Irs Form 1120 2012

What is the Irs Form 1120

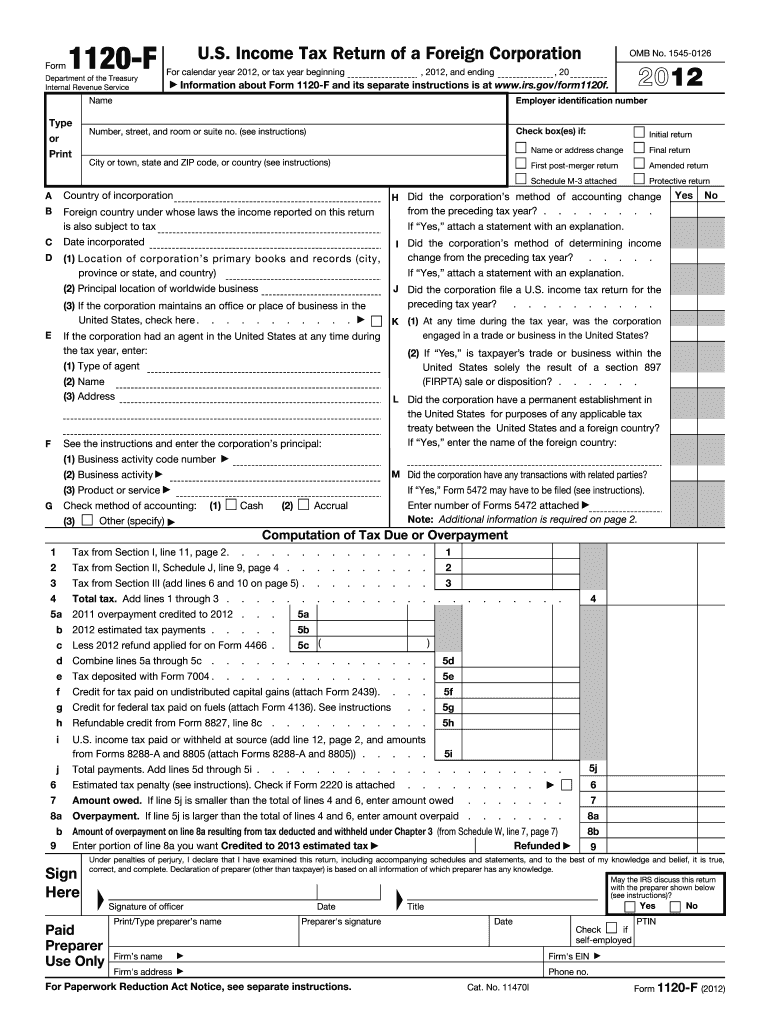

The Irs Form 1120 is a tax return form used by corporations to report their income, gains, losses, deductions, and credits. This form is essential for C corporations, which are separate legal entities from their owners. By filing Form 1120, corporations fulfill their obligation to report their financial activities to the Internal Revenue Service (IRS) and calculate their tax liability. The form includes sections for various income types, deductions, and tax credits, ensuring that corporations accurately disclose their financial status.

How to use the Irs Form 1120

Using the Irs Form 1120 involves several steps to ensure accurate reporting of corporate income and expenses. Corporations must gather all relevant financial documents, including profit and loss statements, balance sheets, and any supporting documentation for deductions and credits. After completing the form, it must be signed by an authorized officer of the corporation. This signature certifies that the information provided is true and complete. Once completed, the form can be submitted electronically or by mail, depending on the corporation's preference and IRS guidelines.

Steps to complete the Irs Form 1120

Completing the Irs Form 1120 requires careful attention to detail. Here are the key steps:

- Gather financial records, including income statements and expense reports.

- Fill out the basic information section, including the corporation's name, address, and Employer Identification Number (EIN).

- Report income in the appropriate sections, detailing all sources of revenue.

- List allowable deductions, ensuring to include all eligible expenses that can reduce taxable income.

- Calculate the total tax liability based on the corporation's taxable income.

- Review the form for accuracy and completeness before signing.

- Submit the completed form to the IRS by the designated deadline.

Legal use of the Irs Form 1120

The legal use of the Irs Form 1120 is crucial for compliance with federal tax laws. Corporations must file this form annually to report their financial activities accurately. Failure to file or inaccuracies in the form can lead to penalties, including fines and interest on unpaid taxes. It is important for corporations to maintain thorough records and ensure that all information reported on the form is truthful and complete, as the IRS may audit submissions to verify compliance.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the Irs Form 1120. Generally, the form is due on the fifteenth day of the fourth month after the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by April 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Corporations can request an automatic six-month extension to file, but any taxes owed must still be paid by the original deadline to avoid penalties.

Penalties for Non-Compliance

Non-compliance with the filing requirements for the Irs Form 1120 can result in significant penalties. If a corporation fails to file the form on time, the IRS may impose a penalty based on the number of months the return is late. Additionally, inaccuracies or omissions can lead to further penalties and interest on any unpaid taxes. It is essential for corporations to understand their obligations and ensure timely and accurate submissions to avoid these consequences.

Quick guide on how to complete 2012 irs form 1120

Finalize Irs Form 1120 seamlessly on any gadget

Digital document management has become increasingly favored among enterprises and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to generate, adjust, and electronically sign your documents quickly and efficiently. Handle Irs Form 1120 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related workflow today.

The optimal method to adjust and electronically sign Irs Form 1120 effortlessly

- Find Irs Form 1120 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, SMS, invite link, or download it onto your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Irs Form 1120 to ensure excellent communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 irs form 1120

Create this form in 5 minutes!

How to create an eSignature for the 2012 irs form 1120

How to make an eSignature for a PDF document online

How to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The way to create an electronic signature right from your smart phone

The best way to make an eSignature for a PDF document on iOS

The way to create an electronic signature for a PDF on Android OS

People also ask

-

What is IRS Form 1120 and why is it important for businesses?

IRS Form 1120 is the U.S. Corporation Income Tax Return that corporations must file annually to report their income, gains, losses, deductions, and credits. It is crucial for businesses as it determines their tax obligations and helps maintain compliance with federal tax regulations. Understanding how to complete IRS Form 1120 accurately can save businesses money and prevent audits.

-

How can airSlate SignNow help with filing IRS Form 1120?

airSlate SignNow simplifies the process of preparing and submitting IRS Form 1120 by allowing businesses to electronically sign and send documents securely. With its user-friendly interface, you can easily manage your tax documents and ensure they are completed accurately and on time. This streamlines the filing process, helping you avoid delays and potential penalties.

-

Are there any costs associated with using airSlate SignNow for IRS Form 1120?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, making it a cost-effective solution for managing IRS Form 1120 and other documents. You can choose a plan that fits your budget while benefiting from features like electronic signatures and document tracking. Explore our pricing options to find the best fit for your business.

-

What features does airSlate SignNow offer for managing IRS Form 1120?

airSlate SignNow provides features that enhance the management of IRS Form 1120, including customizable templates, secure e-signature options, and document storage. These tools help ensure that your tax documentation is organized and accessible, making the filing process more efficient. With airSlate SignNow, you can easily create, sign, and send your forms with confidence.

-

Can I integrate airSlate SignNow with other accounting software for IRS Form 1120?

Yes, airSlate SignNow integrates seamlessly with various accounting software, allowing you to streamline your workflow when handling IRS Form 1120. This integration means you can pull in relevant data, manage documents, and e-sign directly from your preferred accounting tools. This connectivity enhances efficiency and reduces the risk of errors.

-

Is airSlate SignNow secure for handling sensitive documents like IRS Form 1120?

Absolutely! airSlate SignNow employs robust security measures, including encryption and secure cloud storage, to protect sensitive documents such as IRS Form 1120. You can trust that your financial information is safe while using the platform. Additionally, our compliance with industry standards ensures that your data remains confidential and protected.

-

How does airSlate SignNow improve collaboration for IRS Form 1120 preparation?

airSlate SignNow enhances collaboration by allowing multiple users to access, edit, and sign IRS Form 1120 documents in real-time. This feature is particularly beneficial for teams working together on tax filings, as it facilitates communication and ensures everyone is on the same page. Effective collaboration can lead to more accurate and timely submissions.

Get more for Irs Form 1120

- A m commerce transcript request form

- Ferpa permission form

- Academic calendar st thomas university form

- Initial swop application franciscan university of steubenville franciscan form

- Graduate certificate in biomedical sciences troy university form

- Registrars office augusta university form

- Re certification application form indian river state college irsc

- Rn to bsn track lamar university form

Find out other Irs Form 1120

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple