Form 8809 2016

What is the Form 8809

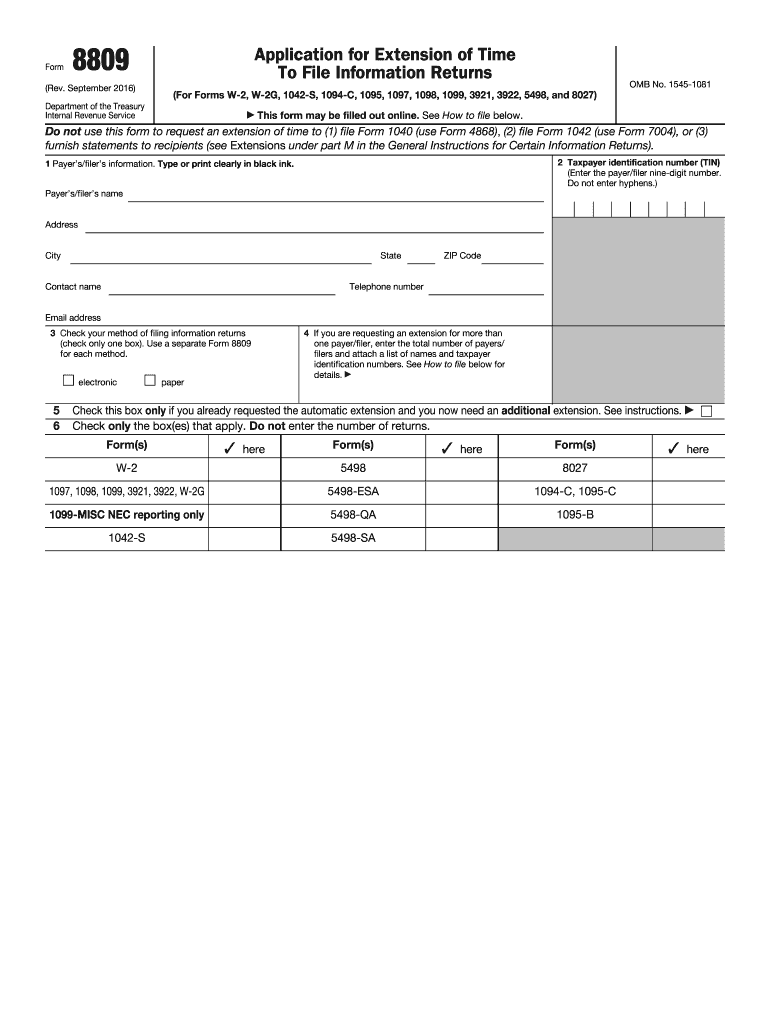

The Form 8809, officially known as the Application for Extension of Time To File Information Returns, is a crucial document used by businesses and organizations in the United States. This form allows filers to request an extension for submitting various information returns, such as Form 1099 and Form W-2. By completing Form 8809, organizations can ensure they meet IRS requirements while managing their reporting timelines effectively.

How to use the Form 8809

Using Form 8809 involves a straightforward process. Filers must complete the form with relevant information, including the type of returns for which they are seeking an extension. It is essential to submit the form to the IRS by the original due date of the returns. This application can be submitted electronically or via mail, depending on the preference of the filer. Utilizing a reliable eSignature platform can streamline this process, ensuring that the form is signed and submitted securely.

Steps to complete the Form 8809

Completing Form 8809 requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including the name, address, and taxpayer identification number of the organization.

- Indicate the specific type of information returns for which the extension is requested.

- Provide the original due date of these returns.

- Sign and date the form, ensuring that the signature is from an authorized individual.

- Submit the form to the IRS by the original due date to avoid penalties.

Legal use of the Form 8809

The legal use of Form 8809 is critical for compliance with IRS regulations. Filing this form grants an automatic extension of time to file information returns, provided it is submitted correctly and on time. It is important to note that while Form 8809 allows for an extension, it does not extend the time for paying any taxes owed. Therefore, organizations must ensure they meet all tax obligations to avoid penalties.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with Form 8809 is essential for compliance. The form must be submitted by the original due date of the information returns for which an extension is being requested. Typically, this deadline falls in January or February, depending on the specific type of return. Organizations should keep track of these dates to ensure timely submissions and avoid unnecessary penalties.

Form Submission Methods (Online / Mail / In-Person)

Form 8809 can be submitted through various methods, providing flexibility for filers. The submission options include:

- Online: Organizations can file electronically through the IRS e-file system, which is often the fastest and most efficient method.

- Mail: Filers may choose to print the form and send it via postal service to the appropriate IRS address.

- In-Person: While not common, some may opt to deliver the form directly to an IRS office, though this method is less frequently used.

Quick guide on how to complete 2016 form 8809

Complete Form 8809 seamlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to locate the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without hindrances. Manage Form 8809 on any device with airSlate SignNow Android or iOS applications and simplify any document-based workflow today.

How to alter and electronically sign Form 8809 with ease

- Find Form 8809 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent parts of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, either via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Form 8809 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 8809

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 8809

How to create an eSignature for the 2016 Form 8809 in the online mode

How to make an eSignature for the 2016 Form 8809 in Google Chrome

How to make an electronic signature for putting it on the 2016 Form 8809 in Gmail

How to generate an electronic signature for the 2016 Form 8809 right from your mobile device

How to make an eSignature for the 2016 Form 8809 on iOS devices

How to create an electronic signature for the 2016 Form 8809 on Android OS

People also ask

-

What is Form 8809?

Form 8809 is an application for an extension of time to file information returns with the IRS. It's often used by businesses to ensure they meet filing deadlines for forms such as 1099s and W-2s. Utilizing airSlate SignNow, you can easily eSign and submit your Form 8809, streamlining the entire process.

-

How can airSlate SignNow help with Form 8809?

airSlate SignNow simplifies the process of preparing and signing Form 8809 by providing a user-friendly interface for document management. Users can quickly add signatures and collect necessary approvals online. This efficiency reduces the risk of errors and ensures timely submission to the IRS.

-

Is there a cost associated with using airSlate SignNow for Form 8809?

Yes, airSlate SignNow offers affordable pricing plans that cater to various business needs, including the creation and management of Form 8809. The cost-effectiveness of airSlate SignNow makes it a great option for businesses looking to save on administrative expenses while ensuring compliance with IRS regulations.

-

What features does airSlate SignNow offer for managing Form 8809?

AirSlate SignNow provides features like document templates, secure eSignature capabilities, and real-time collaboration to effectively manage Form 8809. These tools allow users to create, edit, and send their Form 8809 for eSignature in a streamlined way. This enhances productivity and ensures that your compliance tasks are handled efficiently.

-

Can I integrate airSlate SignNow with other software for handling Form 8809?

Absolutely! airSlate SignNow offers integration options with various software, such as accounting and tax preparation tools, making it easier to handle Form 8809. By integrating with your existing systems, you can automate workflows and ensure seamless information flow, reducing administrative burdens.

-

What are the benefits of using airSlate SignNow for Form 8809 compared to traditional methods?

Using airSlate SignNow for Form 8809 enhances efficiency, accuracy, and security compared to traditional paper forms. Electronic signatures eliminate the need for printing and scanning, speeding up the submission process. Additionally, airSlate SignNow provides secure storage and compliance features, ensuring your sensitive information is protected.

-

Is it easy to learn how to use airSlate SignNow for Form 8809?

Yes, airSlate SignNow is designed to be user-friendly and intuitive, even for those unfamiliar with digital document management. The platform offers tutorials and support resources to guide users through the process of preparing and submitting Form 8809. In no time, you'll be able to eSign and manage your documents with confidence.

Get more for Form 8809

Find out other Form 8809

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors