Form 1120 F U S Income Tax Return of a Foreign Corporation 2016

Understanding the Form 1120 F U S Income Tax Return Of A Foreign Corporation

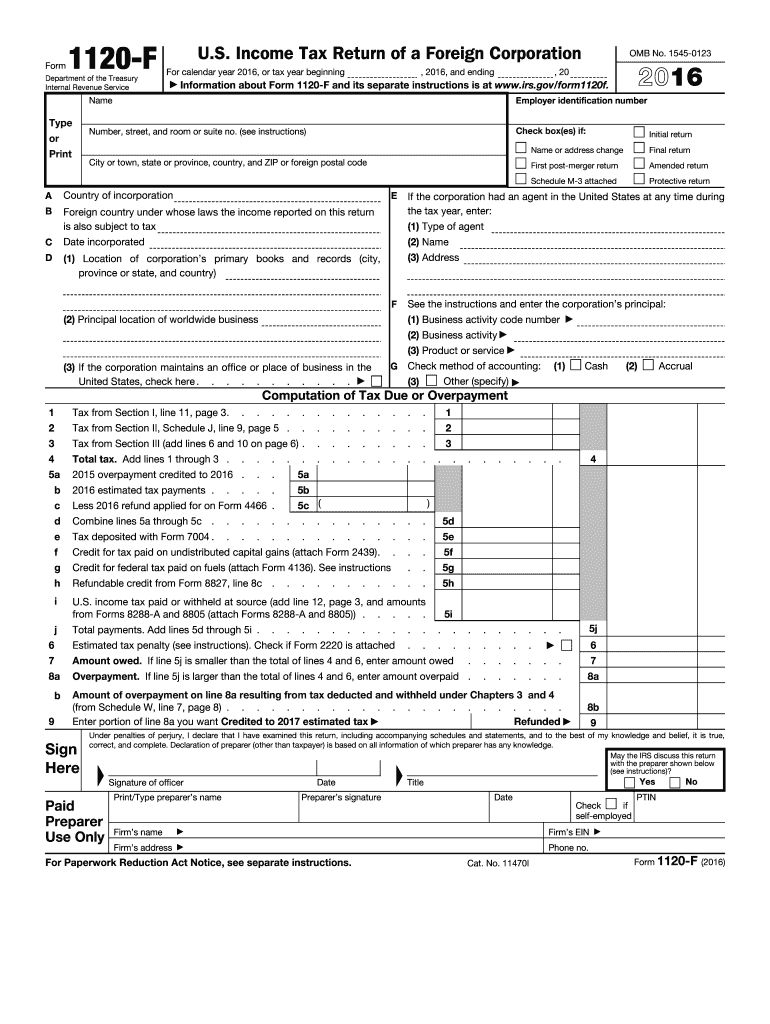

The Form 1120 F U S Income Tax Return Of A Foreign Corporation is a federal tax form used by foreign corporations to report their income, gains, losses, deductions, and credits effectively connected with a trade or business in the United States. This form is essential for ensuring compliance with U.S. tax laws and provides the Internal Revenue Service (IRS) with necessary information about the foreign corporation's U.S. operations. It is crucial for foreign entities to accurately complete this form to avoid potential penalties and ensure proper tax treatment.

Steps to Complete the Form 1120 F U S Income Tax Return Of A Foreign Corporation

Completing the Form 1120 F involves several key steps:

- Gather all necessary financial documents, including income statements, balance sheets, and records of deductions.

- Determine the corporation's effectively connected income with U.S. trade or business.

- Fill out the form accurately, ensuring all sections are completed, including income, deductions, and credits.

- Review the completed form for accuracy and compliance with IRS guidelines.

- Sign and date the form, ensuring that the signature is from an authorized individual.

How to Obtain the Form 1120 F U S Income Tax Return Of A Foreign Corporation

The Form 1120 F can be obtained directly from the IRS website or through various tax preparation software that supports federal tax forms. It is important to ensure that you are using the most current version of the form, as tax regulations may change annually. Additionally, tax professionals can assist in obtaining and completing the form accurately.

Legal Use of the Form 1120 F U S Income Tax Return Of A Foreign Corporation

The legal use of Form 1120 F is critical for foreign corporations conducting business in the U.S. It serves as a declaration of income and tax liability, ensuring compliance with U.S. tax laws. Proper filing is essential to avoid legal repercussions, including fines and penalties. The form must be filed annually, and it is important for foreign corporations to understand their obligations under U.S. tax law.

Filing Deadlines for Form 1120 F U S Income Tax Return Of A Foreign Corporation

The filing deadline for Form 1120 F is typically the 15th day of the sixth month after the end of the corporation's tax year. For corporations following a calendar year, this means the form is due on June 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Extensions may be available, but it is crucial to file for an extension before the original deadline to avoid penalties.

Penalties for Non-Compliance with Form 1120 F U S Income Tax Return Of A Foreign Corporation

Failure to file Form 1120 F on time can result in significant penalties. The IRS may impose a penalty for late filing, which can accrue daily until the form is submitted. Additionally, inaccuracies or omissions on the form can lead to further penalties, including interest on unpaid taxes. It is essential for foreign corporations to adhere to all filing requirements to mitigate these risks.

Quick guide on how to complete 2016 form 1120 f us income tax return of a foreign corporation

Effortlessly Prepare Form 1120 F U S Income Tax Return Of A Foreign Corporation on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents swiftly without any delays. Manage Form 1120 F U S Income Tax Return Of A Foreign Corporation on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Edit and eSign Form 1120 F U S Income Tax Return Of A Foreign Corporation with Ease

- Obtain Form 1120 F U S Income Tax Return Of A Foreign Corporation and click Get Form to begin.

- Use the tools we provide to complete your document.

- Select important sections of your documents or conceal sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which only takes seconds and has the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Decide how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, exhausting searches for forms, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Alter and eSign Form 1120 F U S Income Tax Return Of A Foreign Corporation to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 1120 f us income tax return of a foreign corporation

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 1120 f us income tax return of a foreign corporation

How to make an electronic signature for your 2016 Form 1120 F Us Income Tax Return Of A Foreign Corporation in the online mode

How to make an eSignature for the 2016 Form 1120 F Us Income Tax Return Of A Foreign Corporation in Google Chrome

How to create an eSignature for signing the 2016 Form 1120 F Us Income Tax Return Of A Foreign Corporation in Gmail

How to generate an eSignature for the 2016 Form 1120 F Us Income Tax Return Of A Foreign Corporation straight from your mobile device

How to create an eSignature for the 2016 Form 1120 F Us Income Tax Return Of A Foreign Corporation on iOS

How to make an electronic signature for the 2016 Form 1120 F Us Income Tax Return Of A Foreign Corporation on Android devices

People also ask

-

What is the Form 1120 F U S Income Tax Return Of A Foreign Corporation?

The Form 1120 F U S Income Tax Return Of A Foreign Corporation is a tax document that foreign corporations must file to report their income and expenses to the IRS. This form ensures compliance with U.S. tax obligations and helps foreign entities understand their tax liabilities. Filing this form accurately is crucial to avoid penalties and maintain good standing.

-

How can airSlate SignNow assist with the Form 1120 F U S Income Tax Return Of A Foreign Corporation?

airSlate SignNow offers a streamlined solution to electronically sign and send the Form 1120 F U S Income Tax Return Of A Foreign Corporation. With our platform, users can easily gather the necessary signatures and ensure that their documents are processed efficiently. This feature simplifies complex tax filing processes and saves valuable time.

-

Is there a cost associated with using airSlate SignNow for filing Form 1120 F U S Income Tax Return Of A Foreign Corporation?

Yes, airSlate SignNow provides flexible pricing plans to meet different business needs when filing the Form 1120 F U S Income Tax Return Of A Foreign Corporation. Our cost-effective solutions range from basic plans to more comprehensive packages that cater to larger enterprises. Consider the return on investment when evaluating our pricing options.

-

What features does airSlate SignNow offer for ease of use with tax documents like Form 1120 F U S Income Tax Return Of A Foreign Corporation?

airSlate SignNow includes several features designed for user-friendly document management and eSigning, particularly for the Form 1120 F U S Income Tax Return Of A Foreign Corporation. With customizable templates, automatic reminders, and secure cloud storage, businesses can ensure they manage their tax documents efficiently. These features help maintain organization and compliance throughout the tax filing process.

-

What are the benefits of using airSlate SignNow for Form 1120 F U S Income Tax Return Of A Foreign Corporation?

Using airSlate SignNow for the Form 1120 F U S Income Tax Return Of A Foreign Corporation provides numerous benefits such as enhanced efficiency, reduced paperwork, and improved accuracy. The platform minimizes the risk of errors by providing an easy-to-use interface that ensures all necessary fields are completed. Additionally, real-time tracking and notifications keep users informed throughout the process.

-

Can I integrate airSlate SignNow with other accounting software for Form 1120 F U S Income Tax Return Of A Foreign Corporation?

Absolutely! airSlate SignNow offers integrations with various accounting software programs to facilitate the filing of the Form 1120 F U S Income Tax Return Of A Foreign Corporation. This allows for seamless data transfer, reducing redundancies, and ensuring the accuracy of information. Integrating these tools streamlines the entire tax preparation and submission process.

-

How secure is the airSlate SignNow platform for handling Form 1120 F U S Income Tax Return Of A Foreign Corporation?

airSlate SignNow prioritizes security, implementing advanced encryption and data protection measures for documents, including the Form 1120 F U S Income Tax Return Of A Foreign Corporation. Our platform complies with industry standards to ensure that sensitive financial information remains confidential. Users can confidently manage their tax documents knowing that their data is secure.

Get more for Form 1120 F U S Income Tax Return Of A Foreign Corporation

Find out other Form 1120 F U S Income Tax Return Of A Foreign Corporation

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile

- eSignature Nevada Mechanic's Lien Myself

- eSign California Life-Insurance Quote Form Online

- How To eSignature Ohio Mechanic's Lien

- eSign Florida Life-Insurance Quote Form Online

- eSign Louisiana Life-Insurance Quote Form Online

- How To eSign Michigan Life-Insurance Quote Form

- Can I eSign Colorado Business Insurance Quotation Form

- Can I eSign Hawaii Certeficate of Insurance Request

- eSign Nevada Certeficate of Insurance Request Now

- Can I eSign Missouri Business Insurance Quotation Form

- How Do I eSign Nevada Business Insurance Quotation Form