Ct 1041 2018

What is the CT 1041?

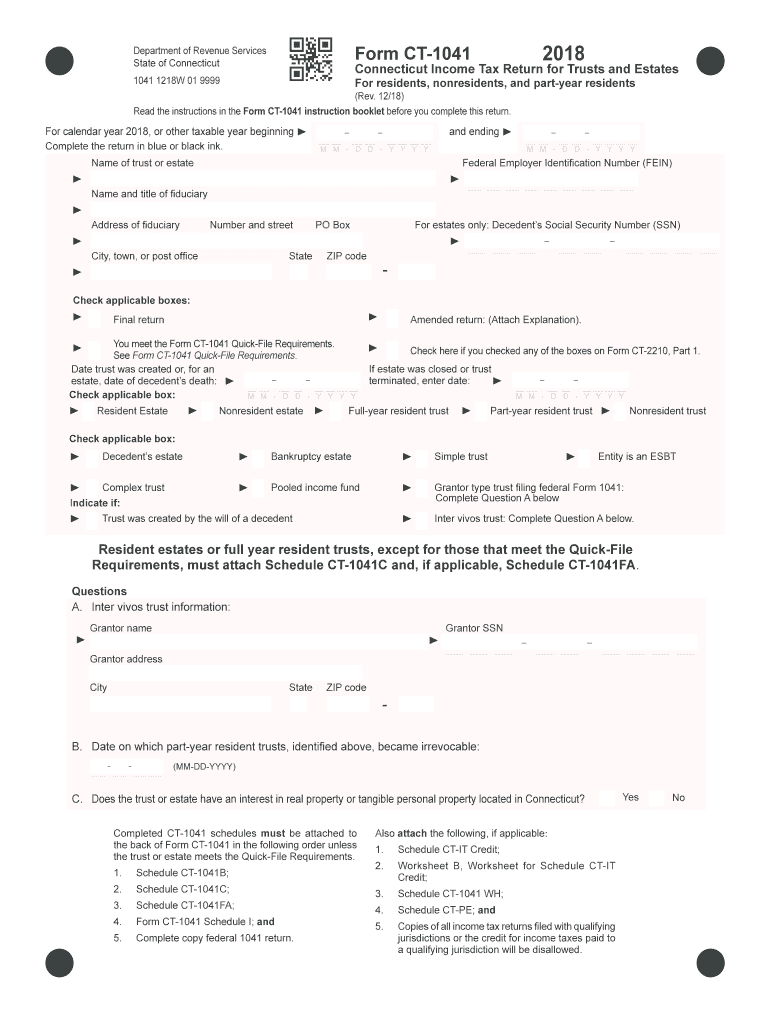

The CT 1041 is a tax form used for reporting the income, deductions, and credits of estates and trusts in Connecticut. This form is essential for fiduciaries who manage the financial affairs of an estate or trust, ensuring compliance with state tax laws. The CT 1041 allows for the calculation of the Connecticut income tax owed by the estate or trust, and it must be filed annually. Understanding the purpose and requirements of the CT 1041 is critical for proper tax reporting and to avoid penalties.

Steps to Complete the CT 1041

Completing the CT 1041 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, expense records, and any relevant tax documents. Next, fill out the form by entering the estate's or trust's income, deductions, and credits in the appropriate sections. It is important to follow the instructions carefully, as errors can lead to delays or penalties. Once completed, review the form for accuracy before signing and dating it. Finally, submit the CT 1041 to the Connecticut Department of Revenue Services by the designated deadline.

Filing Deadlines / Important Dates

Filing deadlines for the CT 1041 are crucial for compliance. Generally, the form must be filed by the 15th day of the fourth month following the close of the estate's or trust's tax year. For estates or trusts operating on a calendar year, this means the CT 1041 is due by April 15. It is advisable to check for any specific extensions or changes in deadlines that may apply, especially in light of any updates from the Connecticut Department of Revenue Services.

Required Documents

To successfully complete the CT 1041, several documents are required. These typically include:

- Income statements from all sources, such as bank interest, dividends, and rental income.

- Records of expenses incurred by the estate or trust, including administrative fees and distributions.

- Previous tax returns, if applicable, to provide context for current filings.

- Documentation of any deductions or credits claimed on the form.

Having these documents organized and accessible will facilitate a smoother filing process.

Legal Use of the CT 1041

The legal use of the CT 1041 is to report and pay state income tax on the income generated by an estate or trust. This form must be filed by the fiduciary responsible for managing the estate or trust's finances. Failure to file the CT 1041 or to report income accurately can result in penalties, including fines and interest on unpaid taxes. It is essential for fiduciaries to understand their legal obligations and ensure that the form is completed and submitted in accordance with Connecticut tax laws.

Form Submission Methods (Online / Mail / In-Person)

The CT 1041 can be submitted through various methods to accommodate different preferences. Taxpayers can file the form online using the Connecticut Department of Revenue Services' e-filing system, which offers a convenient and efficient way to submit documents. Alternatively, the form can be mailed to the appropriate address provided in the instructions. For those who prefer a personal touch, in-person submissions may also be possible at designated state offices. Each method has its own advantages, and taxpayers should choose the one that best suits their needs.

Quick guide on how to complete 2015 form ct 1041 2018 2019

Your assistance manual on how to prepare your Ct 1041

If you’re interested in understanding how to design and submit your Ct 1041, here are a few straightforward instructions on how to simplify tax reporting.

To initiate, you merely need to create your airSlate SignNow account to transform the way you manage documents online. airSlate SignNow is a highly user-friendly and powerful document solution that enables you to edit, generate, and finalize your tax documents with ease. Utilizing its editor, you can navigate between text, check boxes, and electronic signatures and return to modify responses as necessary. Streamline your tax administration with sophisticated PDF editing, eSigning, and user-friendly sharing options.

Follow the instructions below to complete your Ct 1041 in just a few minutes:

- Create your account and begin working on PDFs in no time.

- Utilize our directory to acquire any IRS tax form; explore various versions and schedules.

- Click Obtain form to access your Ct 1041 within our editor.

- Complete the required fields with your details (text, numbers, check marks).

- Employ the Signature Tool to incorporate your legally-binding eSignature (if necessary).

- Review your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please be aware that submitting in hard copy can raise return errors and prolong refunds. Naturally, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2015 form ct 1041 2018 2019

FAQs

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the 2015 form ct 1041 2018 2019

How to create an electronic signature for your 2015 Form Ct 1041 2018 2019 online

How to generate an eSignature for your 2015 Form Ct 1041 2018 2019 in Google Chrome

How to make an eSignature for putting it on the 2015 Form Ct 1041 2018 2019 in Gmail

How to create an eSignature for the 2015 Form Ct 1041 2018 2019 straight from your mobile device

How to make an electronic signature for the 2015 Form Ct 1041 2018 2019 on iOS devices

How to create an electronic signature for the 2015 Form Ct 1041 2018 2019 on Android devices

People also ask

-

What is the 2017 form ct 1040?

The 2017 form ct 1040 is a state income tax return form used by Connecticut residents to report their income and calculate their tax obligations for the year. It is essential for ensuring compliance with state tax laws and properly filing your income taxes. Completing this form accurately is crucial to avoid penalties and ensure timely processing.

-

How can airSlate SignNow assist with the 2017 form ct 1040?

airSlate SignNow simplifies the process of completing and submitting the 2017 form ct 1040 by providing a user-friendly platform for electronic signatures and document management. This allows you to easily prepare and sign your tax forms, ensuring everything is in order before submission. Our solution helps streamline the filing process, making it faster and more efficient.

-

Are there any costs associated with using airSlate SignNow for the 2017 form ct 1040?

Yes, airSlate SignNow offers various pricing plans designed to cater to different business needs, including features for preparing the 2017 form ct 1040. Our pricing is competitive, providing cost-effective solutions for businesses looking to manage their documentation processes efficiently. You can choose a plan that best suits your volume of documents and eSigning needs.

-

What features does airSlate SignNow offer for handling the 2017 form ct 1040?

airSlate SignNow offers several key features to assist with the 2017 form ct 1040, including document templates, customizable signing workflows, and secure storage for sensitive documents. The platform also enables easy sharing and tracking, ensuring that all parties involved can stay updated on the signing process. These features help ensure a smooth filing experience.

-

Can I integrate airSlate SignNow with other tools for the 2017 form ct 1040?

Yes, airSlate SignNow integrates seamlessly with various tools and software applications, making it easier to manage the 2017 form ct 1040 alongside your other business processes. Whether you use accounting software or cloud storage services, our platform offers API integrations that help enhance your workflow. This flexibility supports a more streamlined approach to document management.

-

What are the benefits of using airSlate SignNow for tax documents like the 2017 form ct 1040?

Using airSlate SignNow for tax documents such as the 2017 form ct 1040 comes with numerous benefits, including increased efficiency and reduced paperwork. Electronic signing speeds up the process, allowing you to finalize your tax forms quickly. Additionally, our secure platform ensures that your sensitive information is protected throughout the entire process.

-

How do I get started with airSlate SignNow for my 2017 form ct 1040?

Getting started with airSlate SignNow is straightforward. Simply sign up for an account, choose a suitable pricing plan, and you can immediately begin creating and managing your 2017 form ct 1040. We also provide user-friendly tutorials and support to help you navigate the platform effectively, ensuring you can maximize the benefits from day one.

Get more for Ct 1041

- Alabama department of public health form

- Singular publishing group child case history form appendix ee

- Co ownership agreement template form

- Matkalasku pvm nro miss ominaisuudessa matkalla etry form

- Kern county fictitious business name form

- Il478 0063 form

- Street and network sampling in evaluation studies of hiv risk form

- Schedule 1 a form 1040

Find out other Ct 1041

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe

- Sign South Carolina Vacation Rental Short Term Lease Agreement Now

- How Do I Sign Georgia Escrow Agreement

- Can I Sign Georgia Assignment of Mortgage

- Sign Kentucky Escrow Agreement Simple

- How To Sign New Jersey Non-Disturbance Agreement