Certification of U S Tax Residency Internal Revenue Service 2020

What is the Certification of U.S. Tax Residency?

The Certification of U.S. Tax Residency is a document issued by the Internal Revenue Service (IRS) that verifies an individual's or entity's status as a U.S. tax resident. This certification is essential for various tax-related purposes, including claiming tax treaty benefits and ensuring compliance with U.S. tax laws. It serves as proof that the taxpayer meets the residency requirements set forth by the IRS, which can be crucial for both domestic and international tax obligations.

How to Use the Certification of U.S. Tax Residency

The Certification of U.S. Tax Residency can be utilized in several scenarios, particularly when dealing with foreign tax authorities or financial institutions. Taxpayers may need to present this certification to claim reduced withholding tax rates under applicable tax treaties. Additionally, it can be used when applying for certain financial products or services that require proof of tax residency. Proper use of this certification helps ensure compliance with both U.S. and foreign tax regulations.

Steps to Complete the Certification of U.S. Tax Residency

Completing the Certification of U.S. Tax Residency involves several key steps:

- Gather necessary documentation, including proof of residency and tax identification numbers.

- Fill out the appropriate IRS form, typically Form 8802, which requests the certification.

- Submit the completed form along with any required fees to the IRS.

- Await processing, which can take several weeks, and ensure you keep copies of all submitted documents.

Filing Deadlines / Important Dates

It is important to be aware of filing deadlines related to the Certification of U.S. Tax Residency. Generally, taxpayers should submit Form 8802 well in advance of any tax deadlines or treaty claims to allow sufficient processing time. The IRS recommends filing at least 45 days before the expected date of use to avoid delays. Keeping track of these deadlines ensures that taxpayers can effectively manage their tax obligations and claims.

Required Documents

To obtain the Certification of U.S. Tax Residency, certain documents are typically required. These may include:

- Proof of U.S. residency, such as a utility bill or lease agreement.

- Tax identification number (TIN) for individuals or entities.

- Completed Form 8802, which requests the certification.

Having all necessary documents prepared can streamline the application process and reduce the likelihood of delays.

Penalties for Non-Compliance

Failing to obtain or present the Certification of U.S. Tax Residency when required can lead to significant penalties. Taxpayers may face higher withholding tax rates on income from foreign sources, and they could be subject to additional tax liabilities. Moreover, non-compliance can result in audits or increased scrutiny from tax authorities, which can complicate future tax filings and obligations.

Quick guide on how to complete certification of us tax residency internal revenue service

Easily Prepare Certification Of U S Tax Residency Internal Revenue Service on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, adjust, and electronically sign your documents quickly without any delays. Handle Certification Of U S Tax Residency Internal Revenue Service on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to Edit and Electronically Sign Certification Of U S Tax Residency Internal Revenue Service Effortlessly

- Locate Certification Of U S Tax Residency Internal Revenue Service and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Certification Of U S Tax Residency Internal Revenue Service to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct certification of us tax residency internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the certification of us tax residency internal revenue service

The way to make an eSignature for a PDF document online

The way to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The way to make an electronic signature right from your smart phone

The way to make an eSignature for a PDF document on iOS

The way to make an electronic signature for a PDF on Android OS

People also ask

-

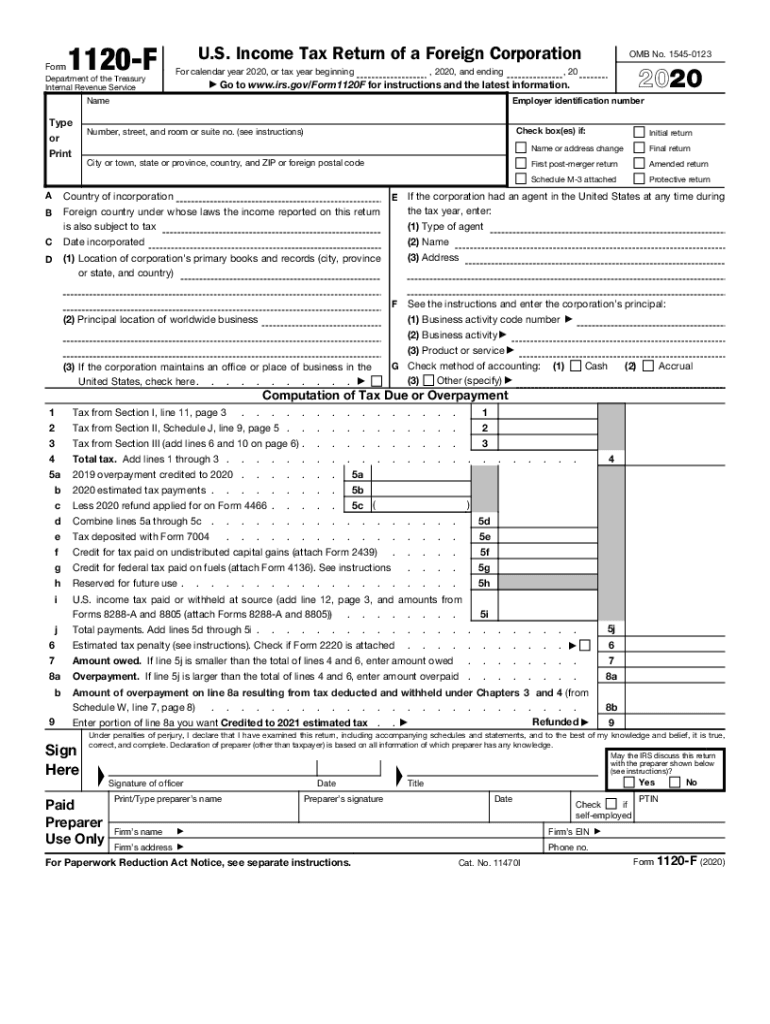

What is the 1120 f 2018 form used for?

The 1120 f 2018 form is used by foreign corporations to report their income, gains, losses, deductions, and to calculate their tax liability in the United States. Understanding how to properly complete the 1120 f 2018 is crucial for compliance and avoiding penalties.

-

How does airSlate SignNow simplify the signing process for 1120 f 2018 forms?

airSlate SignNow streamlines the process by allowing users to send and sign 1120 f 2018 forms electronically. This ensures that documents are quickly executed, keeping your filing timeline on track while maintaining security and compliance.

-

Is there a cost associated with using airSlate SignNow for 1120 f 2018 signing?

airSlate SignNow offers flexible pricing plans tailored to your needs, making it a cost-effective solution for managing 1120 f 2018 forms. Businesses can choose from monthly or annual subscriptions, depending on their usage and team size.

-

What features does airSlate SignNow offer to help with 1120 f 2018 compliance?

airSlate SignNow includes features such as customizable templates, audit trails, and secure storage to assist with 1120 f 2018 compliance. These tools help ensure that your documents are legally binding and easily retrievable for future reference.

-

Can I integrate airSlate SignNow with other software for 1120 f 2018 processing?

Yes, airSlate SignNow integrates seamlessly with various third-party applications, making it easier to import data and manage documentation for your 1120 f 2018 forms. This enhances efficiency and reduces the risk of manual errors.

-

What are the benefits of using airSlate SignNow for 1120 f 2018 forms?

Using airSlate SignNow for 1120 f 2018 forms provides businesses with increased efficiency, reduced processing time, and improved team collaboration. The user-friendly interface ensures that everyone can easily navigate the eSigning process.

-

How do I get started with airSlate SignNow for my 1120 f 2018 documents?

Getting started with airSlate SignNow for your 1120 f 2018 documents is simple. Sign up for an account, choose a suitable plan, and begin uploading your documents to send for electronic signatures quickly.

Get more for Certification Of U S Tax Residency Internal Revenue Service

- Fillable online fergus falls parks recreation ampamp forestry fax email form

- Idaho state department of agriculture po box 7249 boise idaho 83707 form

- Meal count sheet form

- Royal perth hospital dom of information

- Appsazdotgovfilesmvdtravel licenseidentification application adot form

- West virginia division of motor vehicleswest virginia division of motor vehiclesvirginia department of motor vehicles form

- Income and expense worksheet pdf form

- Formsjustiacomvirginiastatewidejustia vehicle registration refund application virginia

Find out other Certification Of U S Tax Residency Internal Revenue Service

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later