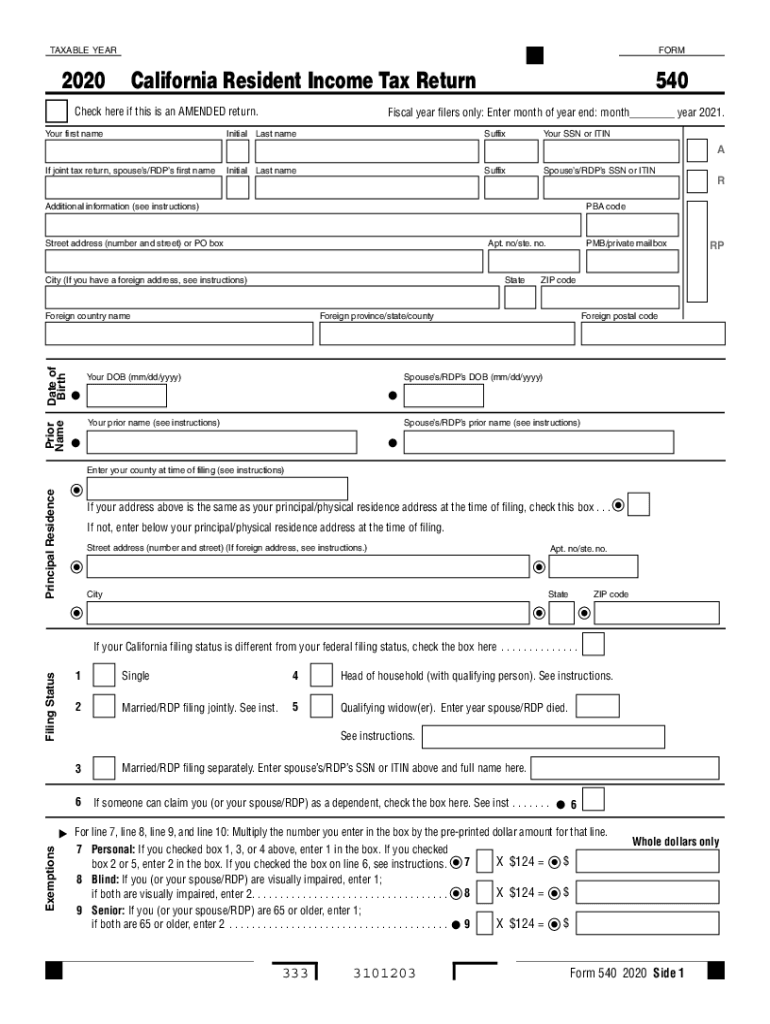

Form 540 California Resident Income Tax Return Form 540 California Resident Income Tax Return 2020

What is the Form 540 California Resident Income Tax Return?

The Form 540 California Resident Income Tax Return is a tax document used by residents of California to report their income and calculate their state tax liability. This form is essential for individuals who earn income within California and need to comply with state tax regulations. It encompasses various income types, deductions, and credits, allowing taxpayers to accurately assess their tax obligations. The 2004 version of this form includes specific instructions and requirements that reflect the tax laws applicable during that year.

Steps to Complete the Form 540 California Resident Income Tax Return

Completing the Form 540 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, such as W-2 forms, 1099 forms, and records of any other income. Next, follow these steps:

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income from all sources, ensuring to include any taxable interest or dividends.

- Claim any deductions you qualify for, such as standard deductions or itemized deductions, depending on your situation.

- Calculate your total tax liability using the provided tax tables and schedules.

- Sign and date the form to validate your submission.

How to Obtain the Form 540 California Resident Income Tax Return

The Form 540 can be obtained through various channels. Taxpayers can download the form directly from the California Franchise Tax Board (FTB) website. Additionally, physical copies are often available at local libraries, post offices, and FTB offices. It is important to ensure you are using the correct version for the tax year you are filing, as forms may vary from year to year.

Legal Use of the Form 540 California Resident Income Tax Return

The Form 540 serves as a legal document for reporting income and calculating taxes owed to the state of California. To be legally binding, the form must be completed accurately and submitted by the designated deadline. Failure to comply with filing requirements can result in penalties or legal repercussions. It is crucial for taxpayers to understand the legal implications of their submissions and retain copies of their filed forms for future reference.

Filing Deadlines / Important Dates

For the 2004 tax year, the filing deadline for the Form 540 typically aligns with the federal tax deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions available for filing, which can provide additional time to submit their returns. Keeping track of these important dates is essential to avoid late fees and penalties.

Required Documents

To complete the Form 540 accurately, taxpayers must gather several key documents, including:

- W-2 forms from employers, detailing wages and withheld taxes.

- 1099 forms for other income sources, such as freelance work or interest income.

- Records of any deductions or credits claimed, including receipts for medical expenses or charitable contributions.

- Previous year’s tax return for reference and consistency.

Eligibility Criteria

To file the Form 540, individuals must meet specific eligibility criteria. Generally, this form is intended for California residents who have earned income during the tax year. Eligibility may also depend on income thresholds, filing status, and whether the taxpayer is claimed as a dependent on someone else's tax return. Understanding these criteria helps ensure that individuals file the correct form and comply with state tax laws.

Quick guide on how to complete 2020 form 540 california resident income tax return 2020 form 540 california resident income tax return

Effortlessly Prepare Form 540 California Resident Income Tax Return Form 540 California Resident Income Tax Return on Any Device

The online management of documents has gained traction among both organizations and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to swiftly create, modify, and electronically sign your documents without any hindrances. Handle Form 540 California Resident Income Tax Return Form 540 California Resident Income Tax Return on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

The Easiest Way to Modify and Electronically Sign Form 540 California Resident Income Tax Return Form 540 California Resident Income Tax Return Effortlessly

- Obtain Form 540 California Resident Income Tax Return Form 540 California Resident Income Tax Return and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive information using the tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or errors that require new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Form 540 California Resident Income Tax Return Form 540 California Resident Income Tax Return and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 540 california resident income tax return 2020 form 540 california resident income tax return

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 540 california resident income tax return 2020 form 540 california resident income tax return

The best way to make an electronic signature for your PDF online

The best way to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The way to generate an eSignature right from your smartphone

How to generate an electronic signature for a PDF on iOS

The way to generate an eSignature for a PDF on Android

People also ask

-

What is the form 540 2004 used for?

The form 540 2004 is used for California residents to file their personal income tax returns. It helps taxpayers report their income, claim deductions, and calculate their tax liabilities. Understanding how to accurately complete the form 540 2004 is crucial for ensuring compliance with state tax laws.

-

How can I easily sign the form 540 2004 online?

With airSlate SignNow, you can easily eSign the form 540 2004 online. Our platform allows you to upload your document, add signatures, and send it for signing in just a few clicks. This streamlines the process and eliminates the need for printing and scanning.

-

What features does airSlate SignNow offer for handling the form 540 2004?

AirSlate SignNow provides a variety of features designed to facilitate the completion of the form 540 2004. You can use our document management tools to track changes, set signing order, and add reminders. These features ensure a smooth and efficient signing process.

-

Are there any costs associated with using airSlate SignNow for form 540 2004?

AirSlate SignNow offers various pricing plans designed to accommodate different needs, including features for managing the form 540 2004. Our plans are cost-effective, ensuring that businesses can access essential eSignature services without breaking the bank. You can choose a plan that suits your needs best.

-

Can I integrate airSlate SignNow with other software while working on the form 540 2004?

Yes, airSlate SignNow supports various integrations that enhance your workflow when dealing with the form 540 2004. Whether you use CRM software, document management systems, or cloud storage, our platform can connect seamlessly. This allows for better efficiency and organization.

-

What benefits does airSlate SignNow provide when completing the form 540 2004?

Using airSlate SignNow for the form 540 2004 simplifies the signing and submission process. It allows for real-time collaboration, reduces errors, and speeds up the overall completion time. Moreover, it provides security features to ensure your documents are safe and compliant.

-

Is there customer support available for questions about the form 540 2004?

Absolutely! AirSlate SignNow offers dedicated customer support for all users, including those handling the form 540 2004. Whether you have questions about the eSignature process or need assistance with your documents, our support team is available to help you every step of the way.

Get more for Form 540 California Resident Income Tax Return Form 540 California Resident Income Tax Return

Find out other Form 540 California Resident Income Tax Return Form 540 California Resident Income Tax Return

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe