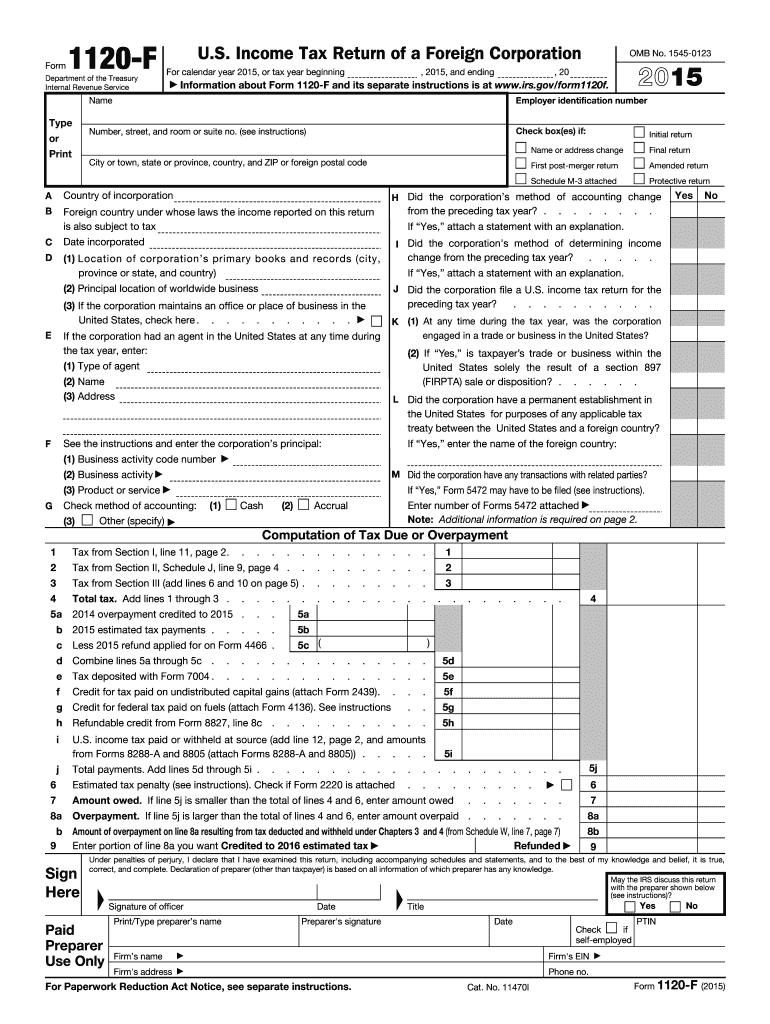

Irs Form 1120 2015

What is the IRS Form 1120

The IRS Form 1120 is the U.S. Corporation Income Tax Return, primarily used by corporations to report their income, gains, losses, deductions, and credits. This form is essential for C corporations, which are separate tax entities from their owners. By filing Form 1120, corporations disclose their financial activities to the IRS, ensuring compliance with federal tax regulations. The information provided on this form helps determine the corporation's tax liability based on its earnings for the year.

How to Obtain the IRS Form 1120

The IRS Form 1120 can be easily obtained from the official IRS website. It is available as a downloadable PDF, which can be printed for completion. Additionally, many tax preparation software programs include the form, allowing for electronic filing. Businesses may also request a physical copy by contacting the IRS directly or visiting a local IRS office.

Steps to Complete the IRS Form 1120

Completing the IRS Form 1120 involves several key steps:

- Gather necessary financial documents, including income statements and expense reports.

- Fill out the identification section, providing the corporation's name, address, and Employer Identification Number (EIN).

- Report income by entering gross receipts and any other income sources on the appropriate lines.

- Detail deductions, including operating expenses, cost of goods sold, and other allowable deductions.

- Calculate the taxable income by subtracting total deductions from total income.

- Determine the tax liability based on the applicable corporate tax rate.

- Complete any additional schedules required for specific deductions or credits.

- Review the form for accuracy before submitting it to the IRS.

Legal Use of the IRS Form 1120

The IRS Form 1120 serves as a legal document for corporations to report their financial activities and tax obligations. When filled out correctly and submitted on time, it fulfills the corporation's legal requirement to report income to the IRS. Failure to file the form can result in penalties, including fines and interest on unpaid taxes. It is crucial for corporations to ensure that all information is accurate and complete to avoid legal complications.

Filing Deadlines / Important Dates

The deadline for filing the IRS Form 1120 is typically the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the due date is April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Corporations can file for an automatic six-month extension, but any taxes owed must still be paid by the original due date to avoid penalties.

Penalties for Non-Compliance

Corporations that fail to file the IRS Form 1120 on time may face significant penalties. The IRS imposes a failure-to-file penalty, which is typically calculated based on the amount of unpaid tax multiplied by the number of months the return is late. Additionally, if a corporation fails to pay the taxes owed, it may incur interest charges and further penalties. Timely filing and payment are essential to avoid these financial repercussions.

Quick guide on how to complete 2015 irs form 1120

Complete Irs Form 1120 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Irs Form 1120 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Irs Form 1120 with ease

- Locate Irs Form 1120 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about missing or misplaced files, tedious document searches, or errors that require printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Irs Form 1120 and guarantee outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 irs form 1120

Create this form in 5 minutes!

How to create an eSignature for the 2015 irs form 1120

The best way to make an electronic signature for your PDF online

The best way to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The way to generate an eSignature right from your smartphone

How to generate an electronic signature for a PDF on iOS

The way to generate an eSignature for a PDF on Android

People also ask

-

What is IRS Form 1120 and why do I need it?

IRS Form 1120 is the U.S. Corporation Income Tax Return that corporations must file to report their income, gains, losses, and deductions. Businesses are required to submit this form annually to ensure compliance with federal tax regulations. Understanding how to accurately complete IRS Form 1120 can help avoid penalties and ensure the corporation maximizes its tax benefits.

-

How can airSlate SignNow help with IRS Form 1120?

airSlate SignNow can streamline the process of completing and eSigning IRS Form 1120 by providing a user-friendly platform for document management. With features like templates and electronic signatures, businesses can easily prepare and file their tax returns without the hassle of paper forms. This efficiency can save time and reduce the risk of errors on IRS Form 1120.

-

Is there a free trial for airSlate SignNow to manage IRS Form 1120?

Yes, airSlate SignNow offers a free trial that allows users to explore its features for managing IRS Form 1120 and other documents. This trial period provides an opportunity to experience the ease of eSigning and document workflows without any financial commitment. Users can evaluate how airSlate SignNow can simplify their tax filing processes.

-

What features does airSlate SignNow offer for eSigning IRS Form 1120?

airSlate SignNow includes several powerful features for eSigning IRS Form 1120, such as customizable templates, in-app signing, and secure cloud storage. These tools ensure that users can prepare their tax documents swiftly and securely. The platform also allows for easy collaboration, enabling multiple stakeholders to review and sign IRS Form 1120 seamlessly.

-

Are there any integrations available with airSlate SignNow for IRS Form 1120?

Yes, airSlate SignNow integrates with various business applications that can aid in the preparation and submission of IRS Form 1120. These integrations enhance workflow efficiency by allowing users to import data directly from accounting software and other platforms. This connectivity ensures that all necessary information is at hand when completing IRS Form 1120.

-

What are the pricing options for using airSlate SignNow for IRS Form 1120?

airSlate SignNow offers flexible pricing plans that cater to different business needs when managing IRS Form 1120 and other documents. Whether you are a small business or a large enterprise, there are options available to fit your budget. Each plan includes features that streamline the eSigning process, making compliance with IRS Form 1120 more manageable.

-

Can I securely store my completed IRS Form 1120 using airSlate SignNow?

Absolutely! airSlate SignNow provides secure cloud storage for all your completed documents, including IRS Form 1120. Your data is protected with industry-standard encryption, ensuring that sensitive tax information remains confidential and accessible only to authorized users. This feature allows you to retrieve your IRS Form 1120 at any time when needed.

Get more for Irs Form 1120

- Lawyer criminal intake form

- Cofc cat cpdf form

- Mckesson form application

- Charter for academy players and parents eflcom form

- Ncds form

- Retailer application form

- Declaration of consent for the receipt of electronic registered messages with incamail form

- Invoicing form for guest lectures and scientific activities fin k2

Find out other Irs Form 1120

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template