Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax under Section 6033e 2022

What is the Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e

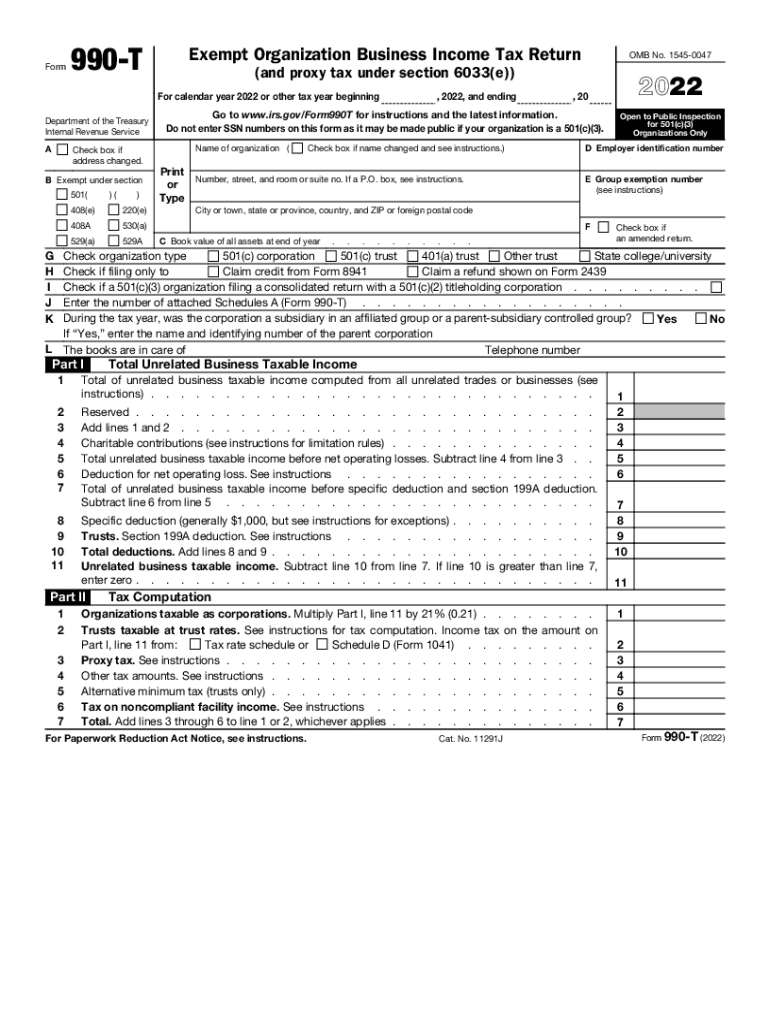

The Form 990 T is a crucial document for exempt organizations that engage in business activities generating unrelated business taxable income (UBTI). This form allows organizations to report their income and calculate the tax owed on that income. Specifically, it is used for reporting income from activities that are not substantially related to the organization's exempt purpose. Additionally, the form includes provisions for proxy taxes under Section 6033e, which applies to certain organizations that fail to meet disclosure requirements regarding lobbying and political expenditures.

Steps to complete the Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e

Completing the Form 990 T involves several key steps to ensure accuracy and compliance. First, gather all necessary financial information, including income from business activities and any related expenses. Next, accurately report UBTI on the form, ensuring that all calculations are correct. It is essential to also include any applicable deductions and credits. After filling out the form, review it thoroughly for any errors before submission. Finally, ensure that the form is filed by the appropriate deadline to avoid penalties.

Filing Deadlines / Important Dates

Organizations must be aware of specific deadlines when filing Form 990 T. Generally, the form is due on the 15th day of the fifth month after the end of the organization’s tax year. For example, if the tax year ends on December 31, the form would be due by May 15 of the following year. Organizations can apply for an automatic six-month extension if needed, but it is important to file the extension request before the original deadline to avoid late penalties.

Legal use of the Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e

The legal use of Form 990 T is governed by IRS regulations that require exempt organizations to report any unrelated business income accurately. Failure to file the form or inaccuracies in reporting can lead to penalties, including taxes owed on UBTI. Organizations must ensure compliance with all IRS guidelines to maintain their tax-exempt status. Additionally, the proxy tax provisions under Section 6033e require organizations to disclose certain lobbying activities, further emphasizing the importance of accurate reporting.

Key elements of the Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e

Key elements of Form 990 T include sections for reporting various types of income, such as gross receipts from unrelated business activities, as well as expenses directly related to those activities. The form also requires organizations to disclose any deductions related to UBTI. Furthermore, organizations must provide information regarding proxy taxes if applicable, which includes details about lobbying expenditures and compliance with disclosure requirements. Understanding these elements is essential for accurate completion and compliance.

Who Issues the Form

The Form 990 T is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. Organizations must obtain the form directly from the IRS, typically available on their official website or through other IRS publications. It is important for organizations to use the most current version of the form to ensure compliance with any updates or changes in tax laws.

Quick guide on how to complete 2022 form 990 t exempt organization business income tax return and proxy tax under section 6033e

Complete Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e effortlessly on any device

The management of documents online has become increasingly favored by both organizations and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, as it allows you to access the right form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e on any gadget with airSlate SignNow’s Android or iOS applications and enhance any document-based process today.

The easiest way to modify and electronically sign Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e seamlessly

- Locate Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e and click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your alterations.

- Select your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e and ensure exceptional communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 990 t exempt organization business income tax return and proxy tax under section 6033e

Create this form in 5 minutes!

How to create an eSignature for the 2022 form 990 t exempt organization business income tax return and proxy tax under section 6033e

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how can it help with my tax form 2017?

airSlate SignNow is a powerful solution that allows you to send and eSign documents seamlessly. For your tax form 2017, you can quickly prepare, send, and receive signatures electronically, ensuring you meet all deadlines efficiently.

-

Is airSlate SignNow cost-effective for handling tax form 2017?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. With various pricing plans, you can manage your tax form 2017 without breaking the bank, ensuring you get great value while increasing efficiency.

-

What features does airSlate SignNow offer for managing tax form 2017?

airSlate SignNow offers features like customizable templates, secure eSigning, and automated reminders. These tools streamline the process of completing your tax form 2017, making it easier to stay organized and compliant.

-

Can I integrate airSlate SignNow with other software for my tax form 2017?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including Google Drive and Dropbox. This makes it easier to access and manage your tax form 2017 from any platform you already use.

-

What benefits does airSlate SignNow provide for my tax form 2017 submissions?

Using airSlate SignNow for your tax form 2017 submissions offers numerous benefits, including time-saving automation and enhanced security. You'll reduce errors, speed up the process, and ensure that your submissions meet compliance standards.

-

How secure is airSlate SignNow for handling sensitive tax form 2017 data?

airSlate SignNow prioritizes security, employing advanced encryption protocols to protect your sensitive data. When handling your tax form 2017, you can rest assured knowing that your information is safe and secure.

-

How do I start using airSlate SignNow for my tax form 2017?

To begin using airSlate SignNow for your tax form 2017, simply sign up for an account on our website. After setting up your profile, you can easily upload documents, create templates, and manage your eSignature workflows.

Get more for Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e

Find out other Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement