Filing IRS Form 1041 a Guide for Estates and Trusts 2024-2026

Understanding IRS Form 1041 for Estates and Trusts

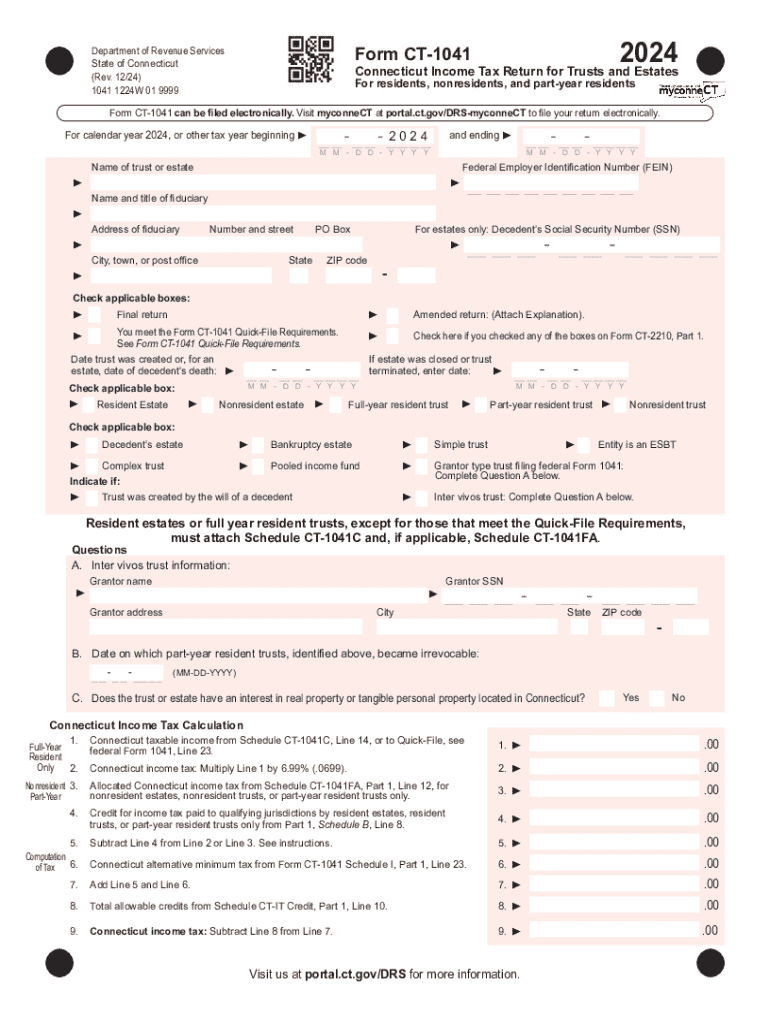

IRS Form 1041, also known as the U.S. Income Tax Return for Estates and Trusts, is essential for reporting income, deductions, gains, and losses for estates and trusts. This form is filed by the fiduciary of a decedent's estate or a trust to report income earned during the tax year. It is crucial for ensuring compliance with federal tax laws and accurately reflecting the financial activities of the estate or trust.

Steps to Complete IRS Form 1041

Completing the IRS Form 1041 involves several key steps:

- Gather necessary information: Collect all relevant financial documents, including income statements, expense records, and prior tax returns.

- Fill out the form: Enter the required information in the appropriate sections, including income, deductions, and tax calculations.

- Review for accuracy: Double-check all entries to ensure there are no errors or omissions that could lead to penalties.

- Sign and date the form: The fiduciary must sign the form, confirming the accuracy of the information provided.

Important Filing Deadlines for IRS Form 1041

The deadline for filing IRS Form 1041 typically falls on the fifteenth day of the fourth month following the close of the estate's tax year. For most estates, this means the form is due on April fifteenth. If the estate's tax year ends on a date other than December thirty-first, the filing deadline will adjust accordingly. It is essential to adhere to these deadlines to avoid penalties and interest on unpaid taxes.

Required Documents for Filing IRS Form 1041

When preparing to file IRS Form 1041, the following documents are generally required:

- Income statements: Documentation of all income earned by the estate or trust, such as interest, dividends, and rental income.

- Expense records: Receipts and statements for all deductible expenses incurred during the tax year.

- Prior year tax returns: Previous tax filings can provide a reference for completing the current year's form.

Penalties for Non-Compliance with IRS Form 1041

Failure to file IRS Form 1041 on time or inaccuracies in the form can result in significant penalties. The IRS may impose a penalty for late filing, which generally accrues based on the number of months the return is overdue. Additionally, if the form is filed with errors that lead to underpayment of taxes, the estate or trust may face further financial penalties and interest charges. It is crucial to ensure that the form is completed accurately and submitted on time to avoid these consequences.

Digital vs. Paper Version of IRS Form 1041

Taxpayers have the option to file IRS Form 1041 either digitally or via paper submission. Filing electronically can streamline the process, reduce errors, and expedite processing times. Many tax software programs are compatible with Form 1041, making it easier for fiduciaries to complete their tax obligations. However, some may prefer to file a paper version for record-keeping purposes. Regardless of the method chosen, it is important to retain copies of the submitted form and any supporting documents for future reference.

Create this form in 5 minutes or less

Find and fill out the correct filing irs form 1041 a guide for estates and trusts

Create this form in 5 minutes!

How to create an eSignature for the filing irs form 1041 a guide for estates and trusts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 1041 and why is it important?

IRS Form 1041 is the U.S. Income Tax Return for Estates and Trusts. It is essential for reporting income, deductions, and tax liability for estates and trusts. Properly completing IRS Form 1041 ensures compliance with tax regulations and helps avoid penalties.

-

How can airSlate SignNow assist with IRS Form 1041?

airSlate SignNow simplifies the process of preparing and signing IRS Form 1041 by providing an intuitive platform for document management. Users can easily upload, edit, and eSign the form, ensuring that all necessary signatures are obtained efficiently. This streamlines the filing process and enhances accuracy.

-

What features does airSlate SignNow offer for IRS Form 1041?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for IRS Form 1041. These tools help users manage their tax documents effectively, ensuring that they are completed correctly and submitted on time. Additionally, the platform provides a user-friendly interface for easy navigation.

-

Is airSlate SignNow cost-effective for filing IRS Form 1041?

Yes, airSlate SignNow is a cost-effective solution for filing IRS Form 1041. With flexible pricing plans, users can choose the option that best fits their needs without breaking the bank. The platform's efficiency can also save time and reduce costs associated with traditional document handling.

-

Can I integrate airSlate SignNow with other software for IRS Form 1041?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage IRS Form 1041 alongside your other financial documents. This integration enhances workflow efficiency and ensures that all relevant data is synchronized across platforms.

-

What are the benefits of using airSlate SignNow for IRS Form 1041?

Using airSlate SignNow for IRS Form 1041 offers numerous benefits, including enhanced security, ease of use, and faster processing times. The platform ensures that your documents are securely stored and easily accessible, while its intuitive design allows users to complete forms quickly and accurately.

-

How does airSlate SignNow ensure the security of IRS Form 1041?

airSlate SignNow prioritizes security by employing advanced encryption and secure cloud storage for IRS Form 1041. This ensures that sensitive information is protected from unauthorized access. Additionally, the platform complies with industry standards to safeguard your data throughout the signing process.

Get more for Filing IRS Form 1041 A Guide For Estates And Trusts

- Open public records act request form 626204384

- Horse park of nj entry form summer fun shows

- Notarial bond form

- Cap form 255 permits consultants to tailor their responses to the specific project being considered by an agency used in

- Georgia form

- Form consent 414730980

- 454 exhibit 1 report of suspected child abuse form

- Participation physical evaluationclearance form wi

Find out other Filing IRS Form 1041 A Guide For Estates And Trusts

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple