Www Irs GovInternal Revenue Service IRS Tax Forms 2021

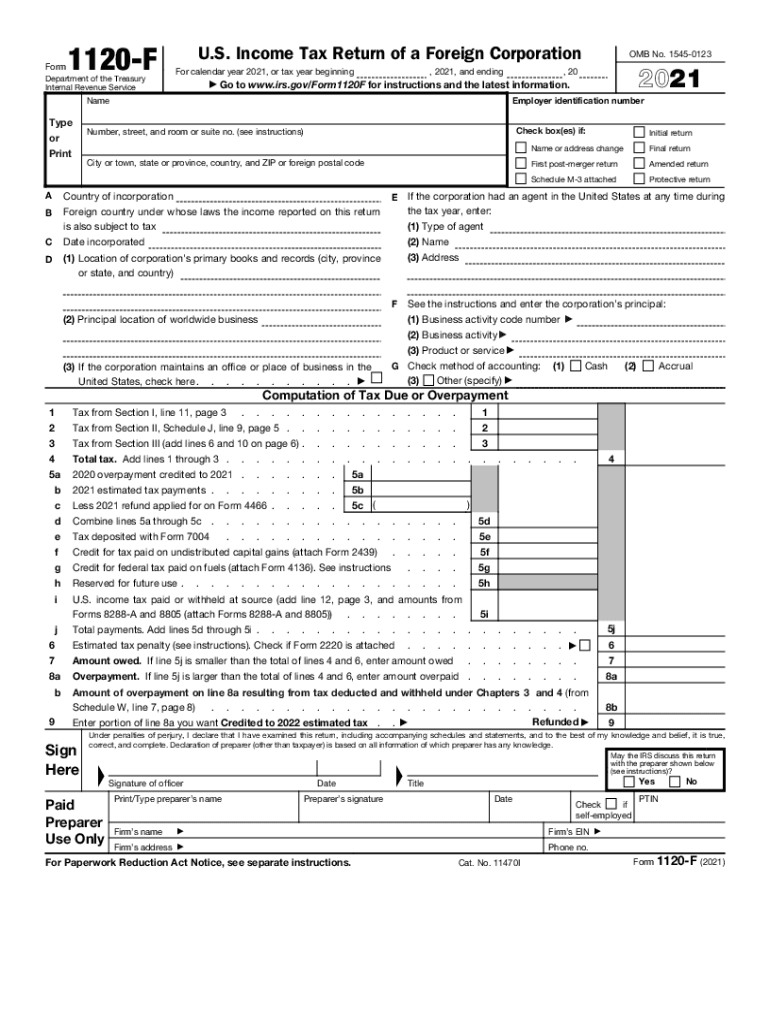

Understanding IRS Form 1120-F

IRS Form 1120-F is a tax return specifically designed for foreign corporations doing business in the United States. This form is essential for reporting income, gains, losses, deductions, and credits. It ensures compliance with U.S. tax laws and helps foreign entities accurately report their U.S. income. Understanding the nuances of this form is crucial for foreign corporations to avoid penalties and ensure proper tax treatment.

Steps to Complete IRS Form 1120-F

Filling out IRS Form 1120-F involves several key steps:

- Gather Required Information: Collect all necessary financial information, including income earned in the U.S., deductions, and any applicable credits.

- Complete the Form: Fill out the form accurately, ensuring that all sections are completed, including income, deductions, and tax calculation.

- Review for Accuracy: Double-check all entries for accuracy to prevent errors that could lead to penalties.

- Submit the Form: File the completed form with the IRS by the due date, which is typically the 15th day of the sixth month after the end of the corporation's tax year.

Filing Deadlines for IRS Form 1120-F

The filing deadline for IRS Form 1120-F is generally the 15th day of the sixth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by June 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. It is important for foreign corporations to adhere to these deadlines to avoid late filing penalties.

Legal Use of IRS Form 1120-F

IRS Form 1120-F must be used in compliance with U.S. tax laws. It is legally binding when completed accurately and submitted on time. The form serves as a declaration of the corporation's U.S. income and tax obligations. Failure to file or incorrect filings can result in significant penalties, including fines and interest on unpaid taxes. Ensuring legal compliance is essential for maintaining good standing with the IRS.

Required Documents for IRS Form 1120-F

To complete IRS Form 1120-F, foreign corporations need to gather several key documents:

- Financial statements detailing U.S. income and expenses.

- Records of any deductions and credits claimed.

- Documentation supporting the corporation's business activities in the U.S.

- Any prior year tax returns, if applicable.

Penalties for Non-Compliance with IRS Form 1120-F

Non-compliance with IRS Form 1120-F can lead to severe penalties. These may include:

- Failure-to-file penalties, which can accumulate if the form is not submitted by the deadline.

- Failure-to-pay penalties for any taxes owed that are not paid on time.

- Interest on unpaid taxes, which can increase the total amount owed over time.

It is crucial for foreign corporations to understand these potential penalties to ensure timely and accurate filing.

Quick guide on how to complete wwwirsgovinternal revenue service irs tax forms

Complete Www irs govInternal Revenue Service IRS Tax Forms effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents promptly without hassles. Manage Www irs govInternal Revenue Service IRS Tax Forms on any platform using airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to edit and eSign Www irs govInternal Revenue Service IRS Tax Forms effortlessly

- Access Www irs govInternal Revenue Service IRS Tax Forms and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your delivery method for the form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiresome form searches, or errors that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Edit and eSign Www irs govInternal Revenue Service IRS Tax Forms to ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwirsgovinternal revenue service irs tax forms

Create this form in 5 minutes!

How to create an eSignature for the wwwirsgovinternal revenue service irs tax forms

How to create an electronic signature for your PDF in the online mode

How to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to create an e-signature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

How to create an e-signature for a PDF document on Android OS

People also ask

-

What is the 1120 f form and how can airSlate SignNow help with it?

The 1120 f form is used by foreign corporations to report their income, deductions, and tax liability in the United States. airSlate SignNow provides an easy-to-use platform to send and eSign your 1120 f documents securely and efficiently, helping you comply with IRS regulations.

-

Can I track the status of my 1120 f documents sent through airSlate SignNow?

Yes, airSlate SignNow offers real-time tracking features for your 1120 f documents. You can easily see when your documents have been sent, viewed, and signed, ensuring you never lose track of important filings.

-

What pricing plans does airSlate SignNow offer for managing 1120 f eSignatures?

airSlate SignNow provides various pricing plans to suit different business needs, which include options for managing 1120 f eSignatures. You can choose a plan that fits your requirements and enjoy cost-effective solutions tailored for document management.

-

Are there any integrations available for managing 1120 f forms with airSlate SignNow?

Absolutely! airSlate SignNow integrates seamlessly with other software applications, allowing you to easily manage your 1120 f forms within your existing workflow. This compatibility streamlines the process, making it easier to handle documents in one place.

-

How secure is my data while using airSlate SignNow for my 1120 f submissions?

The security of your data is a top priority for airSlate SignNow. When handling your 1120 f submissions, we utilize advanced encryption protocols and secure storage solutions to protect your sensitive information from unauthorized access.

-

Can airSlate SignNow help automate the process of sending 1120 f documents?

Yes, airSlate SignNow offers automation features that can help streamline the process of sending your 1120 f documents. You can automate reminders and follow-ups, ensuring that all parties involved stay informed and engaged throughout the signing process.

-

What benefits does airSlate SignNow provide for businesses dealing with 1120 f forms?

Using airSlate SignNow for 1120 f forms allows businesses to save time and reduce paperwork while ensuring compliance with regulatory deadlines. The intuitive platform not only enhances productivity but also facilitates a smooth eSignature experience for all users.

Get more for Www irs govInternal Revenue Service IRS Tax Forms

- Hawaii revocation form

- Hi agreement form

- Amendment to postnuptial property agreement hawaii hawaii form

- Quitclaim deed from husband and wife to an individual hawaii form

- Warranty deed from husband and wife to an individual hawaii form

- Warranty deed trust to husband and wife hawaii form

- Hi property form

- Hawaii lien 497304308 form

Find out other Www irs govInternal Revenue Service IRS Tax Forms

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document