Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax under Section 6033e 2020

What is the Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e

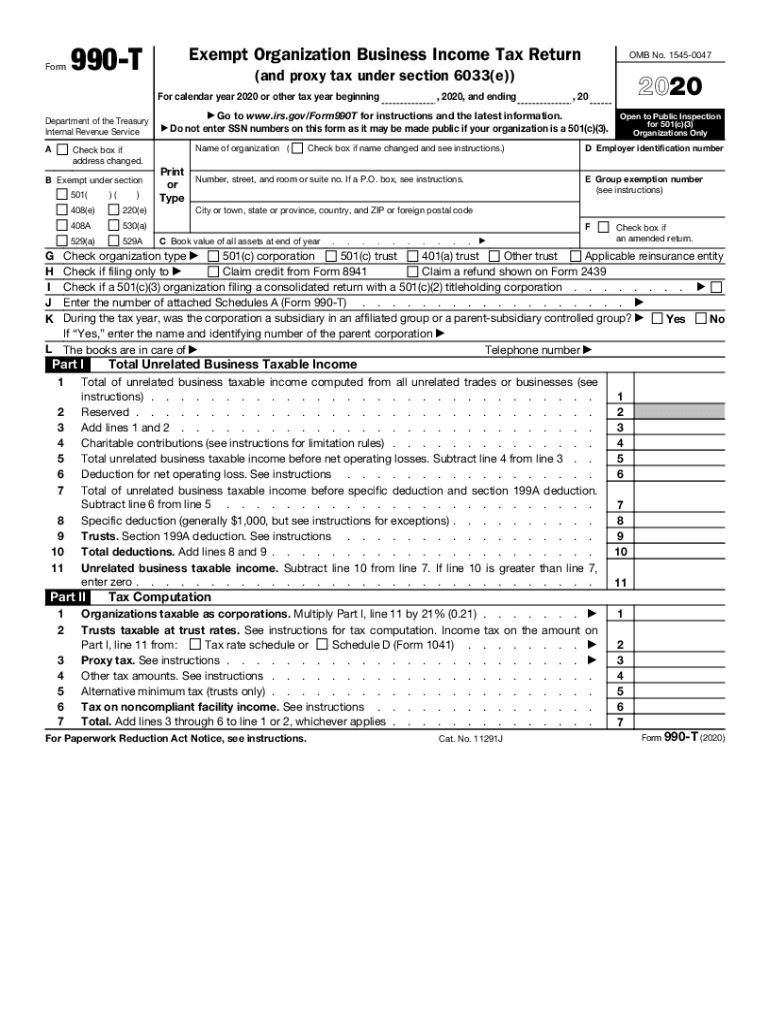

The Form 990 T is a crucial document for exempt organizations that generate income from activities unrelated to their primary exempt purposes. This form is used to report and pay taxes on that unrelated business income. It is also known as the Exempt Organization Business Income Tax Return. Additionally, it addresses proxy taxes under Section 6033e, which applies to certain organizations that fail to disclose specific information regarding lobbying activities. Understanding the purpose and requirements of Form 990 T is essential for compliance with IRS regulations.

Steps to complete the Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e

Completing Form 990 T involves several steps to ensure accuracy and compliance. First, gather all necessary financial information related to the organization's unrelated business income. This includes revenue from activities not directly tied to the exempt purpose. Next, calculate the allowable deductions, which can reduce the taxable income. Fill out the form by providing the organization's details, income, deductions, and tax owed. Finally, review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

Timely filing of Form 990 T is critical to avoid penalties. The form is generally due on the fifteenth day of the fifth month after the end of the organization’s tax year. For organizations operating on a calendar year, this means the form is due by May 15. If additional time is needed, organizations can file for an extension using Form 8868, which grants an automatic six-month extension. However, it is important to note that any taxes owed must still be paid by the original due date to avoid interest and penalties.

Required Documents

To complete Form 990 T, certain documents are essential. Organizations should prepare financial statements that detail all income sources and expenses related to unrelated business activities. This includes profit and loss statements, balance sheets, and any relevant supporting documentation for deductions claimed. Additionally, organizations should have records of any lobbying activities if applicable, as this information is necessary for proxy tax calculations under Section 6033e.

Penalties for Non-Compliance

Failure to file Form 990 T or inaccuracies in reporting can lead to significant penalties. The IRS imposes a penalty of $20 per day for each day the form is late, with a maximum penalty of $10,000. If the organization fails to pay the required tax, additional penalties and interest may accrue. Understanding the implications of non-compliance emphasizes the importance of accurate and timely filing of this form.

IRS Guidelines

The IRS provides specific guidelines for completing and filing Form 990 T. These guidelines outline the types of income that must be reported, allowable deductions, and the necessary documentation required for compliance. Organizations should refer to the IRS instructions for Form 990 T for detailed information on each section of the form and any updates to filing requirements. Staying informed about IRS guidelines is essential for maintaining compliance and avoiding penalties.

Quick guide on how to complete 2020 form 990 t exempt organization business income tax return and proxy tax under section 6033e

Effortlessly prepare Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e on any device

Digital document management has gained traction among companies and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and electronically sign your documents quickly without any holdups. Manage Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

Effortlessly edit and electronically sign Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e

- Locate Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e and then click Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in a few clicks from any device of your choice. Edit and electronically sign Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 990 t exempt organization business income tax return and proxy tax under section 6033e

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 990 t exempt organization business income tax return and proxy tax under section 6033e

How to make an eSignature for your PDF file online

How to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The way to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

The way to create an electronic signature for a PDF file on Android devices

People also ask

-

What are the form 990 t filing requirements for nonprofits?

The form 990 t filing requirements for nonprofits involve reporting income from unrelated business activities. Nonprofits must file this form if they earn over $1,000 from such activities. Understanding these requirements ensures compliance and helps avoid penalties, making it crucial for nonprofit organizations.

-

How does airSlate SignNow assist with meeting form 990 t filing requirements?

airSlate SignNow simplifies the documentation process required to meet form 990 t filing requirements. Our platform allows users to prepare, send, and securely sign forms and supporting documentation with ease. This streamlines filing and helps organizations maintain accurate records.

-

What features does airSlate SignNow offer that are beneficial for form 990 t filing?

airSlate SignNow offers features such as customizable templates and automated workflow management that are beneficial for form 990 t filing. These tools allow organizations to create and manage their documents efficiently, ensuring they capture all necessary information to comply with filing requirements.

-

Can I integrate airSlate SignNow with accounting software for form 990 t filing?

Yes, airSlate SignNow can be integrated with various accounting software to streamline the form 990 t filing process. This integration allows users to automatically sync data and documents, ensuring that all financial information is accurately reflected in the filing process, meeting compliance efficiently.

-

What is the pricing structure for airSlate SignNow related to filing requirements?

airSlate SignNow offers a tiered pricing structure that caters to different organizational needs for form 990 t filing requirements. Our plans are designed to be cost-effective while providing essential features for document management and e-signatures, making it accessible for nonprofits of all sizes.

-

Are there training resources available for using airSlate SignNow for form 990 t filing?

Absolutely! airSlate SignNow provides a variety of training resources to help users navigate form 990 t filing requirements effectively. Our tutorials, webinars, and customer support are tailored to ensure you maximize the platform's capabilities for smoother document management.

-

What benefits does airSlate SignNow offer for organizations needing to file form 990 t?

Using airSlate SignNow offers multiple benefits for organizations needing to file form 990 t, including increased efficiency and accuracy in document handling. Our solution minimizes paperwork errors and speeds up the filing process, ensuring that all requirements are met promptly and correctly.

Get more for Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e

Find out other Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter