Form 990 Ez Schedule a 2022

Understanding Form 990 EZ Schedule A

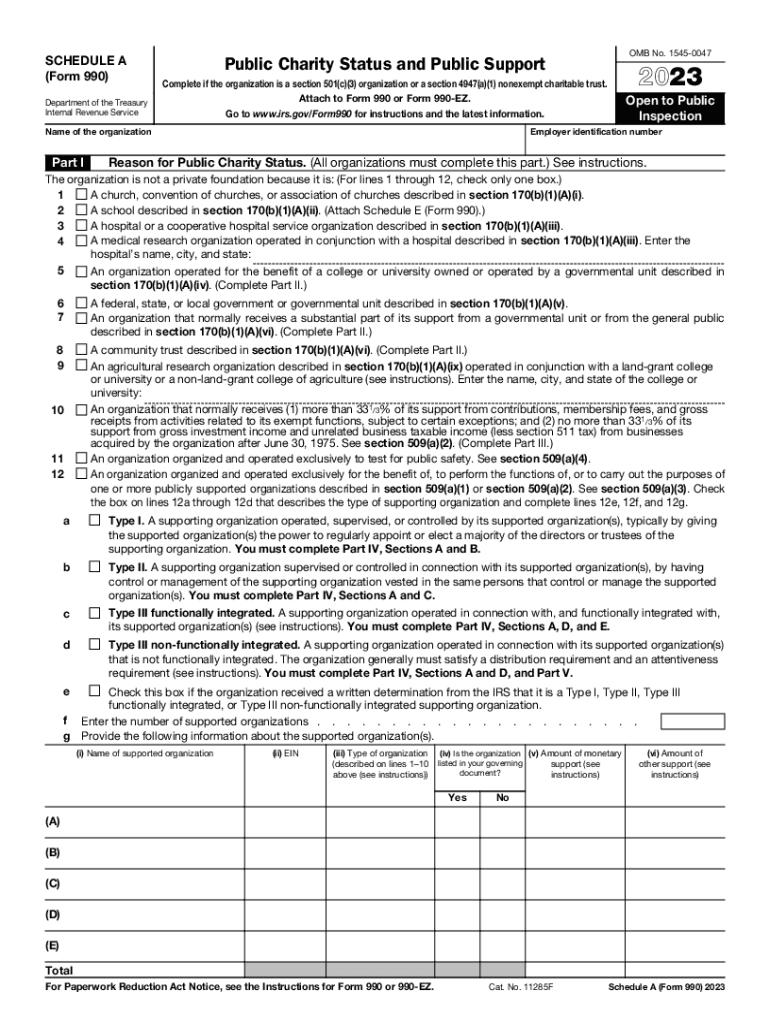

The Form 990 EZ Schedule A is a crucial component for organizations that qualify as tax-exempt under section 501(c)(3) of the Internal Revenue Code. This schedule provides detailed information about the organization’s public charity status and helps the IRS determine whether the organization meets the requirements for maintaining its tax-exempt status. The form is designed for smaller organizations with gross receipts under two hundred fifty thousand dollars and total assets under five hundred thousand dollars. Understanding the nuances of this schedule is essential for compliance and transparency.

Steps to Complete Form 990 EZ Schedule A

Completing the Form 990 EZ Schedule A involves several key steps:

- Gather necessary information: Collect data regarding your organization’s activities, financial statements, and governance structure.

- Fill out the form: Accurately complete each section of the schedule, ensuring that all information aligns with your organization’s financial records.

- Review for accuracy: Double-check all entries for correctness to avoid potential penalties or issues with the IRS.

- Submit the form: Follow the appropriate submission guidelines, whether filing online or by mail.

IRS Guidelines for Form 990 EZ Schedule A

The IRS provides specific guidelines on how to properly complete and file the Form 990 EZ Schedule A. Organizations must adhere to the definitions and requirements outlined in the IRS instructions to ensure compliance. Key points include:

- Understanding the eligibility criteria for filing the EZ version versus the full Form 990.

- Providing accurate descriptions of the organization’s programs and activities.

- Maintaining proper documentation to support the information reported on the form.

Filing Deadlines for Form 990 EZ Schedule A

Timely filing of the Form 990 EZ Schedule A is essential to avoid penalties. The general deadline for filing is the fifteenth day of the fifth month after the end of your organization’s fiscal year. For organizations with a calendar year end, this typically falls on May fifteenth. Extensions may be available, but it is important to file the request before the original deadline to ensure compliance.

Required Documents for Form 990 EZ Schedule A

When preparing to file the Form 990 EZ Schedule A, organizations should have the following documents ready:

- Financial statements for the fiscal year.

- Records of contributions and grants received.

- Documentation of program activities and accomplishments.

- Governance documents, including bylaws and board meeting minutes.

Penalties for Non-Compliance with Form 990 EZ Schedule A

Failure to file the Form 990 EZ Schedule A or inaccuracies in the submitted information can result in significant penalties. The IRS may impose fines for late submissions, which can accumulate over time. Additionally, non-compliance may lead to the loss of tax-exempt status, which could have severe financial implications for the organization. Therefore, it is crucial to adhere to all filing requirements and deadlines.

Quick guide on how to complete form 990 ez schedule a

Complete Form 990 Ez Schedule A effortlessly on any gadget

Digital document management has become widely embraced by businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed forms, allowing you to obtain the necessary document and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without interruptions. Manage Form 990 Ez Schedule A on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Form 990 Ez Schedule A with ease

- Locate Form 990 Ez Schedule A and click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the files or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your document, via email, text message (SMS), or shareable link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Form 990 Ez Schedule A to ensure exceptional communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 990 ez schedule a

Create this form in 5 minutes!

How to create an eSignature for the form 990 ez schedule a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 990 Schedule A for 2021?

Form 990 Schedule A for 2021 is a supplementary document that tax-exempt organizations must file with their annual Form 990. It provides detailed information about an organization's public charity status and activities. Understanding this form is crucial for compliance and ensuring that your organization maintains its tax-exempt status.

-

How can airSlate SignNow help with Form 990 Schedule A 2021?

airSlate SignNow offers a streamlined process for signing and sending Form 990 Schedule A for 2021. With features like document tracking and e-signature capabilities, organizations can efficiently manage their filings. This not only saves time but also ensures accuracy and compliance with IRS regulations.

-

What is the cost of using airSlate SignNow for Form 990 Schedule A 2021?

airSlate SignNow provides various pricing plans that are budget-friendly for organizations needing to file Form 990 Schedule A for 2021. Plans are designed to cater to businesses of all sizes, and you'll find that the cost is signNowly lower compared to traditional methods of document signing and management.

-

What features does airSlate SignNow offer for managing Form 990 Schedule A 2021?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage to manage Form 990 Schedule A for 2021 efficiently. These features help streamline the document preparation process and ensure that your organization meets all filing deadlines with ease.

-

Is airSlate SignNow safe for handling Form 990 Schedule A for 2021?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling Form 990 Schedule A for 2021. With robust encryption, secure data storage, and compliance with privacy regulations, organizations can trust that their sensitive information is well-protected.

-

Can I integrate airSlate SignNow with other software for Form 990 Schedule A 2021?

Absolutely! airSlate SignNow provides integration with various applications, allowing you to easily connect your tools when preparing Form 990 Schedule A for 2021. This seamless integration enhances productivity and ensures all your organizational data remains consistent and up-to-date.

-

What are the benefits of using e-signatures for Form 990 Schedule A 2021?

Using e-signatures for Form 990 Schedule A for 2021 offers numerous benefits, including faster turnaround times and reduced paperwork. Additionally, e-signatures help maintain a trail of document history, thus improving accountability and ensuring that all necessary approvals are documented efficiently.

Get more for Form 990 Ez Schedule A

- Pa forestry application nyc parks is form

- If your situation is form

- Form cs 0727 ampquotinitial intake placement and well being

- The department of healths website www form

- Sc child support application form

- Registering a farm in wisconsin form

- Massachusetts cover fax sheet form

- Iowa department of human services forms

Find out other Form 990 Ez Schedule A

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement