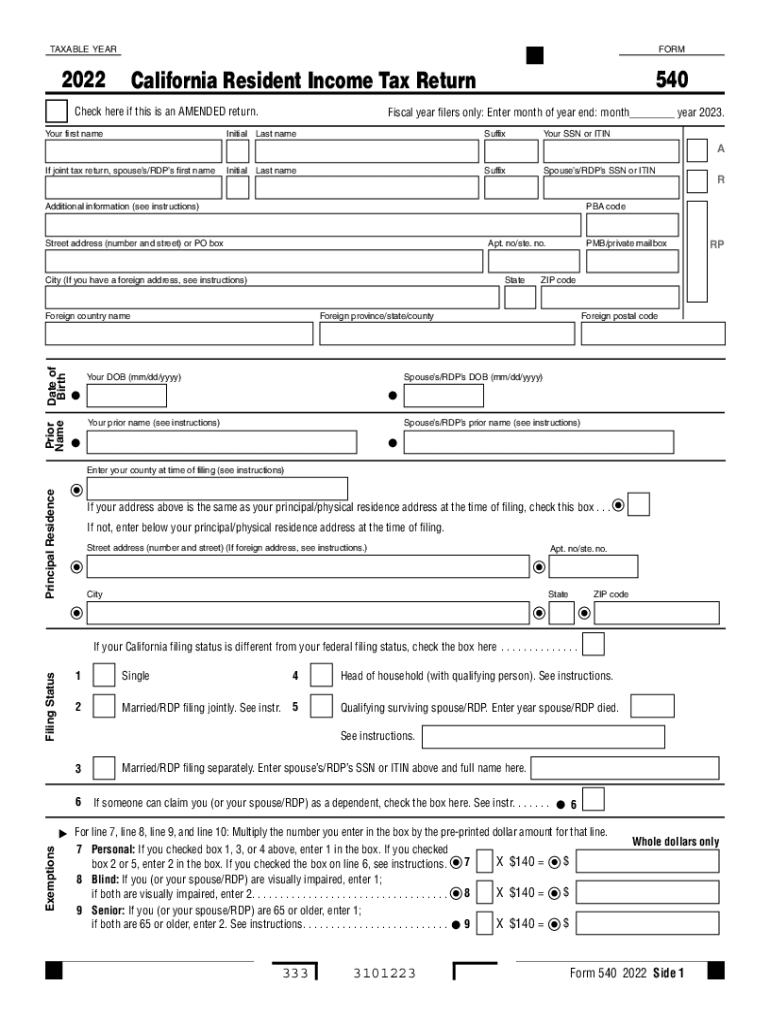

The Form 540 is the California Resident Income Tax Return, designed for residents of California to report their income and calculate their tax liability. This form is essential for individuals who earn income in California and need to comply with state tax laws. It allows taxpayers to detail their income sources, deductions, and credits, ultimately determining the amount of tax owed or the refund due.

Steps to complete the Form 540 California Resident Income Tax Return

Completing the Form 540 involves several key steps to ensure accuracy and compliance with California tax regulations. Start by gathering all necessary documents, including W-2s, 1099s, and any other income statements. Next, follow these steps:

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income from various sources, such as wages, interest, and dividends.

- Claim any deductions you qualify for, such as standard deductions or itemized deductions.

- Apply any tax credits that may reduce your tax liability.

- Calculate your total tax owed or refund due based on the information provided.

How to obtain the Form 540 California Resident Income Tax Return

The Form 540 can be obtained through multiple channels to ensure easy access for all taxpayers. You can download the form directly from the California Franchise Tax Board's website. Additionally, physical copies may be available at local tax offices, libraries, or government buildings. It is advisable to ensure you have the correct version for the specific tax year you are filing.

Legal use of the Form 540 California Resident Income Tax Return

The Form 540 is legally recognized for filing state income taxes in California. To ensure its validity, it must be completed accurately and submitted by the designated deadlines. Compliance with the California Revenue and Taxation Code is essential, as it outlines the legal framework governing tax filings. Using an electronic signature solution can enhance the legal standing of your submission, ensuring that it meets all regulatory requirements.

Filing Deadlines / Important Dates

Understanding filing deadlines is crucial for avoiding penalties and ensuring timely submission of the Form 540. Typically, the deadline for filing your California Resident Income Tax Return is April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes in deadlines, especially during tax season.

Required Documents

To accurately complete the Form 540, certain documents are required. These include:

- W-2 forms from employers detailing wages and tax withheld.

- 1099 forms for other income sources, such as freelance work or interest.

- Records of any deductions or credits you plan to claim, such as mortgage interest statements or education expenses.

- Identification documents, including your Social Security number and California driver's license number.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Form 540 can be done through various methods, providing flexibility for taxpayers. The form can be filed electronically using approved e-filing software or through the California Franchise Tax Board’s website. Alternatively, you can mail a paper copy of the completed form to the designated address provided in the instructions. In-person submissions may also be accepted at local tax offices, allowing for direct assistance if needed.

Quick guide on how to complete 2022 form 540 california resident income tax return 2022 form 540 california resident income tax return

Effortlessly Prepare Form 540 California Resident Income Tax Return Form 540 California Resident Income Tax Return on Any Device

Digital document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form 540 California Resident Income Tax Return Form 540 California Resident Income Tax Return on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Modify and eSign Form 540 California Resident Income Tax Return Form 540 California Resident Income Tax Return with Ease

- Locate Form 540 California Resident Income Tax Return Form 540 California Resident Income Tax Return and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight relevant sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes just a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and then click the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Form 540 California Resident Income Tax Return Form 540 California Resident Income Tax Return to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 540 california resident income tax return 2022 form 540 california resident income tax return

Create this form in 5 minutes!

How to create an eSignature for the 2022 form 540 california resident income tax return 2022 form 540 california resident income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are 2020 forms and how can they be used with airSlate SignNow?

2020 forms are standardized documents widely used for various transactions and reporting. With airSlate SignNow, these forms can be easily sent, signed, and managed electronically, streamlining your workflow and ensuring compliance.

-

What features does airSlate SignNow offer for managing 2020 forms?

airSlate SignNow provides features like customizable templates, bulk sending, and secure cloud storage specifically for 2020 forms. These tools simplify the signing process and enhance collaboration among stakeholders.

-

Is airSlate SignNow cost-effective for handling 2020 forms?

Yes, airSlate SignNow offers competitive pricing plans that make it a cost-effective solution for handling 2020 forms. The transparent pricing structure ensures you pay only for what you need, while the efficiency gained can lead to signNow savings over time.

-

How does airSlate SignNow integrate with other tools for 2020 forms?

airSlate SignNow easily integrates with various third-party applications such as CRM systems and cloud storage services, enabling seamless management of 2020 forms. This integration helps you maintain a cohesive workflow across your organization.

-

What are the benefits of using airSlate SignNow for 2020 forms?

Using airSlate SignNow for your 2020 forms offers benefits like reduced turnaround time, enhanced security, and improved accuracy. This digital approach minimizes errors and expedites the signing process, allowing your business to operate more efficiently.

-

Can I customize 2020 forms within airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize 2020 forms with their branding and specific fields to meet unique requirements. This level of personalization ensures that the forms align with your company’s image and operational needs.

-

Is it secure to send 2020 forms using airSlate SignNow?

Yes, airSlate SignNow prioritizes the security of your 2020 forms by employing industry-standard encryption and compliance with legal regulations. This ensures that your sensitive information is protected throughout the signing process.

Get more for Form 540 California Resident Income Tax Return Form 540 California Resident Income Tax Return

- Legal last will and testament form for divorced person not remarried with adult children south carolina

- Legal last will and testament form for divorced person not remarried with no children south carolina

- Legal last will and testament form for divorced person not remarried with minor children south carolina

- Legal last will and testament form for divorced person not remarried with adult and minor children south carolina

- Mutual wills package with last wills and testaments for married couple with adult children south carolina form

- Mutual wills package with last wills and testaments for married couple with no children south carolina form

- Mutual wills package with last wills and testaments for married couple with minor children south carolina form

- South carolina will 497326009 form

Find out other Form 540 California Resident Income Tax Return Form 540 California Resident Income Tax Return

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy