Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax under Section 6033e 2021

What is the Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e

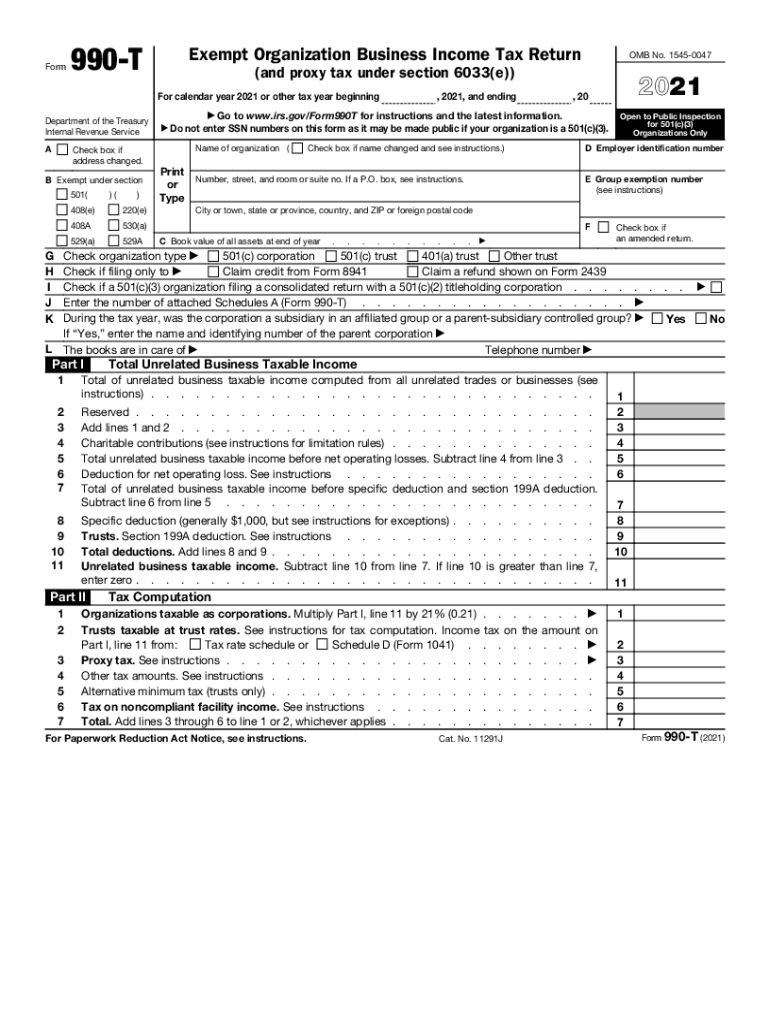

The Form 990 T is a tax return specifically designed for exempt organizations that generate income from business activities unrelated to their primary exempt purpose. This form is essential for organizations such as charities, educational institutions, and religious groups that may engage in commercial activities. The Internal Revenue Service (IRS) requires these organizations to report their unrelated business income (UBI) and pay taxes on it, if applicable. Additionally, the form addresses proxy taxes under Section 6033e, which applies to certain organizations that engage in lobbying activities or political expenditures.

Steps to complete the Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e

Completing the Form 990 T involves several key steps to ensure compliance with IRS regulations. First, organizations should gather all relevant financial information, including income from business activities and any allowable deductions. Next, fill out the form accurately, detailing the sources of UBI and calculating the tax owed. It's important to review the instructions provided by the IRS to ensure all sections are completed correctly. After completing the form, organizations must sign and date it before submission, ensuring that all information is truthful and accurate.

Filing Deadlines / Important Dates

Organizations must adhere to specific deadlines when filing the Form 990 T. Generally, the form is due on the 15th day of the fifth month after the end of the organization’s tax year. For organizations operating on a calendar year, this typically means the due date is May 15. If additional time is needed, organizations can file for an extension using Form 8868, which grants an automatic six-month extension. However, it is crucial to note that any taxes owed must still be paid by the original due date to avoid penalties and interest.

Legal use of the Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e

The legal use of Form 990 T is governed by IRS regulations that dictate how exempt organizations report their unrelated business income. Organizations must ensure that they are compliant with federal tax laws when filing this form. Failure to do so can result in penalties, including taxes owed on unreported income. Additionally, organizations must maintain accurate records to substantiate the income and expenses reported on the form, as the IRS may require documentation during audits.

Required Documents

To complete the Form 990 T, organizations need to gather several key documents. These include financial statements that detail income from business activities, receipts for expenses related to those activities, and any prior tax returns that may provide context for the current filing. Additionally, organizations should have documentation related to any lobbying activities or political expenditures if applicable, as this information is necessary for accurately reporting proxy taxes under Section 6033e.

Penalties for Non-Compliance

Non-compliance with the filing requirements for Form 990 T can lead to significant penalties for exempt organizations. If the form is not filed by the due date, the IRS may impose a penalty based on the organization's gross receipts. Furthermore, if an organization fails to report unrelated business income accurately, it may be subject to additional taxes and penalties. Maintaining compliance with the IRS guidelines is essential to avoid these consequences and ensure the organization retains its tax-exempt status.

Quick guide on how to complete 2021 form 990 t exempt organization business income tax return and proxy tax under section 6033e

Complete Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without issues. Manage Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e on any platform using airSlate SignNow Android or iOS applications and simplify any document-focused procedure today.

The easiest method to alter and eSign Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e without hassle

- Find Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method of delivering your form: via email, SMS, or invite link, or download it to your PC.

Say goodbye to lost or mislaid files, cumbersome form navigation, or errors that necessitate printing new copies of documents. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Alter and eSign Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 990 t exempt organization business income tax return and proxy tax under section 6033e

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 990 t exempt organization business income tax return and proxy tax under section 6033e

The way to make an e-signature for your PDF online

The way to make an e-signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

The best way to make an electronic signature for a PDF file on Android

People also ask

-

What is the 990 t feature in airSlate SignNow?

The 990 t feature in airSlate SignNow allows users to efficiently manage documents that require electronic signatures. This feature simplifies the signing process, making it quick and hassle-free for both senders and recipients.

-

How does airSlate SignNow pricing compare for services like 990 t?

airSlate SignNow offers competitive pricing for its services, including the 990 t feature. Customers can choose from various plans depending on their needs, with options that cater to both small businesses and larger enterprises.

-

Can I integrate airSlate SignNow with other applications when using the 990 t feature?

Yes, airSlate SignNow offers robust integrations with popular applications, enhancing the functionality of the 990 t feature. Businesses can seamlessly connect their existing software, making document management even more efficient.

-

What benefits does the 990 t feature provide for businesses?

The 990 t feature streamlines document workflows, saves time, and reduces paper usage, which is beneficial for businesses looking to improve efficiency. Additionally, it enhances security and legal compliance through its secure eSigning capabilities.

-

Is airSlate SignNow easy to use for first-time users of the 990 t feature?

Absolutely! airSlate SignNow is designed to be user-friendly, even for those unfamiliar with the 990 t feature. Its intuitive interface guides users through the eSigning process, ensuring a smooth experience.

-

How can the 990 t feature help improve turnaround times for businesses?

The 990 t feature signNowly improves turnaround times by enabling instant document sending and eSigning. This reduces waiting periods compared to traditional methods, allowing businesses to close deals faster and enhance productivity.

-

What types of documents can I sign using the 990 t feature?

With the 990 t feature in airSlate SignNow, you can sign a variety of documents, including contracts, agreements, and legal forms. This versatility makes it suitable for numerous industries and business needs.

Get more for Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e

- Missouri mechanic lien 497313086 form

- Missouri lien form

- Quitclaim deed by two individuals to llc missouri form

- Warranty deed from two individuals to llc missouri form

- Mo deed beneficiary form

- Quitclaim deed husband and wife to three individuals missouri form

- Quitclaim deed from limited liability company to limited liability company missouri form

- Deed beneficiary form 497313094

Find out other Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later