Form 1120 F U S Income Tax Return of a Foreign Corporation 2016

Understanding the Form 1120 F U S Income Tax Return Of A Foreign Corporation

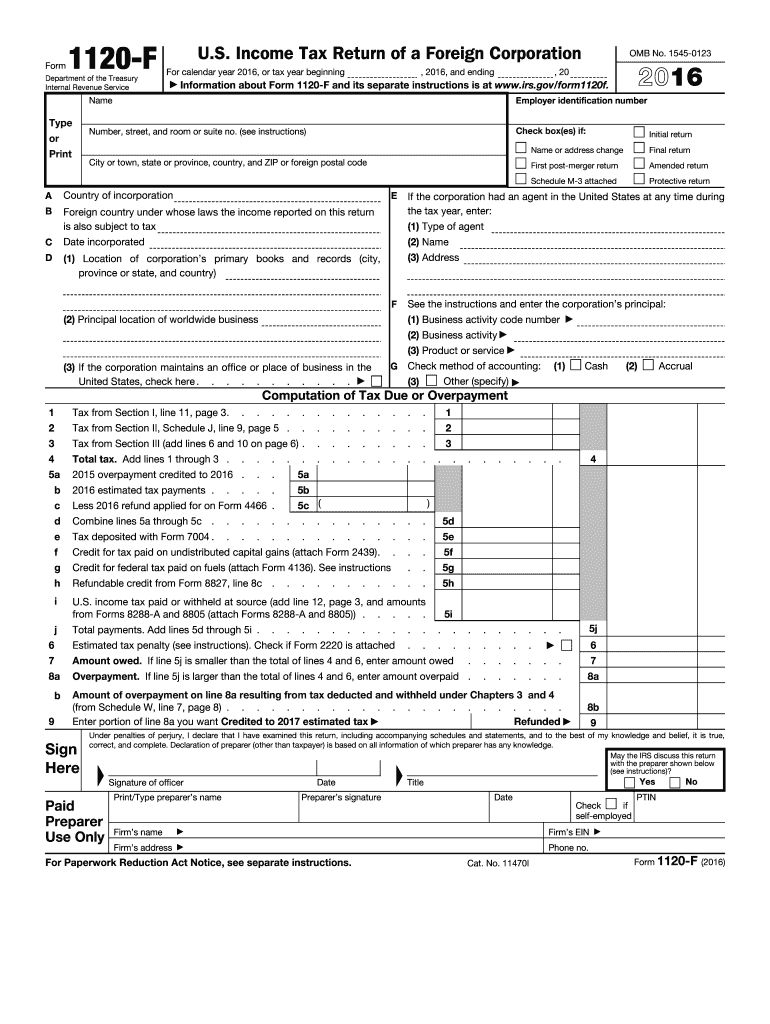

The Form 1120 F U S Income Tax Return Of A Foreign Corporation is a federal tax form used by foreign corporations to report their income, gains, losses, deductions, and credits effectively connected with a trade or business in the United States. This form is essential for ensuring compliance with U.S. tax laws and provides the Internal Revenue Service (IRS) with necessary information about the foreign corporation's U.S. operations. It is crucial for foreign entities to accurately complete this form to avoid potential penalties and ensure proper tax treatment.

Steps to Complete the Form 1120 F U S Income Tax Return Of A Foreign Corporation

Completing the Form 1120 F involves several key steps:

- Gather all necessary financial documents, including income statements, balance sheets, and records of deductions.

- Determine the corporation's effectively connected income with U.S. trade or business.

- Fill out the form accurately, ensuring all sections are completed, including income, deductions, and credits.

- Review the completed form for accuracy and compliance with IRS guidelines.

- Sign and date the form, ensuring that the signature is from an authorized individual.

How to Obtain the Form 1120 F U S Income Tax Return Of A Foreign Corporation

The Form 1120 F can be obtained directly from the IRS website or through various tax preparation software that supports federal tax forms. It is important to ensure that you are using the most current version of the form, as tax regulations may change annually. Additionally, tax professionals can assist in obtaining and completing the form accurately.

Legal Use of the Form 1120 F U S Income Tax Return Of A Foreign Corporation

The legal use of Form 1120 F is critical for foreign corporations conducting business in the U.S. It serves as a declaration of income and tax liability, ensuring compliance with U.S. tax laws. Proper filing is essential to avoid legal repercussions, including fines and penalties. The form must be filed annually, and it is important for foreign corporations to understand their obligations under U.S. tax law.

Filing Deadlines for Form 1120 F U S Income Tax Return Of A Foreign Corporation

The filing deadline for Form 1120 F is typically the 15th day of the sixth month after the end of the corporation's tax year. For corporations following a calendar year, this means the form is due on June 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Extensions may be available, but it is crucial to file for an extension before the original deadline to avoid penalties.

Penalties for Non-Compliance with Form 1120 F U S Income Tax Return Of A Foreign Corporation

Failure to file Form 1120 F on time can result in significant penalties. The IRS may impose a penalty for late filing, which can accrue daily until the form is submitted. Additionally, inaccuracies or omissions on the form can lead to further penalties, including interest on unpaid taxes. It is essential for foreign corporations to adhere to all filing requirements to mitigate these risks.

Quick guide on how to complete 2016 form 1120 f us income tax return of a foreign corporation

Effortlessly Prepare Form 1120 F U S Income Tax Return Of A Foreign Corporation on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents swiftly without any delays. Manage Form 1120 F U S Income Tax Return Of A Foreign Corporation on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Edit and eSign Form 1120 F U S Income Tax Return Of A Foreign Corporation with Ease

- Obtain Form 1120 F U S Income Tax Return Of A Foreign Corporation and click Get Form to begin.

- Use the tools we provide to complete your document.

- Select important sections of your documents or conceal sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which only takes seconds and has the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Decide how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, exhausting searches for forms, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Alter and eSign Form 1120 F U S Income Tax Return Of A Foreign Corporation to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 1120 f us income tax return of a foreign corporation

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 1120 f us income tax return of a foreign corporation

How to make an electronic signature for your 2016 Form 1120 F Us Income Tax Return Of A Foreign Corporation in the online mode

How to make an eSignature for the 2016 Form 1120 F Us Income Tax Return Of A Foreign Corporation in Google Chrome

How to create an eSignature for signing the 2016 Form 1120 F Us Income Tax Return Of A Foreign Corporation in Gmail

How to generate an eSignature for the 2016 Form 1120 F Us Income Tax Return Of A Foreign Corporation straight from your mobile device

How to create an eSignature for the 2016 Form 1120 F Us Income Tax Return Of A Foreign Corporation on iOS

How to make an electronic signature for the 2016 Form 1120 F Us Income Tax Return Of A Foreign Corporation on Android devices

People also ask

-

What is the Form 1120 F U S Income Tax Return Of A Foreign Corporation?

The Form 1120 F U S Income Tax Return Of A Foreign Corporation is a tax form used by foreign corporations to report their income and calculate tax obligations in the United States. This form helps ensure compliance with U.S. tax laws and regulations. Properly filing this form is crucial for foreign entities conducting business in the U.S.

-

How can airSlate SignNow assist with the Form 1120 F U S Income Tax Return Of A Foreign Corporation?

airSlate SignNow provides an efficient platform for electronically signing and sending the Form 1120 F U S Income Tax Return Of A Foreign Corporation. With our user-friendly interface, you can easily manage your documents, ensuring they are securely signed and submitted on time. Our solution streamlines the process, making tax compliance simpler for foreign corporations.

-

What features does airSlate SignNow offer for handling the Form 1120 F U S Income Tax Return Of A Foreign Corporation?

airSlate SignNow offers features such as customizable templates, secure e-signature functionality, and real-time tracking for the Form 1120 F U S Income Tax Return Of A Foreign Corporation. These tools help businesses stay organized and ensure that all necessary documents are completed accurately and promptly. Additionally, our platform is designed to enhance collaboration among team members.

-

Is airSlate SignNow cost-effective for managing the Form 1120 F U S Income Tax Return Of A Foreign Corporation?

Yes, airSlate SignNow is a cost-effective solution for managing the Form 1120 F U S Income Tax Return Of A Foreign Corporation. Our pricing plans are tailored to fit businesses of all sizes, ensuring that you only pay for what you need. By using our platform, you can save time and resources that would otherwise be spent on traditional document management processes.

-

Can I integrate airSlate SignNow with my existing accounting software for the Form 1120 F U S Income Tax Return Of A Foreign Corporation?

Absolutely! airSlate SignNow offers seamless integrations with various accounting software, allowing you to streamline your workflow when dealing with the Form 1120 F U S Income Tax Return Of A Foreign Corporation. This means you can easily transfer data and documents between applications, enhancing efficiency and reducing the risk of errors.

-

What are the benefits of using airSlate SignNow for the Form 1120 F U S Income Tax Return Of A Foreign Corporation?

Using airSlate SignNow for the Form 1120 F U S Income Tax Return Of A Foreign Corporation provides numerous benefits, including enhanced security, legal compliance, and improved turnaround times. Our platform ensures that all signatures are legally binding and securely stored, giving you peace of mind during the tax filing process. Additionally, our intuitive interface makes it easy for anyone to use.

-

How does airSlate SignNow ensure the security of my Form 1120 F U S Income Tax Return Of A Foreign Corporation documents?

airSlate SignNow prioritizes the security of your documents, including the Form 1120 F U S Income Tax Return Of A Foreign Corporation. We utilize advanced encryption methods, secure cloud storage, and comply with industry regulations to protect your sensitive information. You can trust that your documents are safe while being processed through our platform.

Get more for Form 1120 F U S Income Tax Return Of A Foreign Corporation

Find out other Form 1120 F U S Income Tax Return Of A Foreign Corporation

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document