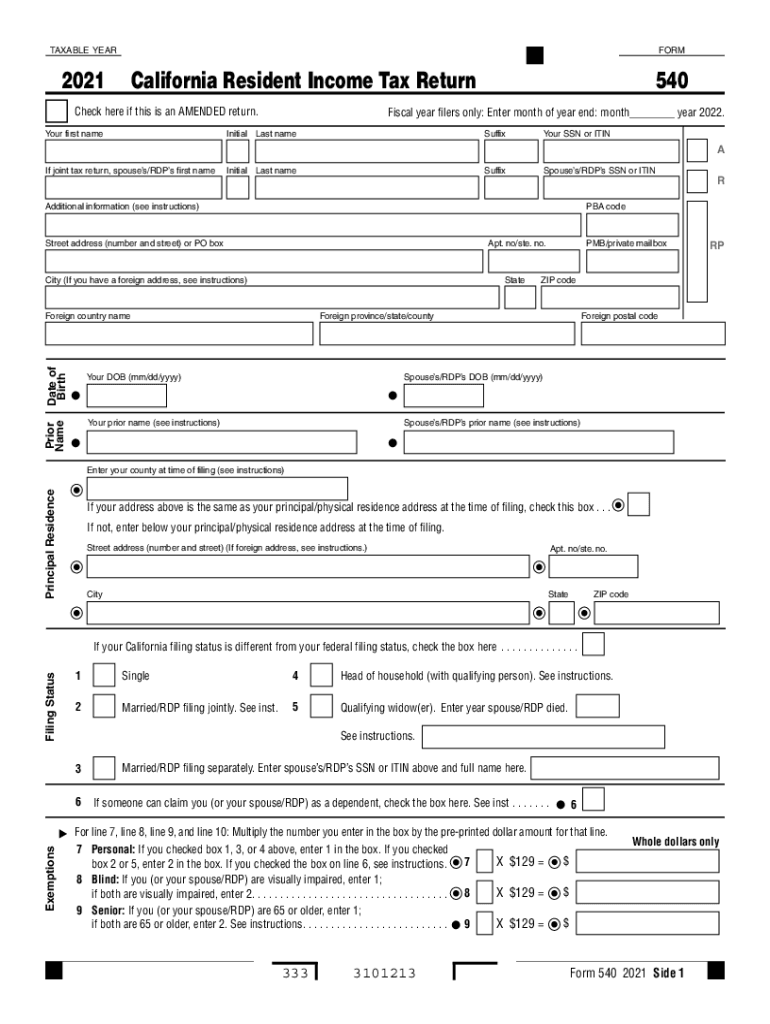

Form 540 California Resident Income Tax Return PDF 2021

What is the Form 540 California Resident Income Tax Return?

The Form 540 is the California Resident Income Tax Return, used by residents to report their income and calculate their state tax liability. This form is essential for individuals who earn income within California and need to fulfill their tax obligations. It includes various sections that allow taxpayers to detail their income, claim deductions, and apply for credits. Understanding this form is crucial for ensuring compliance with California tax laws.

Steps to Complete the Form 540 California Resident Income Tax Return

Completing the Form 540 involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, such as your name, address, and Social Security number.

- Report your total income, including wages, interest, and dividends.

- Claim applicable deductions, such as standard or itemized deductions.

- Calculate your tax liability using the provided tax tables.

- Sign and date the form to certify its accuracy.

Following these steps can help ensure that your Form 540 is completed accurately and submitted on time.

Legal Use of the Form 540 California Resident Income Tax Return

The Form 540 serves as a legally binding document when properly filled out and submitted. To ensure its legality, it must be signed by the taxpayer, affirming that the information provided is accurate to the best of their knowledge. Additionally, electronic submissions through secure platforms comply with regulations set forth by the IRS and California tax authorities, making them valid for legal purposes.

Required Documents for Form 540 Submission

To successfully complete and submit the Form 540, taxpayers should have the following documents ready:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits claimed

- Proof of health insurance coverage, if applicable

Having these documents on hand will streamline the filing process and help ensure accuracy in reporting income and deductions.

Form Submission Methods for Form 540

Taxpayers can submit their Form 540 through multiple methods, including:

- Online filing through approved e-filing services

- Mailing a paper form to the appropriate California tax office

- In-person submission at designated tax assistance centers

Each method has its own advantages, with online filing typically offering faster processing times and immediate confirmation of receipt.

Filing Deadlines for Form 540

The deadline for submitting the Form 540 is typically April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should be aware of these deadlines to avoid penalties and ensure timely compliance with state tax regulations.

Quick guide on how to complete form 540 california resident income tax returnpdf

Complete Form 540 California Resident Income Tax Return pdf effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed paperwork, as you can easily locate the required form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Form 540 California Resident Income Tax Return pdf on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign Form 540 California Resident Income Tax Return pdf without hassle

- Locate Form 540 California Resident Income Tax Return pdf and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to deliver your form, via email, text message (SMS), or an invite link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow efficiently addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign Form 540 California Resident Income Tax Return pdf to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 540 california resident income tax returnpdf

Create this form in 5 minutes!

How to create an eSignature for the form 540 california resident income tax returnpdf

The way to generate an e-signature for a PDF in the online mode

The way to generate an e-signature for a PDF in Chrome

How to create an e-signature for putting it on PDFs in Gmail

The way to generate an e-signature right from your smart phone

The way to create an e-signature for a PDF on iOS devices

The way to generate an e-signature for a PDF on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to ftb ca gov?

airSlate SignNow is a powerful e-signature platform that allows businesses to send and sign documents electronically. It integrates seamlessly with various government services, including those provided by ftb ca gov, ensuring that your tax documents and forms can be processed quickly and efficiently.

-

How much does airSlate SignNow cost?

AirSlate SignNow offers a variety of pricing plans to suit different business needs, starting from a budget-friendly solution for small businesses to more comprehensive plans for larger enterprises. For specific pricing details that might affect your dealings with ftb ca gov, visit their official site or contact customer support for tailored advice.

-

What features does airSlate SignNow offer?

airSlate SignNow provides a wide range of features, including document templates, real-time collaboration, and workflow automation. These features enhance the user experience and can be particularly beneficial for clients dealing with ftb ca gov to streamline document submission and approvals.

-

How can airSlate SignNow benefit my business?

By using airSlate SignNow, your business can save time and reduce costs associated with paper-based documentation. Not only does it simplify the signing process for internal and external documents, but it also ensures compliance with regulations, including those required by ftb ca gov.

-

Can airSlate SignNow integrate with other tools I use?

Yes, airSlate SignNow boasts integrations with various third-party applications, such as Google Workspace, Salesforce, and Microsoft Office. These integrations allow for smooth data transfer and improved workflow management, especially when working on projects related to ftb ca gov.

-

Is airSlate SignNow secure for my sensitive documents?

Security is a top priority for airSlate SignNow, which uses advanced encryption and data protection measures to safeguard your documents. This is particularly important for sensitive information that may be required by ftb ca gov and other regulatory bodies.

-

How does electronic signing work with airSlate SignNow?

With airSlate SignNow, electronic signing is quick and simple. Once you upload a document, you can invite others to sign it directly through the platform, making the process effortless while complying with regulations set by authorities like ftb ca gov.

Get more for Form 540 California Resident Income Tax Return pdf

- Name affidavit of seller louisiana form

- Non foreign affidavit under irc 1445 louisiana form

- Owners or sellers affidavit of no liens louisiana form

- Louisiana affidavit financial form

- Marital domestic separation and property settlement agreement for persons with no children no joint property or debts where 497309254 form

- Marital domestic separation and property settlement agreement minor children no joint property or debts where divorce action form

- Louisiana settlement minor form

- Marital domestic separation and property settlement agreement minor children parties may have joint property or debts where form

Find out other Form 540 California Resident Income Tax Return pdf

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement