Please Note that Each 2019

Key elements of the 2017 form CT 1040

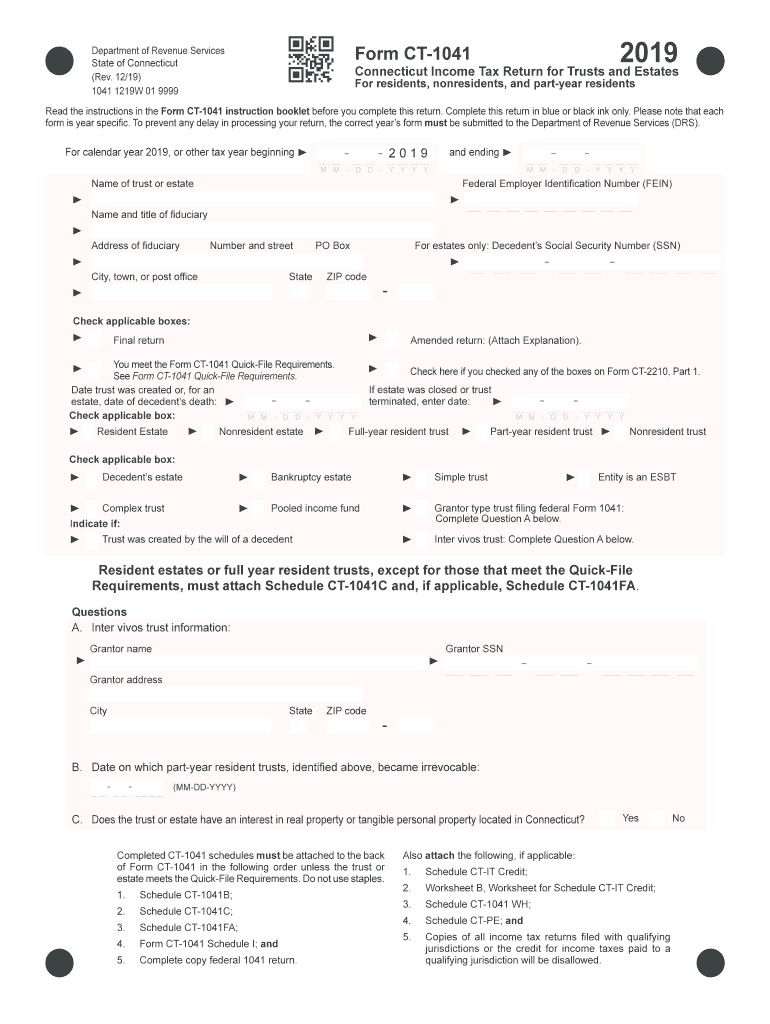

The 2017 form CT 1040 is a crucial document for Connecticut residents filing their state income tax returns. It includes essential sections that taxpayers must complete accurately to ensure compliance with state tax laws. Key elements of the form include:

- Personal Information: Taxpayers must provide their name, address, and Social Security number, along with the same details for their spouse if filing jointly.

- Income Reporting: All sources of income, including wages, interest, dividends, and other earnings, need to be reported in designated sections.

- Deductions and Credits: Taxpayers can claim various deductions and credits that may reduce their taxable income, such as the personal exemption and property tax credit.

- Signature Section: A signature is required to validate the form, confirming that the information provided is accurate to the best of the taxpayer's knowledge.

Steps to complete the 2017 form CT 1040

Completing the 2017 form CT 1040 involves several steps to ensure accuracy and compliance. Here are the steps to follow:

- Gather Documentation: Collect all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill Out Personal Information: Enter your name, address, and Social Security number at the top of the form.

- Report Income: Accurately report all sources of income in the designated sections of the form.

- Claim Deductions and Credits: Review eligibility for deductions and credits, and fill in the corresponding sections.

- Review and Sign: Double-check all entries for accuracy, then sign and date the form.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the 2017 form CT 1040 is essential for avoiding penalties. The key dates include:

- Tax Filing Deadline: The deadline for filing the 2017 form CT 1040 was April 18, 2018, for most taxpayers.

- Extension Deadline: If an extension was filed, the extended deadline was October 15, 2018.

Form Submission Methods

Taxpayers have several options for submitting the 2017 form CT 1040. These methods include:

- Online Submission: Many taxpayers choose to file electronically using tax software, which can streamline the process.

- Mail: The completed form can be mailed to the Connecticut Department of Revenue Services. Ensure that the correct address is used based on the filing method.

- In-Person: Some taxpayers may prefer to submit their forms in person at designated state offices.

IRS Guidelines

While the 2017 form CT 1040 is a state-specific form, it is essential to be aware of IRS guidelines that may affect state tax filings. Key points to consider include:

- Federal Adjusted Gross Income: The form may require information from the federal tax return, specifically the adjusted gross income.

- Compliance with Federal Laws: Ensure that all reported income and deductions comply with federal tax regulations, as discrepancies can lead to audits or penalties.

Penalties for Non-Compliance

Failing to file the 2017 form CT 1040 or inaccuracies can result in various penalties, including:

- Late Filing Penalty: A penalty may be assessed for filing after the deadline without an extension.

- Accuracy-Related Penalties: Errors in reporting income or claiming deductions can lead to additional fines.

- Interest on Unpaid Taxes: Interest may accrue on any unpaid taxes from the original due date until payment is made.

Quick guide on how to complete please note that each

Prepare Please Note That Each effortlessly on any device

Web-based document handling has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without hassle. Manage Please Note That Each on any device using airSlate SignNow apps for Android or iOS and enhance any document-driven process today.

The easiest way to modify and eSign Please Note That Each seamlessly

- Locate Please Note That Each and click Get Form to begin.

- Employ the tools we offer to finalize your document.

- Emphasize pertinent sections of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method of delivering your form: via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form hunting, or mistakes that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Adjust and eSign Please Note That Each and ensure excellent communication at any phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct please note that each

Create this form in 5 minutes!

How to create an eSignature for the please note that each

The way to create an eSignature for a PDF online

The way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The best way to make an electronic signature from your smartphone

The best way to generate an eSignature for a PDF on iOS

The best way to make an electronic signature for a PDF file on Android

People also ask

-

What is the 2017 form ct 1040 and why is it important?

The 2017 form ct 1040 is Connecticut's individual income tax return form. It is crucial for residents to file this form accurately to ensure compliance with state tax laws, which can result in penalties if not completed correctly. Using airSlate SignNow can simplify the eSigning process and keep your documents organized.

-

How can airSlate SignNow assist in filling out the 2017 form ct 1040?

airSlate SignNow provides a user-friendly platform that enables users to upload, edit, and electronically sign the 2017 form ct 1040. With our intuitive interface, you can easily manage your documents and ensure all necessary fields are completed accurately before submission.

-

Is there a cost associated with using airSlate SignNow for the 2017 form ct 1040?

Yes, airSlate SignNow offers competitive pricing plans tailored to different needs. Whether you're an individual filing the 2017 form ct 1040 or part of a larger organization, our cost-effective solution ensures you get the best value for your document management and eSigning needs.

-

What features does airSlate SignNow offer for eSigning the 2017 form ct 1040?

Key features include customizable templates, secure eSigning, and document tracking, all designed to facilitate the completion of the 2017 form ct 1040. With airSlate SignNow, you can also collaborate with multiple signers and streamline the approval process, ensuring a seamless experience.

-

Can I integrate airSlate SignNow with other applications for the 2017 form ct 1040?

Absolutely! airSlate SignNow supports integration with a variety of applications such as Google Drive and Salesforce. This allows you to access your files easily and manage the 2017 form ct 1040 directly from your preferred platforms, enhancing overall productivity.

-

What are the benefits of using airSlate SignNow for my 2017 form ct 1040?

Using airSlate SignNow to manage your 2017 form ct 1040 offers numerous benefits including speed, security, and convenience. You'll be able to complete your form quickly, have peace of mind knowing your documents are securely stored, and access them from anywhere at any time.

-

How secure is the information I upload for the 2017 form ct 1040?

Security is a top priority at airSlate SignNow. We utilize state-of-the-art encryption and strict compliance protocols to protect your personal and financial information when uploading your 2017 form ct 1040, ensuring that your data remains confidential and safe.

Get more for Please Note That Each

- Agreement common 497333513 form

- Letter invitation party 497333514 form

- Quitclaim deed curing encroachment 497333515 form

- Sample letter boss 497333516 form

- Notice to adjoining landowner of intent to excavate along common boundary form

- Sample complaint form 497333518

- Notice landowner form

- Letter resident form

Find out other Please Note That Each

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document