Form 990 T 2024

What is the Form 990 T

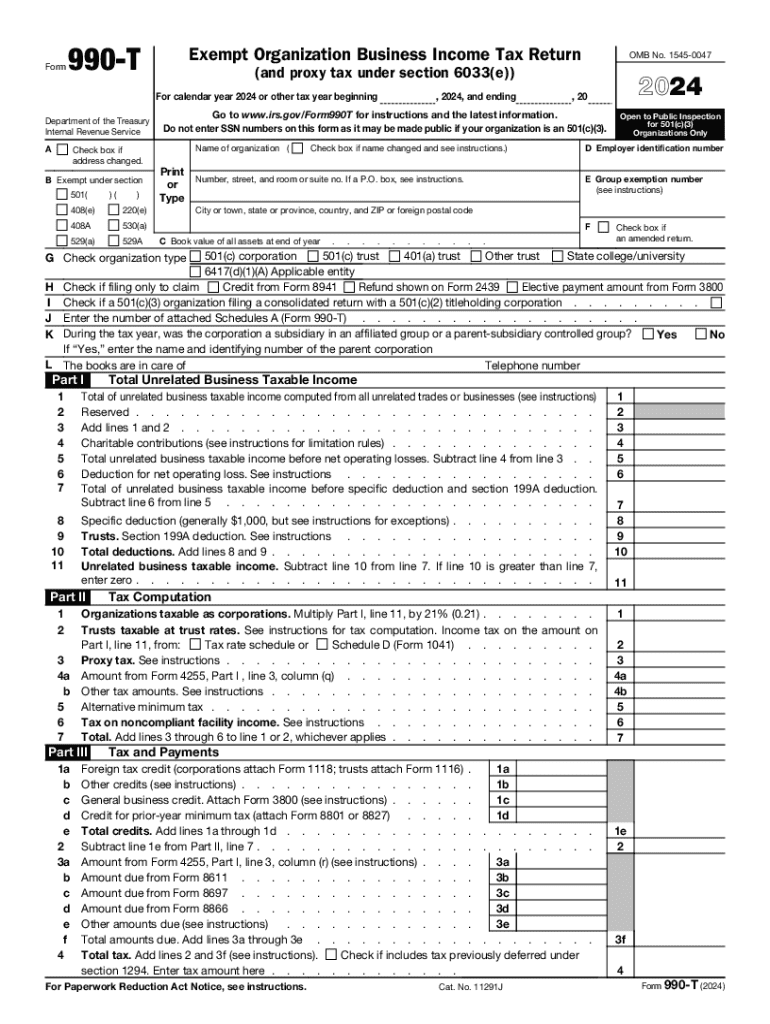

The Form 990 T is a tax return specifically designed for exempt organizations to report unrelated business income. This form is essential for organizations that earn income from activities not substantially related to their exempt purpose. By filing the 990 T, organizations ensure compliance with IRS regulations regarding taxation on this income. The form helps the Internal Revenue Service (IRS) identify and tax income generated by activities that do not align with the organization's primary mission.

How to use the Form 990 T

To effectively use the Form 990 T, organizations must first determine if they have any unrelated business income (UBI). If UBI exists, the organization must complete the form, detailing the income and expenses related to those activities. The form requires specific information about the sources of income and the costs incurred in generating that income. Organizations must also ensure that they are aware of the applicable tax rates and any deductions that may apply to their situation.

Steps to complete the Form 990 T

Completing the Form 990 T involves several key steps:

- Identify unrelated business income: Review all income sources to determine if any are unrelated to the organization’s exempt purpose.

- Gather financial data: Collect all relevant financial information, including income and expenses associated with the unrelated business activities.

- Fill out the form: Accurately complete each section of the Form 990 T, ensuring all information is correct and complete.

- Review for accuracy: Double-check all entries for accuracy and completeness to avoid potential penalties.

- Submit the form: File the completed Form 990 T with the IRS by the designated deadline.

Filing Deadlines / Important Dates

The filing deadline for the Form 990 T is typically the fifteenth day of the fifth month after the end of the organization’s tax year. For organizations operating on a calendar year, this means the form is due on May fifteenth. If an organization requires additional time, it may file for an extension, allowing for an additional six months to submit the form. It is crucial for organizations to adhere to these deadlines to avoid penalties and interest on unpaid taxes.

Penalties for Non-Compliance

Failure to file the Form 990 T or filing it late can result in significant penalties for organizations. The IRS imposes a penalty based on the amount of unpaid tax, which can accumulate over time. Additionally, organizations may face a loss of their tax-exempt status if they consistently fail to comply with filing requirements. It is essential for organizations to stay informed about their filing obligations to avoid these consequences.

IRS Guidelines

The IRS provides specific guidelines for completing and filing the Form 990 T. These guidelines outline the types of income that qualify as unrelated business income, as well as the necessary deductions that can be claimed. Organizations should refer to the IRS instructions for Form 990 T to ensure compliance with all requirements. Understanding these guidelines helps organizations accurately report their income and avoid potential issues with the IRS.

Create this form in 5 minutes or less

Find and fill out the correct form 990 t

Create this form in 5 minutes!

How to create an eSignature for the form 990 t

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 990 T form and why is it important?

The 990 T form is a tax form used by tax-exempt organizations to report unrelated business income. It is important because it ensures compliance with IRS regulations and helps organizations avoid penalties. Understanding how to properly fill out the 990 T form can save organizations time and money.

-

How can airSlate SignNow help with the 990 T form?

airSlate SignNow provides an efficient platform for electronically signing and sending the 990 T form. With its user-friendly interface, businesses can streamline the process of preparing and submitting this important tax document. This saves time and reduces the risk of errors.

-

What features does airSlate SignNow offer for managing the 990 T form?

airSlate SignNow offers features such as customizable templates, secure eSignature capabilities, and document tracking specifically for the 990 T form. These features enhance the efficiency of document management and ensure that all necessary signatures are obtained promptly.

-

Is airSlate SignNow cost-effective for filing the 990 T form?

Yes, airSlate SignNow is a cost-effective solution for businesses needing to file the 990 T form. With various pricing plans, organizations can choose an option that fits their budget while still accessing essential features for document management and eSigning.

-

Can I integrate airSlate SignNow with other software for the 990 T form?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage the 990 T form alongside your other financial documents. This integration helps streamline workflows and improves overall efficiency.

-

What are the benefits of using airSlate SignNow for the 990 T form?

Using airSlate SignNow for the 990 T form offers numerous benefits, including enhanced security, faster processing times, and reduced paperwork. The platform's ease of use allows organizations to focus on their core activities while ensuring compliance with tax regulations.

-

How secure is airSlate SignNow when handling the 990 T form?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive information related to the 990 T form. This ensures that your documents are safe from unauthorized access and that your organization remains compliant with data protection regulations.

Get more for Form 990 T

- Formularioschengen rus3 0 doc

- Immigration services citizenship office form

- Orlando building permits form

- Complete your application on mydorway at mydorway form

- Ffa membership form providence high school clubs

- Circle the correct answer questionnaire for traveller full form

- Security guard agreement template form

- Security guard service agreement template form

Find out other Form 990 T

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors