Printable New York Form it 236 Credit for Taxicabs and Livery Service Vehicles Accessible to Persons with Disabilities for Costs 2020

Understanding the Printable New York Form IT 236

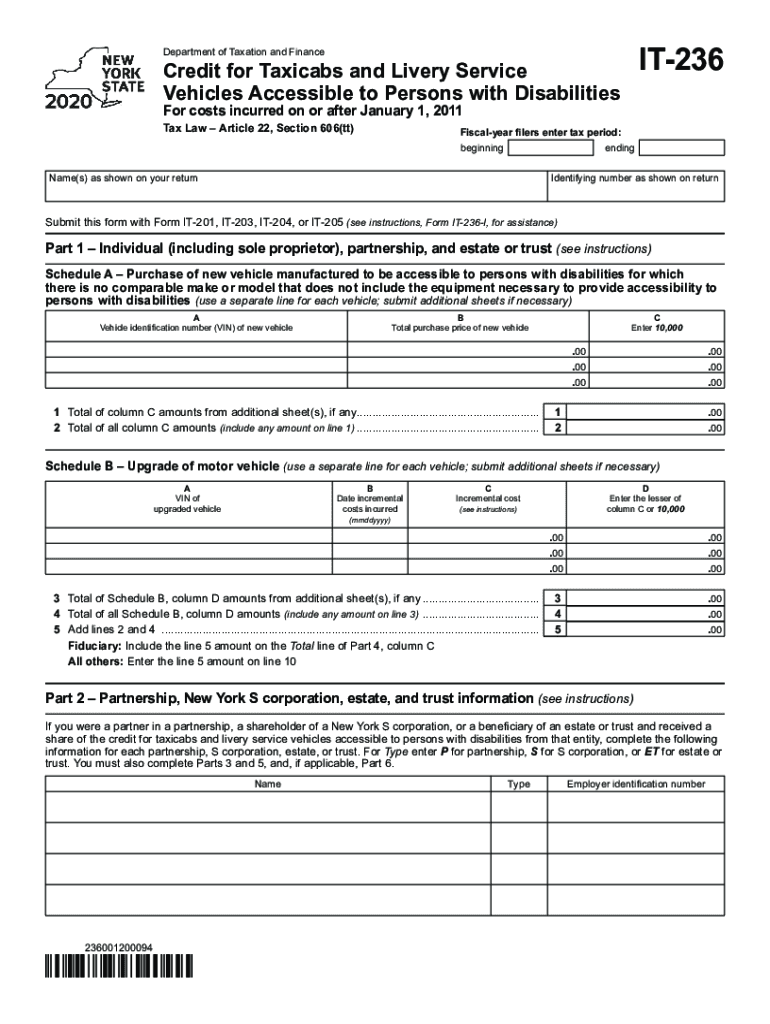

The Printable New York Form IT 236 is a tax credit application specifically designed for taxicabs and livery service vehicles that are accessible to persons with disabilities. This form allows eligible businesses to claim a credit for costs incurred on or after January 1, which can significantly reduce their tax liability. The intent of this credit is to encourage the use of accessible transportation options, thereby enhancing mobility for individuals with disabilities. The form must be completed accurately to ensure compliance with state tax regulations.

Steps to Complete the Printable New York Form IT 236

Completing the Printable New York Form IT 236 requires careful attention to detail. Here are the essential steps to follow:

- Gather necessary documentation, including proof of expenses related to the purchase or modification of vehicles.

- Fill out the form by providing accurate information about your business and the specific costs incurred.

- Ensure that all claims for credit are supported by valid receipts and documentation.

- Review the form for completeness and accuracy before submission.

Eligibility Criteria for the IT 236 Credit

To qualify for the IT 236 credit, businesses must meet specific eligibility criteria. These include:

- The vehicle must be used for providing transportation services to individuals with disabilities.

- Expenses claimed must be directly related to the purchase or modification of the vehicle to make it accessible.

- Businesses must be registered and in good standing within New York State.

Legal Use of the Printable New York Form IT 236

Using the Printable New York Form IT 236 legally involves adhering to the regulations set forth by the New York State Department of Taxation and Finance. The form must be completed in accordance with the guidelines provided, and all claims must be substantiated with appropriate documentation. Misrepresentation or failure to comply with the requirements can lead to penalties, including disqualification from receiving the credit.

Filing Deadlines for the IT 236 Credit

It is crucial to be aware of the filing deadlines associated with the Printable New York Form IT 236. Typically, the form must be submitted along with your annual tax return. Be sure to check for any specific dates that may apply for the current tax year, as these can vary. Timely submission is essential to ensure that you receive the credit for which you are eligible.

Form Submission Methods for IT 236

The Printable New York Form IT 236 can be submitted through various methods, including:

- Online submission via the New York State Department of Taxation and Finance website.

- Mailing a physical copy of the completed form to the designated address.

- In-person submission at local tax offices, if applicable.

Choosing the right submission method can help streamline the process and ensure that your application is processed efficiently.

Quick guide on how to complete printable 2020 new york form it 236 credit for taxicabs and livery service vehicles accessible to persons with disabilities for

Effortlessly Complete Printable New York Form IT 236 Credit For Taxicabs And Livery Service Vehicles Accessible To Persons With Disabilities For Costs on Any Device

Managing documents online has gained popularity among both businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without delays. Handle Printable New York Form IT 236 Credit For Taxicabs And Livery Service Vehicles Accessible To Persons With Disabilities For Costs on any device using airSlate SignNow's Android or iOS applications and streamline your document-based processes today.

The Easiest Way to Modify and eSign Printable New York Form IT 236 Credit For Taxicabs And Livery Service Vehicles Accessible To Persons With Disabilities For Costs with Ease

- Locate Printable New York Form IT 236 Credit For Taxicabs And Livery Service Vehicles Accessible To Persons With Disabilities For Costs and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Highlight important sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal significance as a conventional wet ink signature.

- Review the details and then click on the Done button to store your modifications.

- Choose your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any chosen device. Edit and eSign Printable New York Form IT 236 Credit For Taxicabs And Livery Service Vehicles Accessible To Persons With Disabilities For Costs while ensuring efficient communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable 2020 new york form it 236 credit for taxicabs and livery service vehicles accessible to persons with disabilities for

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 new york form it 236 credit for taxicabs and livery service vehicles accessible to persons with disabilities for

The best way to make an electronic signature for a PDF online

The best way to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The way to create an electronic signature from your smartphone

How to generate an eSignature for a PDF on iOS

The way to create an electronic signature for a PDF file on Android

People also ask

-

What is airSlate SignNow and how does it relate to it 236?

airSlate SignNow is an electronic signature platform that enables businesses to easily send and sign documents online. The solution is often referred to in discussions about efficient document management, including topics like it 236, highlighting its user-friendly interface and powerful capabilities.

-

How does airSlate SignNow pricing work for it 236 users?

airSlate SignNow offers flexible pricing plans tailored for different business needs, including plans suitable for it 236 users. You can select a plan based on the number of users and features required, ensuring you receive the best cost-effective solution for your organization.

-

What features does airSlate SignNow offer that support it 236?

With airSlate SignNow, users can access various features such as customizable templates, real-time notifications, and integrations with popular applications, all aligned with it 236 principles. These features streamline the document signing process, improving productivity and reducing turnaround times.

-

How does airSlate SignNow support document security for it 236 transactions?

Document security is paramount at airSlate SignNow. The platform employs advanced encryption methods, access controls, and compliance with regulations like eIDAS and GDPR, making it an ideal choice for it 236 users who prioritize secure document handling.

-

Can I integrate airSlate SignNow with other software tools for it 236?

Yes, airSlate SignNow offers seamless integrations with a wide variety of software tools, enhancing your workflow for it 236 processes. Whether you use CRM systems, project management tools, or cloud storage solutions, you can easily connect airSlate SignNow to optimize your document management strategy.

-

What are the benefits of using airSlate SignNow for it 236?

Using airSlate SignNow for it 236 provides numerous benefits, including increased efficiency, reduced paper usage, and faster turnaround for document approvals. This cost-effective solution allows businesses to streamline operations and enhance collaboration across teams.

-

How user-friendly is the airSlate SignNow interface for it 236 applications?

The airSlate SignNow interface is designed with users in mind, ensuring that it 236 applications are simple to navigate. With intuitive design elements and user-friendly features, businesses can quickly adapt to the platform without intensive training or onboarding.

Get more for Printable New York Form IT 236 Credit For Taxicabs And Livery Service Vehicles Accessible To Persons With Disabilities For Costs

- Oil and gas facilities water compliance information texas tceq texas

- Criminal history questionnaire tdlr texasgov form

- Form tceq 20425 ampquotapplication for a temporary water use

- Limited liability company division of corporations florida form

- Illinois driver training school application for branch license form

- Certificate of conversion wisconsin department of form

- Form 1000 dfi wisconsin department of financial institutions

- Secretary of state annual reports soskygov form

Find out other Printable New York Form IT 236 Credit For Taxicabs And Livery Service Vehicles Accessible To Persons With Disabilities For Costs

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed