Form California Tax 2018

What is the Form?

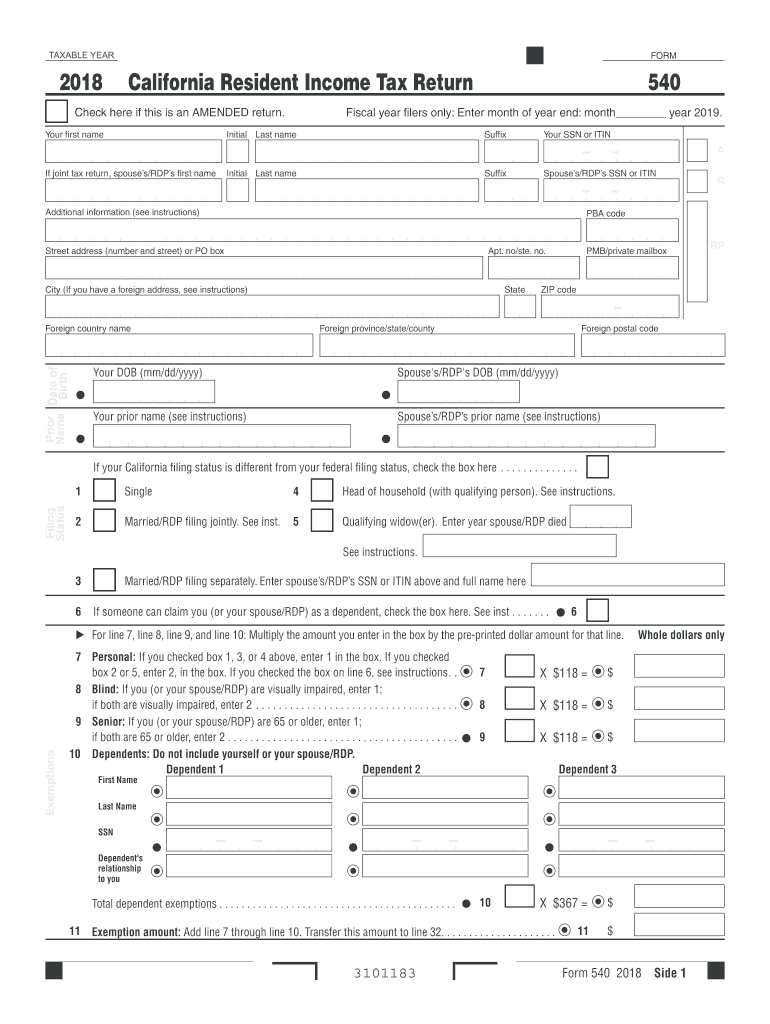

The Form is a California state income tax return specifically designed for residents of California. This form is used to report income, calculate taxes owed, and determine eligibility for various credits and deductions. It is essential for individuals who were residents of California during the 2004 tax year to accurately complete this form to ensure compliance with state tax laws.

Key elements of the Form

Understanding the key elements of the Form is crucial for accurate filing. The form includes sections for personal information, income reporting, and tax calculation. Taxpayers must provide details such as:

- Name and address

- Filing status (single, married, etc.)

- Income sources (wages, interest, dividends)

- Adjustments to income

- Tax credits and payments made

Each section must be filled out carefully to avoid errors that could lead to penalties or delays in processing.

Steps to complete the Form

Completing the Form involves several steps to ensure accuracy and compliance. Follow these steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out your personal information at the top of the form.

- Report your income in the appropriate sections, ensuring all sources are included.

- Calculate your total income and any adjustments needed.

- Determine your tax liability using the provided tax tables or software.

- Claim any eligible credits and deductions.

- Review the completed form for accuracy before signing and dating it.

Following these steps will help ensure that your tax return is completed correctly and submitted on time.

Filing Deadlines / Important Dates

For the 2004 tax year, the filing deadline for the Form 540 is typically April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important for taxpayers to be aware of these deadlines to avoid late filing penalties. Additionally, if you are unable to file by the deadline, you may request an extension, but any taxes owed must still be paid by the original due date to avoid interest and penalties.

Form Submission Methods

Taxpayers have several options for submitting the Form. These methods include:

- Online submission through authorized e-filing services.

- Mailing a paper copy of the form to the appropriate California tax authority address.

- In-person submission at designated tax offices.

Choosing the right submission method can help ensure that your form is processed efficiently and securely.

Legal use of the Form

The Form must be used in accordance with California state tax laws. This includes accurately reporting all income and deductions, as well as adhering to filing deadlines. Misuse of the form, such as providing false information or failing to report income, can result in legal consequences, including fines and penalties. It is essential for taxpayers to understand their legal obligations when completing and submitting this form.

Quick guide on how to complete form california tax 2018 2019

Your assistance manual on how to prepare your Form California Tax

If you’re wondering how to finalize and submit your Form California Tax, here are a few concise instructions to simplify the tax filing process.

To begin, you just need to create your airSlate SignNow profile to revolutionize how you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to modify, generate, and complete your income tax forms effortlessly. With its editor, you can toggle between text, check boxes, and electronic signatures, and revisit to amend responses where necessary. Optimize your tax administration with enhanced PDF editing, eSigning, and seamless sharing.

Follow the instructions below to finalize your Form California Tax in a matter of minutes:

- Create your account and begin working on PDFs almost immediately.

- Utilize our directory to locate any IRS tax document; browse through various versions and schedules.

- Click Obtain form to access your Form California Tax in our editor.

- Populate the necessary fillable fields with your data (text, figures, check marks).

- Employ the Sign Tool to insert your legally-binding electronic signature (if needed).

- Examine your document and rectify any errors.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that paper filing can lead to more errors and slow down refunds. Furthermore, prior to e-filing your taxes, verify the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct form california tax 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

I started teaching piano lessons this year, how do I pay quarterly taxes in California? What form should I fill out?

Go to https://www.irs.gov/pub/irs-pdf/... You will file a form 1040ES each quarter. The website will tell you the due dates for each quarterly payment. Get a similar form from your state tax board website if you pay state taxes.Note: If this is your first year filing, ever, then you can get away without sending in estimated payments because you owe the LESSER of what you owe this year or last year. Having been self-employed most of my life, I always filed quarterly estimated taxes, using the amount I had owed the year before, because I had to to avoid fines, and because I didn't want to get to April of the next year and not have the money. As for the amount you should pay to the IRS and your state, you might be able to figure this out using worksheets available on the IRS and state websites. If you chose to deal in cash and not report it, that's your business. Your students are not going to send you a 1099 at the end of the year. But if you teach at an institution which pays you more than a few thousand dollars a year, they WILL file a 1099 stating how much they paid you in miscellaneous income, with the IRS and state.

-

What tax forms would I have to fill out for a single-owner LLC registered in Delaware (generating income in California)?

A2A - LLC are a tax fiction - they do not exist for tax purposes. There are default provisions thus assuming you've done nothing you are a sole proprietor.Sounds to me link you have a Delaware, California, and whatever your state of residence is in addition to federal.You've not provided enough information to answer it properly however.

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

Create this form in 5 minutes!

How to create an eSignature for the form california tax 2018 2019

How to make an electronic signature for your Form California Tax 2018 2019 online

How to make an eSignature for your Form California Tax 2018 2019 in Chrome

How to make an eSignature for putting it on the Form California Tax 2018 2019 in Gmail

How to make an eSignature for the Form California Tax 2018 2019 right from your smartphone

How to generate an eSignature for the Form California Tax 2018 2019 on iOS devices

How to make an electronic signature for the Form California Tax 2018 2019 on Android devices

People also ask

-

What is the form 540 2004 and why is it important?

The form 540 2004 is a California income tax return used by residents to report their earnings and calculate their taxes owed. It’s important for ensuring compliance with state tax laws and accurately determining any potential refund or payment due.

-

How can airSlate SignNow help me with the form 540 2004?

airSlate SignNow simplifies the process of sending and eSigning the form 540 2004. Our platform allows you to securely share the form, collect signatures, and store documents digitally, making tax filing more efficient.

-

Is there a cost associated with using airSlate SignNow for the form 540 2004?

Yes, there is a cost associated with using airSlate SignNow, but we offer various pricing plans that cater to businesses of all sizes. Our affordable pricing ensures you can easily manage the form 540 2004 and other important documents.

-

What features does airSlate SignNow offer for managing the form 540 2004?

With airSlate SignNow, you can seamlessly create, send, and eSign the form 540 2004. Our features include templates, document tracking, and secure cloud storage, all designed to streamline your tax document management.

-

Can I integrate airSlate SignNow with other tools for the form 540 2004?

Absolutely! airSlate SignNow offers integrations with various business applications such as CRM and accounting software, allowing for a cohesive workflow when dealing with the form 540 2004. This enhances efficiency and reduces manual data entry.

-

What are the benefits of using airSlate SignNow for the form 540 2004?

Using airSlate SignNow for the form 540 2004 offers several benefits, including faster processing times, enhanced security for sensitive data, and the convenience of digital signatures. These features contribute to a more efficient tax filing experience.

-

Is airSlate SignNow secure for handling the form 540 2004?

Yes, airSlate SignNow prioritizes the security of your documents, including the form 540 2004. Our platform uses industry-standard encryption and authentication protocols to protect your sensitive information throughout the signing process.

Get more for Form California Tax

- Ct 706 nt form

- Florida supreme court approved family law form 12901b1

- Student financial aid application form ilc

- Classification form seneca county common pleas court senecacocourts

- Missouri chartis form

- Calculating average atomic mass worksheet answer key form

- Internet safety contract template form

- International trade contract template form

Find out other Form California Tax

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online