Instructions for Form it 205 Fiduciary Income 2022

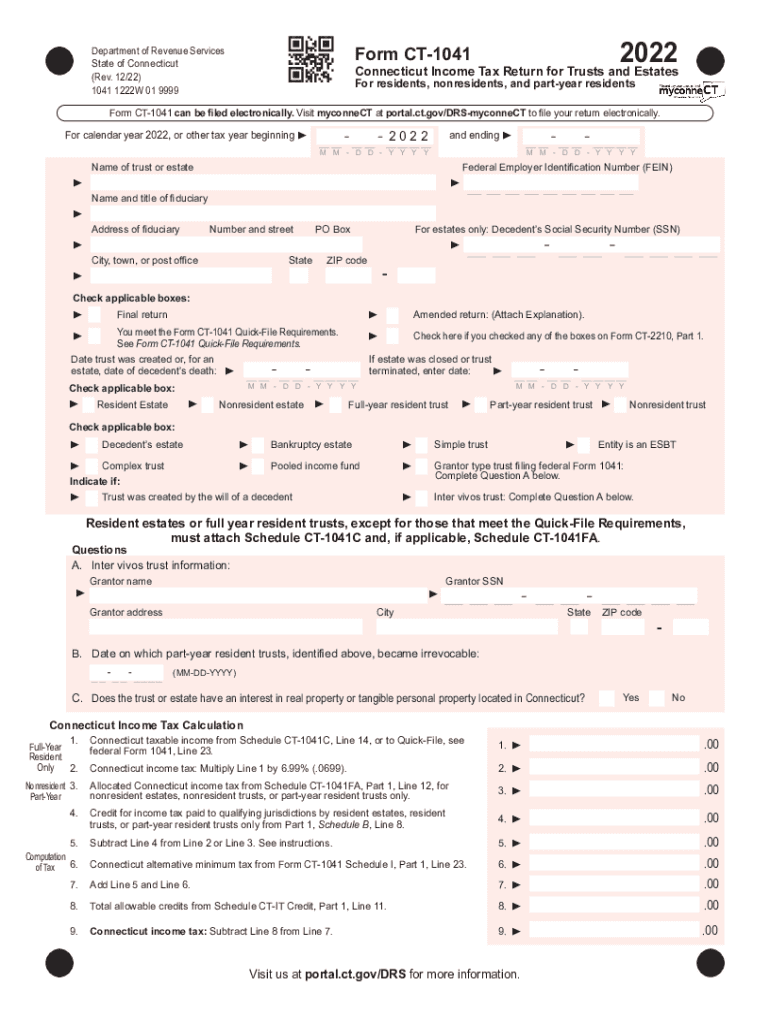

What is the ct 1041 instructions?

The ct 1041 instructions provide detailed guidance on how to complete the Connecticut Income Tax Return for Estates and Trusts. This form is essential for fiduciaries managing estates or trusts that generate income. Understanding these instructions ensures compliance with state tax laws and helps avoid penalties. The instructions outline various sections of the form, including income reporting, deductions, and credits applicable to estates and trusts.

Steps to complete the ct 1041 instructions

Completing the ct 1041 form involves several key steps:

- Gather necessary documentation, including income statements and expense records related to the estate or trust.

- Fill out the identification section, providing the name, address, and tax identification number of the estate or trust.

- Report all sources of income, including interest, dividends, and capital gains, in the appropriate sections.

- Claim allowable deductions, such as administrative expenses and distributions to beneficiaries, as specified in the instructions.

- Calculate the total tax liability using the provided tax rate tables for estates and trusts.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

Filing deadlines for the ct 1041 form are crucial for compliance. Typically, the form is due on the fifteenth day of the fourth month following the end of the estate's or trust's taxable year. For estates and trusts operating on a calendar year, this means the form is due by April 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Extensions may be available, but it is important to file the extension request before the original deadline.

Legal use of the ct 1041 instructions

The legal use of the ct 1041 instructions ensures that fiduciaries fulfill their obligations under Connecticut tax law. Adhering to these instructions is essential for the proper reporting of income and expenses associated with the estate or trust. Failure to comply can result in penalties, interest, and potential legal issues. The instructions also clarify the legal definitions of income, deductions, and credits, helping fiduciaries navigate complex tax regulations.

Required Documents

To complete the ct 1041 form accurately, several documents are required:

- Income statements, such as K-1s from partnerships or S corporations.

- Records of expenses related to the administration of the estate or trust.

- Documentation for any deductions claimed, including receipts and invoices.

- Previous year’s tax return for reference, if applicable.

Who Issues the Form

The ct 1041 form is issued by the Connecticut Department of Revenue Services. This state agency is responsible for administering tax laws and ensuring compliance among fiduciaries managing estates and trusts. The instructions provided with the form are designed to help users understand their responsibilities and complete the form correctly.

Quick guide on how to complete instructions for form it 205 fiduciary income

Complete Instructions For Form IT 205 Fiduciary Income effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents swiftly without delays. Handle Instructions For Form IT 205 Fiduciary Income on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The best way to modify and eSign Instructions For Form IT 205 Fiduciary Income effortlessly

- Find Instructions For Form IT 205 Fiduciary Income and then click Get Form to commence.

- Employ the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere moments and holds the same legal validity as a traditional handwritten signature.

- Verify all the details and then click on the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Put aside concerns about lost or disorganized files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Instructions For Form IT 205 Fiduciary Income and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form it 205 fiduciary income

Create this form in 5 minutes!

How to create an eSignature for the instructions for form it 205 fiduciary income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are CT 1041 instructions?

CT 1041 instructions provide guidance for completing the Connecticut income tax return for estates and trusts. Understanding these instructions is crucial for ensuring accurate filing and compliance with state tax laws. By following the CT 1041 instructions, you can avoid costly mistakes and penalties.

-

How does airSlate SignNow assist with CT 1041 instructions?

airSlate SignNow helps streamline the process of preparing CT 1041 forms by allowing users to eSign and send documents securely. Our platform simplifies collaboration, making it easier to gather necessary signatures and approvals. This reduces the time spent on paperwork, letting you focus on the details of the CT 1041 instructions.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for your tax documents, including CT 1041 instructions, provides numerous benefits such as increased efficiency, security, and ease of use. Our eSigning platform is cost-effective, reducing the need for physical document handling. You can manage your tax processes from anywhere, ensuring you meet deadlines effortlessly.

-

Is airSlate SignNow compliant with tax document regulations?

Yes, airSlate SignNow is compliant with regulations surrounding eSigning and digital document management. This means that when you use our platform to handle CT 1041 instructions, you can be confident that you are meeting all necessary legal and regulatory requirements. Our secure system ensures the integrity of your tax documents.

-

Can airSlate SignNow integrate with other accounting software?

Yes, airSlate SignNow offers seamless integration with many popular accounting and tax software platforms. This integration allows you to enhance your workflow when preparing the CT 1041 instructions and other tax forms. By connecting with your favorite tools, you can manage your documents more effectively.

-

What pricing options are available for airSlate SignNow?

airSlate SignNow offers competitive pricing plans suited for businesses of all sizes. Our plans are flexible and designed to accommodate the varying needs of users, including those who need to handle CT 1041 instructions efficiently. You can choose from monthly or annual subscriptions based on your usage requirements.

-

How user-friendly is the airSlate SignNow platform?

The airSlate SignNow platform is designed with ease of use in mind, making it accessible for users at all experience levels. Our intuitive interface allows you to quickly learn how to eSign documents and manage CT 1041 instructions without any hassle. You'll be able to navigate the platform confidently and complete your tasks efficiently.

Get more for Instructions For Form IT 205 Fiduciary Income

- Revocation of living trust tennessee form

- Letter to lienholder to notify of trust tennessee form

- Tennessee sale contract form

- Tennessee sale contract 497326945 form

- Assumption agreement of deed of trust and release of original mortgagors tennessee form

- Tennessee estate form

- Notices eviction form

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house 497326949 form

Find out other Instructions For Form IT 205 Fiduciary Income

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure