Schedule CT 1041 K 1 Instructions E Form RS Login 2023

What is the Schedule CT 1041 K-1 Instructions E Form RS Login

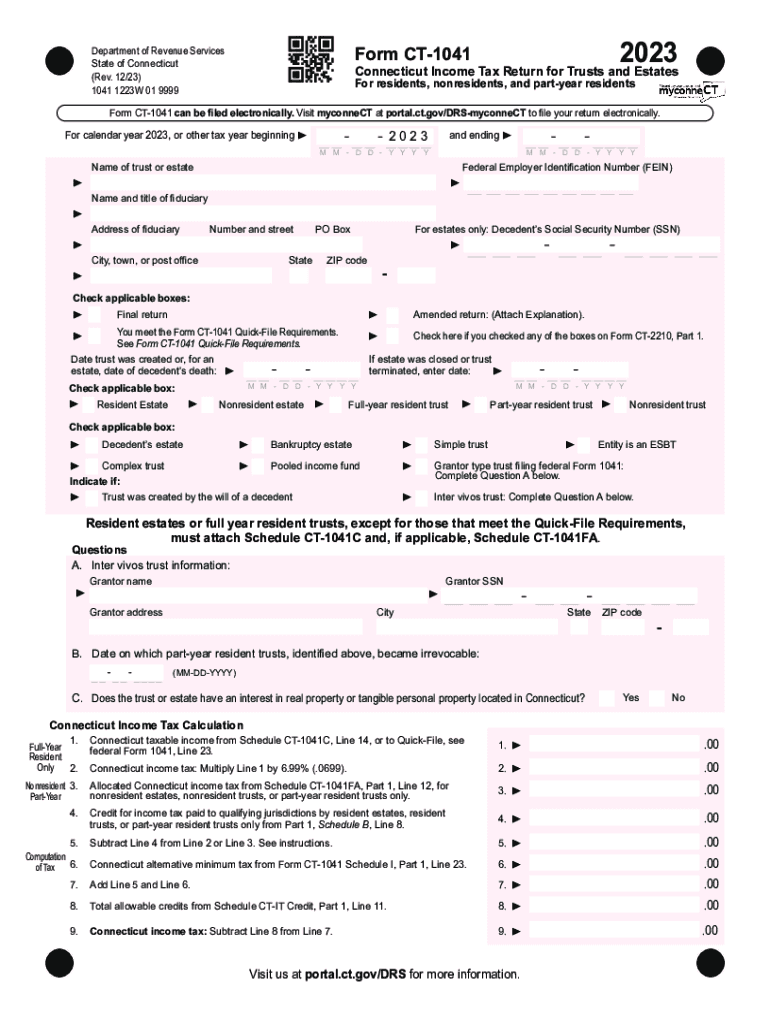

The Schedule CT 1041 K-1 is a tax form used in Connecticut for reporting income, deductions, and credits for beneficiaries of estates or trusts. This form is essential for beneficiaries who need to report their share of the income generated by the estate or trust on their personal tax returns. The E Form RS Login refers to the electronic submission process, allowing users to access and complete the form online. Understanding this form is crucial for compliance with state tax regulations and ensuring accurate reporting of income received from trusts or estates.

Steps to complete the Schedule CT 1041 K-1 Instructions E Form RS Login

Completing the Schedule CT 1041 K-1 requires several steps to ensure accuracy and compliance. Begin by logging into the E Form RS platform using your credentials. Once logged in, locate the Schedule CT 1041 K-1 form within the system. Carefully fill out each section, providing necessary details about the estate or trust, including identification numbers and the beneficiary's share of income. Review the information for accuracy before submitting the form electronically. Make sure to save a copy of the completed form for your records, as it will be needed for your personal tax filings.

Key elements of the Schedule CT 1041 K-1 Instructions E Form RS Login

The Schedule CT 1041 K-1 includes several key elements that are critical for accurate reporting. These elements consist of the beneficiary's name, address, and taxpayer identification number, as well as the estate or trust's information. Additionally, the form outlines the specific amounts of income, deductions, and credits allocated to each beneficiary. Understanding these components is vital for ensuring that all reported figures align with the estate or trust's financial records, which helps in avoiding discrepancies during tax filing.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule CT 1041 K-1 are crucial to avoid penalties. Typically, the form must be filed by the fifteenth day of the fourth month following the end of the estate or trust's tax year. For estates and trusts operating on a calendar year, this means the deadline falls on April 15. It is essential for beneficiaries to receive their K-1 forms in a timely manner to accurately report their income on their personal tax returns, which are also due around the same time.

Legal use of the Schedule CT 1041 K-1 Instructions E Form RS Login

The Schedule CT 1041 K-1 is legally required for beneficiaries of estates and trusts in Connecticut. It serves as a formal record of income distribution and is necessary for compliance with state tax laws. Failing to file this form or providing incorrect information can result in penalties or audits by the Connecticut Department of Revenue Services. Understanding the legal implications and ensuring proper use of the form is essential for both the fiduciaries managing the estate or trust and the beneficiaries receiving distributions.

Required Documents

To complete the Schedule CT 1041 K-1, several documents are necessary. Beneficiaries should gather the trust or estate's financial statements, including income statements and balance sheets, to accurately report their share. Additionally, any prior year K-1 forms may be useful for reference. It is also important to have personal identification documents handy, such as Social Security numbers, to ensure that all information is accurately entered into the form.

Create this form in 5 minutes or less

Find and fill out the correct schedule ct 1041 k 1 instructions e form rs login

Create this form in 5 minutes!

How to create an eSignature for the schedule ct 1041 k 1 instructions e form rs login

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Schedule CT 1041 K 1 Instructions E Form RS Login requirements?

To access the Schedule CT 1041 K 1 Instructions E Form RS Login, users must have a valid account with airSlate SignNow. Additionally, ensure that you have the necessary documents ready for eSigning. This platform simplifies the process, making it easy to follow the instructions for filing.

-

How does airSlate SignNow help with Schedule CT 1041 K 1 Instructions E Form RS Login?

airSlate SignNow streamlines the process of completing the Schedule CT 1041 K 1 Instructions E Form RS Login by providing an intuitive interface for document management. Users can easily upload, edit, and eSign documents, ensuring compliance with state requirements. This efficiency saves time and reduces errors.

-

Is there a cost associated with using airSlate SignNow for Schedule CT 1041 K 1 Instructions E Form RS Login?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Each plan includes features that facilitate the Schedule CT 1041 K 1 Instructions E Form RS Login process, ensuring you get the best value for your investment. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for Schedule CT 1041 K 1 Instructions E Form RS Login?

airSlate SignNow provides features such as document templates, eSignature capabilities, and real-time collaboration tools. These features enhance the user experience when navigating the Schedule CT 1041 K 1 Instructions E Form RS Login. Additionally, users can track document status and receive notifications.

-

Can I integrate airSlate SignNow with other software for Schedule CT 1041 K 1 Instructions E Form RS Login?

Absolutely! airSlate SignNow supports integrations with various software applications, making it easier to manage your documents related to Schedule CT 1041 K 1 Instructions E Form RS Login. This flexibility allows you to streamline your workflow and enhance productivity by connecting with tools you already use.

-

What benefits does airSlate SignNow provide for businesses handling Schedule CT 1041 K 1 Instructions E Form RS Login?

Using airSlate SignNow for Schedule CT 1041 K 1 Instructions E Form RS Login offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform ensures that your documents are safely stored and easily accessible, allowing for a smoother filing process. This ultimately leads to better compliance and fewer errors.

-

How secure is airSlate SignNow for Schedule CT 1041 K 1 Instructions E Form RS Login?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and security protocols to protect your documents during the Schedule CT 1041 K 1 Instructions E Form RS Login process. Users can trust that their sensitive information is safeguarded against unauthorized access.

Get more for Schedule CT 1041 K 1 Instructions E Form RS Login

Find out other Schedule CT 1041 K 1 Instructions E Form RS Login

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement