Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax under Section 6033e 2023

What is the Form 990 T Exempt Organization Business Income Tax Return?

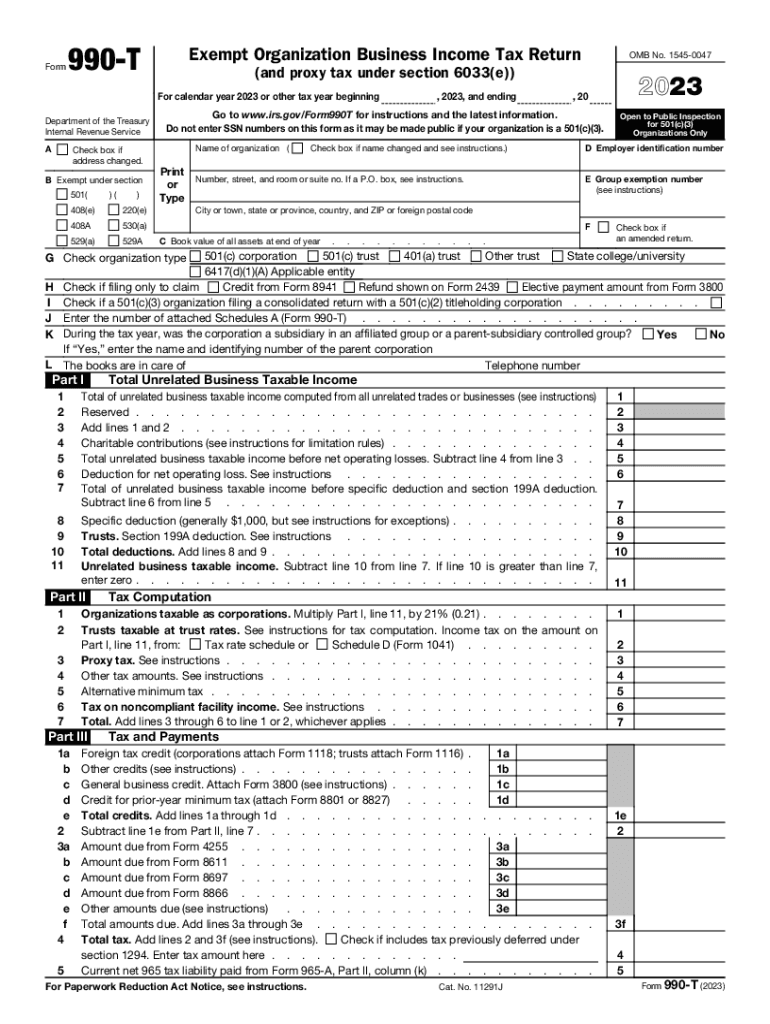

The Form 990 T is a tax return specifically designed for exempt organizations to report unrelated business income. This form is essential for organizations that engage in activities unrelated to their primary exempt purpose, as it ensures compliance with IRS regulations. The form also includes provisions for proxy taxes under Section 6033e, which apply to certain organizations that fail to meet specific disclosure requirements.

How to obtain the Form 990 T

To obtain the Form 990 T, organizations can visit the IRS website, where the form is available for download in PDF format. Alternatively, organizations can request a physical copy by contacting the IRS directly. It is important to ensure that the most current version of the form is used, as tax laws and requirements may change from year to year.

Steps to complete the Form 990 T

Completing the Form 990 T involves several key steps:

- Gather financial information regarding unrelated business income.

- Complete the identification section, including the organization's name and Employer Identification Number (EIN).

- Report all sources of unrelated business income on the appropriate lines of the form.

- Calculate any allowable deductions related to the income reported.

- Determine the tax liability based on the net income.

- Sign and date the form before submission.

Filing Deadlines for Form 990 T

The filing deadline for Form 990 T is typically the fifteenth day of the fifth month after the end of the organization's tax year. For organizations operating on a calendar year, this means the form is due on May 15. Organizations can request an extension, but it is crucial to file the extension request before the original deadline to avoid penalties.

Penalties for Non-Compliance

Failure to file Form 990 T or to report unrelated business income accurately can result in significant penalties. The IRS may impose fines for late filing, which can accumulate daily. Additionally, if an organization consistently fails to comply with filing requirements, it may jeopardize its tax-exempt status.

Eligibility Criteria for Filing Form 990 T

Eligibility to file Form 990 T generally applies to organizations that are recognized as tax-exempt under Section 501(c) of the Internal Revenue Code and that generate unrelated business income. It is important for organizations to assess their activities to determine if they meet the criteria for filing this form. This includes understanding what constitutes unrelated business income and ensuring compliance with IRS guidelines.

Quick guide on how to complete form 990 t exempt organization business income tax return and proxy tax under section 6033e

Complete Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e effortlessly on any device

Web-based document management has gained traction among companies and individuals alike. It presents an ideal eco-conscious substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly and without delays. Manage Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The easiest way to edit and electronically sign Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e with ease

- Find Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e and click on Get Form to initiate the process.

- Utilize the tools provided to complete your form.

- Emphasize signNow sections of the documents or redact sensitive information with features that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as an ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, painstaking form searching, or errors necessitating new copies. airSlate SignNow handles all your document management requirements in just a few clicks from any device of your choice. Edit and electronically sign Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 990 t exempt organization business income tax return and proxy tax under section 6033e

Create this form in 5 minutes!

How to create an eSignature for the form 990 t exempt organization business income tax return and proxy tax under section 6033e

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the importance of the 2018 990t income for tax-exempt organizations?

The 2018 990t income is crucial for tax-exempt organizations as it reports unrelated business income that may be taxable. Understanding this form helps organizations comply with tax regulations and avoid penalties. By accurately reporting 2018 990t income, nonprofits can maintain their tax-exempt status while still engaging in profitable activities.

-

How does airSlate SignNow assist with e-signing 2018 990t income forms?

airSlate SignNow provides a seamless platform for e-signing 2018 990t income forms, ensuring quick processing and enhanced security. With our solution, organizations can gather electronic signatures easily, reducing paperwork and reliance on physical documents. This efficiency is particularly beneficial for tax-exempt organizations dealing with time-sensitive filings.

-

What features does airSlate SignNow offer for managing 2018 990t income submissions?

airSlate SignNow offers a variety of features that streamline the management of 2018 990t income submissions. Users can create customizable templates, set reminders for due dates, and track document status in real-time. These features help organizations stay organized and compliant when filing taxes.

-

Are there any costs associated with using airSlate SignNow for 2018 990t income documents?

Yes, airSlate SignNow offers flexible pricing plans that cater to various organizational needs, even for handling 2018 990t income documents. Pricing depends on the features selected, thus providing options for small to large organizations. The cost-effectiveness of our solution can ultimately save time and resources for your tax-related processes.

-

Can airSlate SignNow integrate with accounting software for 2018 990t income?

Absolutely! airSlate SignNow can integrate seamlessly with various accounting software, making it easier to manage your 2018 990t income data. This integration ensures that your financial records are up-to-date and simplifies the process of syncing your e-signed documents with your accounting systems.

-

What benefits does e-signing provide for 2018 990t income documentation?

E-signing provides numerous benefits for managing 2018 990t income documentation including reduced processing time and improved security. By utilizing airSlate SignNow, organizations can eliminate the hassles of paperwork and enhance their operational efficiency. Additionally, e-signatures are legally binding and recognized, which adds to the credibility of your submissions.

-

How does airSlate SignNow ensure the security of 2018 990t income documents?

airSlate SignNow prioritizes the security of your 2018 990t income documents through advanced encryption and compliance with industry-standard security protocols. We ensure that only authorized personnel can access sensitive information, providing peace of mind for organizations managing confidential tax-related data. Regular audits and updates help maintain our high-security standards.

Get more for Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e

- How much is a fence permit in borough of ellwood city form

- Helping hands application form 36812407

- Leader format sdhandi

- Physical medicine request form idaho state insurance fund idahosif

- Musical theatre audition evaluation form 12244259

- Agencies request comment on anti money laundering form

- Payroll expense tax faqs form

- Additional contract template form

Find out other Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy