Request for Extension of Time to File Information Returns IRS Irs 1995

What is the Request For Extension Of Time To File Information Returns IRS

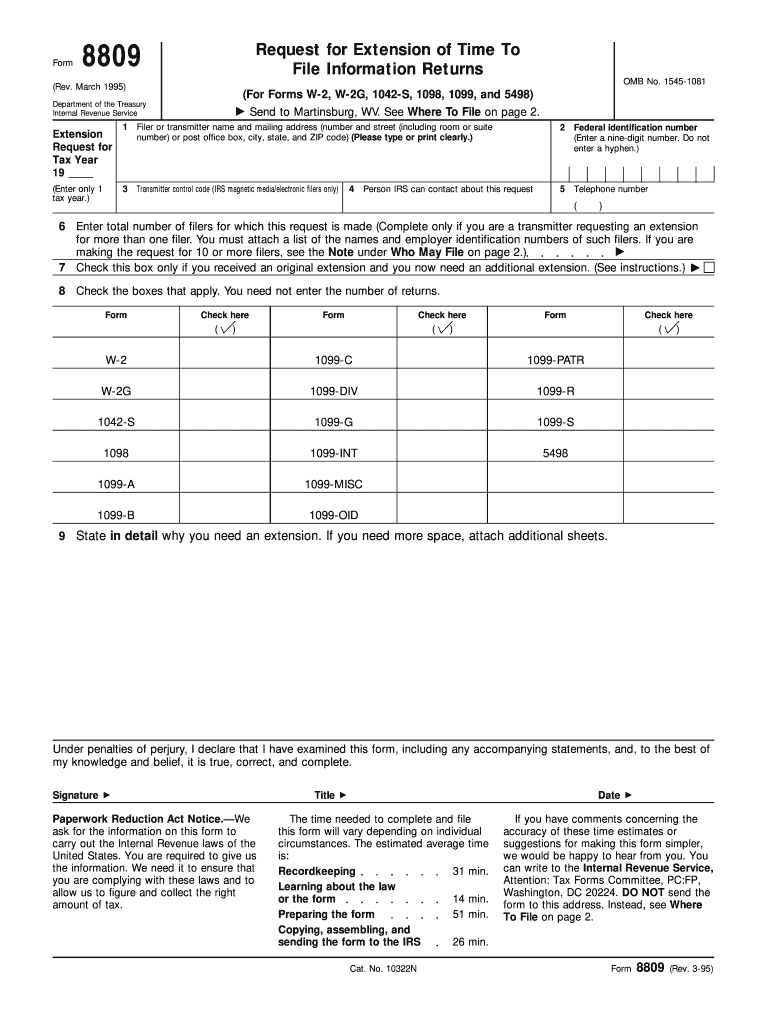

The Request For Extension Of Time To File Information Returns with the IRS is a formal application that allows taxpayers additional time to submit their required information returns. This form is particularly relevant for businesses and individuals who may need extra time to gather necessary documentation or complete their filings accurately. It is important to note that while this request extends the filing deadline, it does not extend the time to pay any taxes owed.

Steps to Complete the Request For Extension Of Time To File Information Returns IRS

Completing the Request For Extension Of Time To File Information Returns involves several key steps:

- Gather required information, including your business name, Employer Identification Number (EIN), and the specific forms for which you are requesting an extension.

- Fill out the form accurately, ensuring all details are correct to avoid delays.

- Review the form for completeness and accuracy before submission.

- Submit the form electronically or via mail, depending on your preference and the IRS guidelines.

IRS Guidelines

The IRS provides specific guidelines regarding the Request For Extension Of Time To File Information Returns. It is essential to adhere to these guidelines to ensure compliance. The IRS typically allows an automatic extension of up to six months for certain information returns, but this must be requested before the original due date of the return. Understanding the specific requirements and deadlines is crucial for a successful extension request.

Filing Deadlines / Important Dates

Filing deadlines for the Request For Extension Of Time To File Information Returns vary based on the type of return being filed. Generally, the request must be submitted by the original due date of the return. For example, if the information return is due on March 15, the extension request must be filed by that date. It is important to keep track of these dates to avoid penalties.

Required Documents

When submitting the Request For Extension Of Time To File Information Returns, certain documents may be required. Typically, you will need:

- Your business name and EIN.

- The specific forms for which you are requesting an extension.

- Any supporting documentation that may be necessary to justify the request.

Penalties for Non-Compliance

Failure to file information returns on time, even with an extension request, can result in significant penalties. The IRS may impose fines for late filings, which can accumulate quickly. Understanding these penalties can emphasize the importance of timely submissions and the necessity of filing for an extension if needed.

Quick guide on how to complete request for extension of time to file information returns irs irs

Complete Request For Extension Of Time To File Information Returns IRS Irs effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Request For Extension Of Time To File Information Returns IRS Irs on any device with airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to modify and electronically sign Request For Extension Of Time To File Information Returns IRS Irs with ease

- Locate Request For Extension Of Time To File Information Returns IRS Irs and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Request For Extension Of Time To File Information Returns IRS Irs to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct request for extension of time to file information returns irs irs

Create this form in 5 minutes!

How to create an eSignature for the request for extension of time to file information returns irs irs

How to make an eSignature for your PDF online

How to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

The way to create an electronic signature for a PDF file on Android

People also ask

-

What is the process to Request For Extension Of Time To File Information Returns IRS Irs using airSlate SignNow?

To Request For Extension Of Time To File Information Returns IRS Irs with airSlate SignNow, simply log into your account, navigate to the document creation section, and select the appropriate IRS form. Complete the necessary fields and use our eSignature feature to sign and send it electronically. This streamlined process ensures that your extension request is submitted quickly and efficiently.

-

How does airSlate SignNow ensure compliance when requesting an extension with the IRS?

airSlate SignNow is designed to help you comply with IRS regulations when you Request For Extension Of Time To File Information Returns IRS Irs. Our platform includes built-in compliance features that ensure your documents meet legal standards and requirements set by the IRS, thus safeguarding the integrity of your submission.

-

Can I track my Request For Extension Of Time To File Information Returns IRS Irs submission?

Yes, airSlate SignNow provides real-time tracking for all documents sent through the platform, including your Request For Extension Of Time To File Information Returns IRS Irs. You will receive notifications and updates as the process moves forward, ensuring transparency and peace of mind.

-

What are the pricing options for using airSlate SignNow to Request For Extension Of Time To File Information Returns IRS Irs?

airSlate SignNow offers flexible pricing plans tailored to fit different business needs. Whether you are a small business or a large enterprise, you can choose a plan that suits your budget and frequency of use, ensuring that you can efficiently Request For Extension Of Time To File Information Returns IRS Irs without overspending.

-

What features does airSlate SignNow offer for managing IRS extension requests?

In addition to eSigning, airSlate SignNow offers features such as document templates, automation workflows, and secure cloud storage to help you manage your IRS extension requests efficiently. These tools save time and reduce potential errors, making it easier to Request For Extension Of Time To File Information Returns IRS Irs.

-

Is there a mobile app for airSlate SignNow to facilitate extension requests?

Yes, airSlate SignNow has a mobile app that allows you to manage your documents and Request For Extension Of Time To File Information Returns IRS Irs on the go. With the app, you can eSign documents, track submissions, and send requests right from your mobile device, providing unmatched convenience.

-

What integrations does airSlate SignNow support for filing IRS extension requests?

airSlate SignNow seamlessly integrates with various business tools and software, including cloud storage services and accounting platforms. This interoperability allows you to efficiently Request For Extension Of Time To File Information Returns IRS Irs without switching between multiple applications, simplifying your workflow.

Get more for Request For Extension Of Time To File Information Returns IRS Irs

- 30 day notice to terminate lease greater than week to week less than year to year from landlord to tenant illinois form

- 5 day notice 497306188 form

- Assignment of mortgage by individual mortgage holder illinois form

- Assignment of mortgage by corporate mortgage holder illinois form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for residential property illinois form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for nonresidential or commercial property 497306193 form

- Notice of intent to vacate at end of specified lease term from tenant to landlord for residential property illinois form

- Notice of intent to vacate at end of specified lease term from tenant to landlord nonresidential illinois form

Find out other Request For Extension Of Time To File Information Returns IRS Irs

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors