Schedule K 1 Form N 35 Rev Shareholder's Share of Income, Credits, Deductions, Etc Forms 2019

Understanding the Schedule K-1 Form N-35

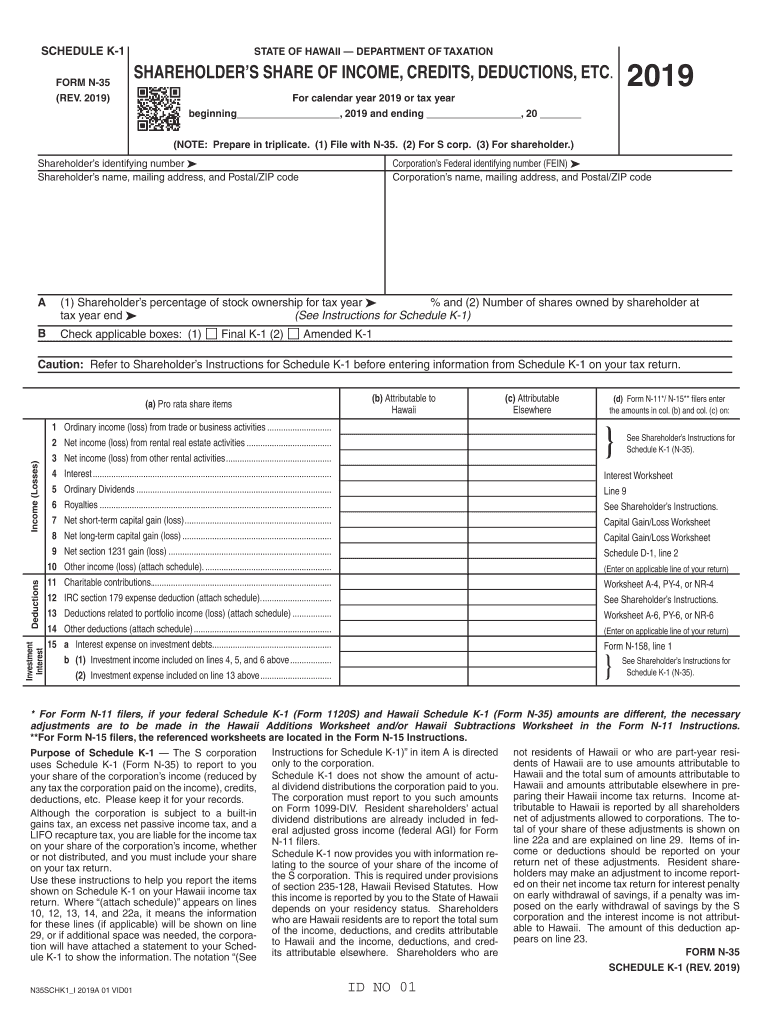

The Schedule K-1 Form N-35 is a crucial document for shareholders of partnerships, S corporations, and certain estates and trusts in Hawaii. It reports each shareholder's share of income, deductions, credits, and other relevant tax information. This form is essential for accurate tax reporting and ensures that shareholders can properly report their income on their personal tax returns. Understanding its components is vital for compliance with state tax regulations.

Steps to Complete the Schedule K-1 Form N-35

Completing the Schedule K-1 Form N-35 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial information from the partnership or corporation, including income, deductions, and credits. Next, accurately fill out each section of the form, ensuring that all figures are correct and correspond with the entity's financial records. After completing the form, review it for any errors before submission. Finally, provide a copy to each shareholder for their records and tax filings.

Obtaining the Schedule K-1 Form N-35

The Schedule K-1 Form N-35 can be obtained through the Hawaii Department of Taxation's website or directly from the partnership or S corporation that issued it. It is important to ensure that the form is the most current version, as tax laws and requirements can change. Shareholders should request this form well in advance of tax filing deadlines to allow sufficient time for completion and review.

Legal Use of the Schedule K-1 Form N-35

The Schedule K-1 Form N-35 serves a legal purpose in tax reporting. It must be completed accurately to reflect each shareholder's share of income and deductions. Failure to provide accurate information can lead to penalties and issues with the IRS or state tax authorities. Therefore, it is crucial to use a reliable method for completing and submitting this form, ensuring compliance with relevant tax laws and regulations.

Key Elements of the Schedule K-1 Form N-35

The Schedule K-1 Form N-35 contains several key elements that are important for shareholders. These include the entity's name and identification number, the shareholder's name and identification number, and detailed breakdowns of income, deductions, and credits. Additionally, it may include information about distributions made to shareholders during the tax year. Understanding these elements helps shareholders accurately report their income on their personal tax returns.

Filing Deadlines for the Schedule K-1 Form N-35

Filing deadlines for the Schedule K-1 Form N-35 align with the tax return deadlines for partnerships and S corporations. Typically, these forms must be issued to shareholders by March 15 of the following tax year. Shareholders should be aware of their own tax filing deadlines to ensure they include the information from the K-1 in their personal tax returns. Timely filing is essential to avoid penalties and interest charges.

Examples of Using the Schedule K-1 Form N-35

Examples of using the Schedule K-1 Form N-35 include scenarios where a shareholder receives income from a partnership or S corporation. For instance, if a shareholder is part of a partnership that earned $100,000 in profit, the K-1 will detail their share of that profit, along with any deductions or credits they can claim. This information is then reported on their individual tax return, impacting their overall tax liability.

Quick guide on how to complete schedule k 1 form n 35 rev 2019 shareholders share of income credits deductions etc forms 2019

Complete Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents swiftly without delays. Handle Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms on any platform using airSlate SignNow’s Android or iOS apps and enhance any document-based operation today.

The easiest way to modify and eSign Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms effortlessly

- Find Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms and click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your delivery method for the form: via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule k 1 form n 35 rev 2019 shareholders share of income credits deductions etc forms 2019

Create this form in 5 minutes!

How to create an eSignature for the schedule k 1 form n 35 rev 2019 shareholders share of income credits deductions etc forms 2019

How to create an electronic signature for a PDF document online

How to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

How to create an eSignature from your smart phone

How to create an eSignature for a PDF document on iOS

How to create an eSignature for a PDF file on Android OS

People also ask

-

What is the Hawaii Schedule K 1?

The Hawaii Schedule K 1 is a tax form used to report income, deductions, and credits from partnerships, S corporations, and other pass-through entities. It is crucial for taxpayers in Hawaii to understand how to accurately complete this form to ensure compliance with state tax laws.

-

How can airSlate SignNow assist with Hawaii Schedule K 1?

airSlate SignNow offers an efficient way to manage the e-signing of your Hawaii Schedule K 1 documents. With its user-friendly interface, users can easily send and sign necessary tax documents securely, enhancing productivity and compliance during tax season.

-

What are the pricing options for using airSlate SignNow for Hawaii Schedule K 1?

airSlate SignNow offers various pricing plans tailored to fit different business needs and budgets. Prospective users looking to manage Hawaii Schedule K 1 forms can choose from flexible monthly subscriptions or opt for discounts on annual plans, ensuring cost-effective access to essential e-signature features.

-

What features of airSlate SignNow help streamline the Hawaii Schedule K 1 process?

Key features of airSlate SignNow that streamline the Hawaii Schedule K 1 process include template creation, automated reminders, and secure document storage. These tools help ensure that all tax documents are completed accurately and on time, minimizing the risk of errors and penalties.

-

Is airSlate SignNow compliant with Hawaii tax regulations for Schedule K 1?

Yes, airSlate SignNow is designed to be compliant with various state and federal regulations, including those related to Hawaii Schedule K 1 submissions. This commitment to compliance ensures that your e-signed documents meet necessary legal standards, helping you stay informed and confident in your filings.

-

Can I integrate airSlate SignNow with accounting software for Hawaii Schedule K 1?

airSlate SignNow integrates seamlessly with popular accounting and tax software, making it easier to handle Hawaii Schedule K 1 documents. This integration helps you streamline your workflow by syncing data directly, reducing manual data entry and increasing overall efficiency.

-

What are the benefits of using airSlate SignNow for Hawaii Schedule K 1?

Using airSlate SignNow for Hawaii Schedule K 1 provides numerous benefits, including faster turnaround times, improved document security, and enhanced tracking capabilities. By digitizing the signing process, businesses can save time and resources, allowing for a smoother tax preparation experience.

Get more for Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms

Find out other Schedule K 1 Form N 35 Rev Shareholder's Share Of Income, Credits, Deductions, Etc Forms

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy