Form it 236 Credit for Taxicabs and Livery Service Vehicles Accessible to Persons with Disabilities Tax Year 2024-2026

Understanding the IT 236 Credit for Taxicabs and Livery Service Vehicles Accessible to Persons with Disabilities

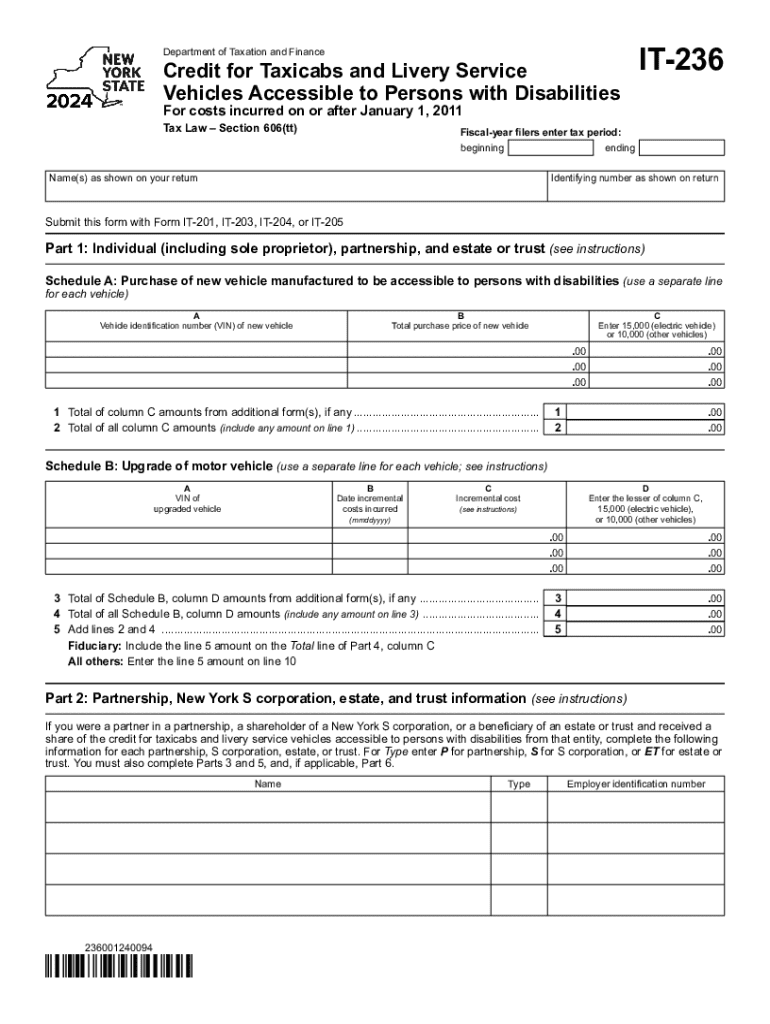

The IT 236 Credit is a tax benefit designed for businesses that operate taxicabs and livery service vehicles accessible to individuals with disabilities. This credit aims to encourage the use of accessible transportation options, ensuring that persons with disabilities have equal access to transportation services. Eligible vehicles must meet specific accessibility standards set forth by state regulations, and the credit can significantly reduce the tax burden for qualifying businesses.

Steps to Complete the IT 236 Credit Form

Completing the IT 236 Credit form requires careful attention to detail. Start by gathering all necessary documentation related to your accessible vehicles, including proof of purchase and any modifications made to enhance accessibility. Follow these steps:

- Fill out your business information, including name, address, and tax identification number.

- Provide details about each vehicle, including make, model, and year of manufacture.

- Indicate the modifications made to ensure accessibility.

- Calculate the credit amount based on the eligible expenses incurred.

- Review the form for accuracy before submission.

Eligibility Criteria for the IT 236 Credit

To qualify for the IT 236 Credit, businesses must meet specific criteria. The vehicles used must be registered for commercial use and must be equipped to accommodate individuals with disabilities. Additionally, the business must demonstrate that it has incurred expenses related to making the vehicles accessible. It is essential to keep detailed records of all expenses to support the claim for the credit.

Legal Use of the IT 236 Credit

The IT 236 Credit is governed by state tax laws, which outline the legal parameters for its use. Businesses must ensure compliance with all applicable regulations when claiming the credit. This includes maintaining accurate records and documentation that support the eligibility of the vehicles and the expenses incurred. Non-compliance could result in penalties or disqualification from claiming the credit in future tax periods.

Obtaining the IT 236 Credit Form

The IT 236 Credit form can be obtained through the state tax authority’s website or by contacting their office directly. It is advisable to download the most current version of the form to ensure compliance with the latest regulations. In some cases, physical copies may be available at local tax offices, providing an alternative for those who prefer to complete the form by hand.

Examples of Using the IT 236 Credit

Businesses can benefit from the IT 236 Credit in various scenarios. For instance, a taxicab company that modifies its fleet to include wheelchair-accessible vehicles can claim the credit for the costs associated with these modifications. Similarly, a livery service that invests in specialized vehicles to accommodate passengers with disabilities can also utilize this credit to offset some of its expenses. These examples illustrate how the credit can support businesses while enhancing accessibility for individuals with disabilities.

Create this form in 5 minutes or less

Find and fill out the correct form it 236 credit for taxicabs and livery service vehicles accessible to persons with disabilities tax year 772088890

Create this form in 5 minutes!

How to create an eSignature for the form it 236 credit for taxicabs and livery service vehicles accessible to persons with disabilities tax year 772088890

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of 236 credit accessible in airSlate SignNow?

The term '236 credit accessible' refers to the ease of access and affordability of our eSigning solutions. With airSlate SignNow, businesses can utilize features that are designed to enhance productivity while remaining budget-friendly. This ensures that even those with limited resources can benefit from our services.

-

How does airSlate SignNow ensure 236 credit accessible pricing?

Our pricing model is designed to be transparent and competitive, making it 236 credit accessible for businesses of all sizes. We offer various plans that cater to different needs, ensuring that you only pay for what you use. This flexibility allows you to scale your usage without breaking the bank.

-

What features make airSlate SignNow 236 credit accessible?

airSlate SignNow offers a range of features that are 236 credit accessible, including customizable templates, mobile compatibility, and robust security measures. These features are designed to streamline your document management process, making it easier for you to send and eSign documents efficiently. Our user-friendly interface further enhances accessibility for all users.

-

Can airSlate SignNow integrate with other tools while remaining 236 credit accessible?

Yes, airSlate SignNow integrates seamlessly with various third-party applications, ensuring that your workflow remains 236 credit accessible. Whether you use CRM systems, cloud storage, or project management tools, our integrations help you maintain efficiency without additional costs. This connectivity enhances your overall productivity.

-

What are the benefits of using airSlate SignNow for 236 credit accessible eSigning?

Using airSlate SignNow for your eSigning needs provides numerous benefits that are 236 credit accessible. You gain access to a secure platform that simplifies document signing, reduces turnaround times, and enhances collaboration. These advantages contribute to a more efficient business process, ultimately saving you time and money.

-

Is customer support available for 236 credit accessible users?

Absolutely! We provide comprehensive customer support for all users, ensuring that our 236 credit accessible services are backed by reliable assistance. Whether you have questions about features, pricing, or troubleshooting, our dedicated support team is here to help you maximize your experience with airSlate SignNow.

-

How can I get started with airSlate SignNow to take advantage of 236 credit accessible features?

Getting started with airSlate SignNow is simple and 236 credit accessible. You can sign up for a free trial to explore our features and see how they can benefit your business. Once you're ready, choose a plan that fits your needs and start sending and eSigning documents effortlessly.

Get more for Form IT 236 Credit For Taxicabs And Livery Service Vehicles Accessible To Persons With Disabilities Tax Year

- Torontomls net form

- Compliance declaration form 41377373

- Vereinfachte einnahmen ausgaben rechnung vereine form

- Jameskuttyinfo form

- Repossessed motor vehicle affidavit form

- M1c republic of the philippines philippine health insurance corporation city state centre building 709 shaw boulevard pasig form

- Release and hold harmless agreement pony tail ranch form

- Apa format outline template apa format outline template

Find out other Form IT 236 Credit For Taxicabs And Livery Service Vehicles Accessible To Persons With Disabilities Tax Year

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document